Providing a dovish surprise, a decision to purchase an additional $100 billion of bonds once the current program expires - a month earlier and in a larger size than most were expecting.

As was as the insertion of a sentence that made note of the rise in the exchange rate which could be argued has merely tracked rising commodity prices in recent months.

“The exchange rate has appreciated and is in the upper end of the range of recent years.”

While the RBA acknowledged the better jobs and growth data of late, it was overshadowed by very explicit dovish forward guidance.

”The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range.” Conditions not expected to be “met until 2024 at the earliest”

Attention now turns to the RBA Governor Lowes speech tomorrow at the National Press Club of Australia in Canberra titled “The Year Ahead” (12.30 pm AEDT) before Friday's quarterly Statement on Monetary Policy (11.30 am AEDT).

Perhaps having noted how keenly interest rate markets in the US and New Zealand have reacted to even the most subtle signs of policy normalization it appears unlikely the RBA will deviate too much from today's message in its communique later this week. That is, ultra-low interest rates are here to stay for the foreseeable future.

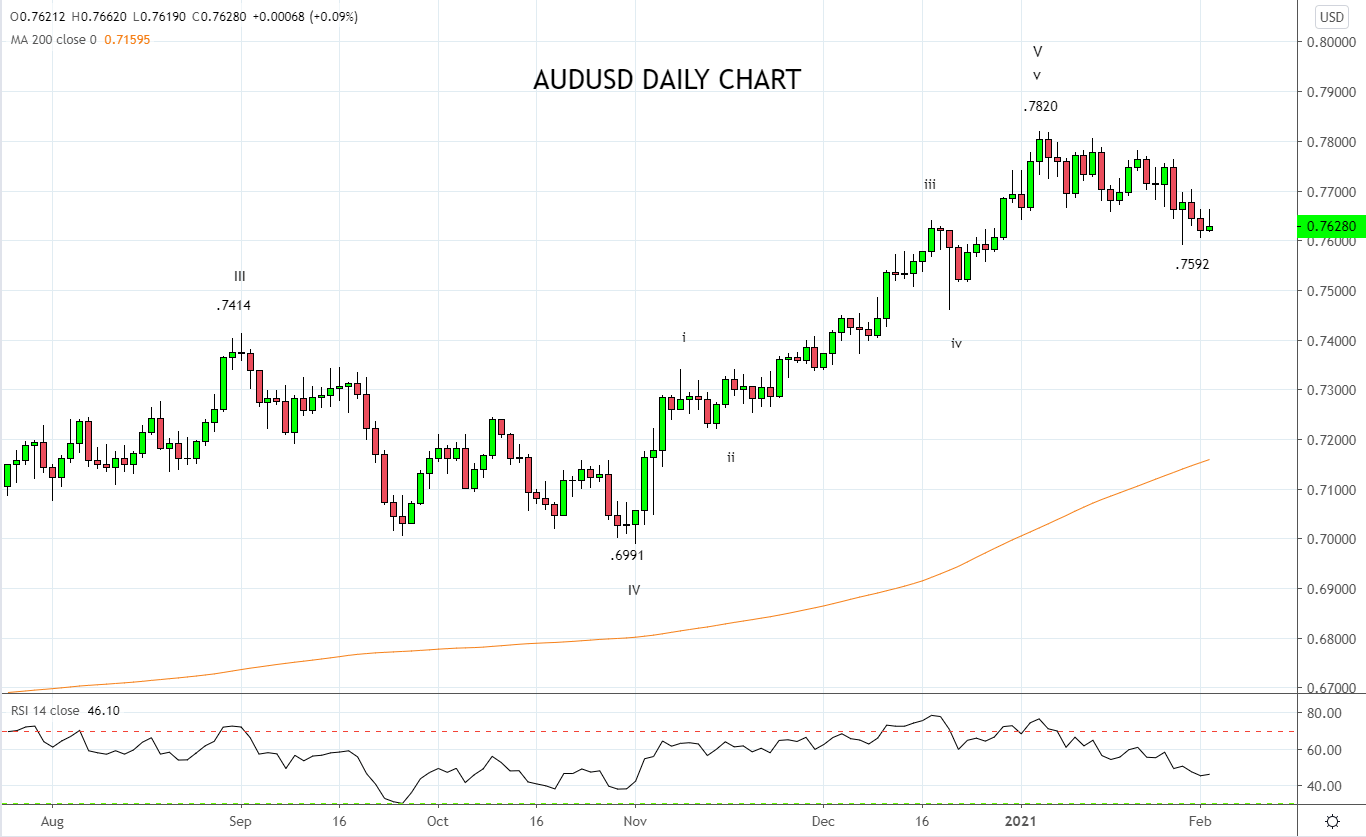

The RBA’s message appears to have had the desired effect on the AUD/USD, falling from just above .7660 at 2.30 pm, down to a low near .7620. Technically, this appears to be a continuation of the correction that commenced from the January .7820 high.

Providing the AUDUSD remains below short-term resistance at .7700/10c the expectation is for the correction to deepen, resulting in a break of last week’s .7592 low, before a test of medium-term support .7500/.7400c.

Source Tradingview. The figures stated areas of the 2nd of February 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation