Qualcomm & AMD: Slightly Different Stories

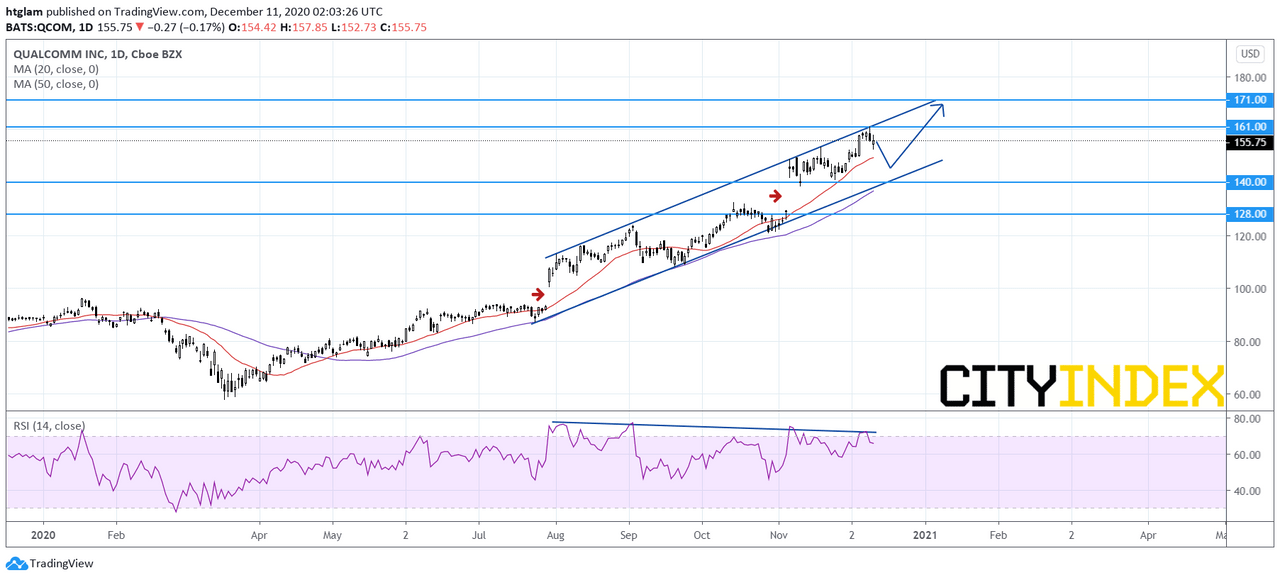

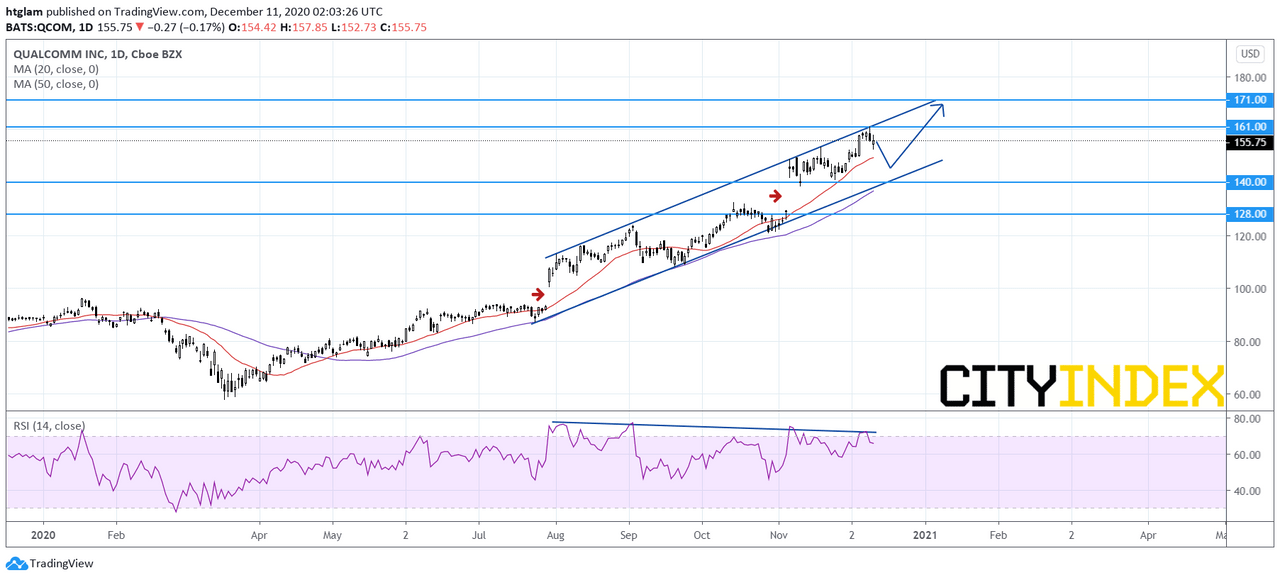

Qualcomm (QCOM): Cautiously Bullish

Source: GAIN Capital, TradingView

On Thursday, Qualcomm (QCOM) lost about 5% in after-hours trading, as Bloomberg reported that Apple has begun building its own cellular modem for its future devices, a move that would replace components from Qualcomm. Though some analysts pointed out that Apple is less likely to be 5G modem-ready by the next iPhone launch in September.

On a daily chart, Qualcomm's (QCOM) technical outlook remains bullish but caution should be taken. It has retreated after reaching the upper boundary of a bullish channel drawn from July, while the relative strength index shows bearish divergence. This suggests that a pull-back may be due, however as long as the bullish channel holds, Qualcomm's uptrend remains intact. The level at $140 may be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $161 and $171 respectively.

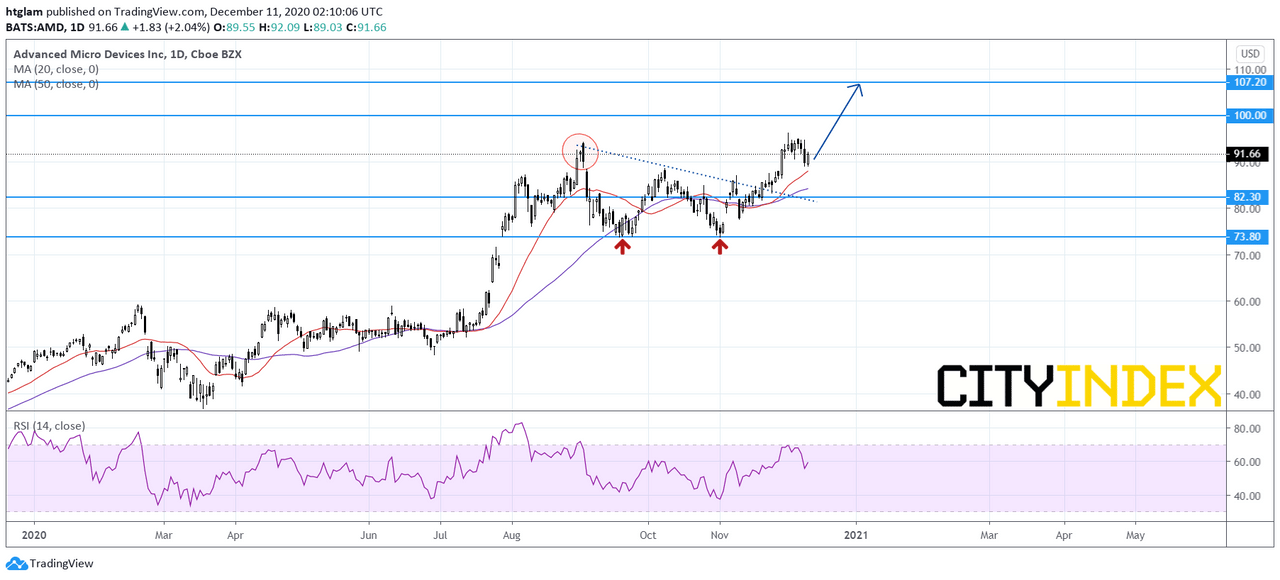

Advanced Micro Devices (AMD): Gathering Upside Momentum

Source: GAIN Capital, TradingView

According to video game platform Steam's survey, the share of its customers using AMD CPU processor rose to 26.51% in November, compared with less than 20% in March.

From a technical point of view, Advanced Micro Devices (AMD) is gathering more upside momentum as shown on the daily chart. The previous bearish signal formed on September 2 appears to be faded, as it has formed a double-bottom pattern afterwards and has now broken above a declining trend line. The level at $82.30 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $100.00 and $107.20 respectively.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM