The expectation is for a -2.5% fall in Q3 Capex, a significant decline from the 4.4% rise in Q2, due to the disruptions caused by extended Covid-19 related lockdowns in NSW and Victoria.

The data will also include an update (Estimate 4) on spending plans for 2021/22, expected to show a modest upgrade to $131bn from $127.7bn in Estimate 3.

Of more importance to the ASX200 in the short term is a sharp lift in iron ore prices today on the Dalian exchange in China, with the most active futures contract surging 10% to 598.5 yuan per tonne.

The market appears to be rounding to the view that the headwinds buffering the Chinese real estate sector are easing and that suppressed steel production will bounce back in December.

Needing no further encouragement, the share prices of the big miners have hit multi-session highs. Fortescue Metal (FMG) is trading at $17.31 (+9.56%), BHP is trading at $38.17 (+4.36%) while Rio Tinto (RIO) is trading at $95.81 (+4.36%).

The strength in the mining index heavyweights has helped the beleaguered ASX200 62 points higher to be trading near 7415 at the time of writing.

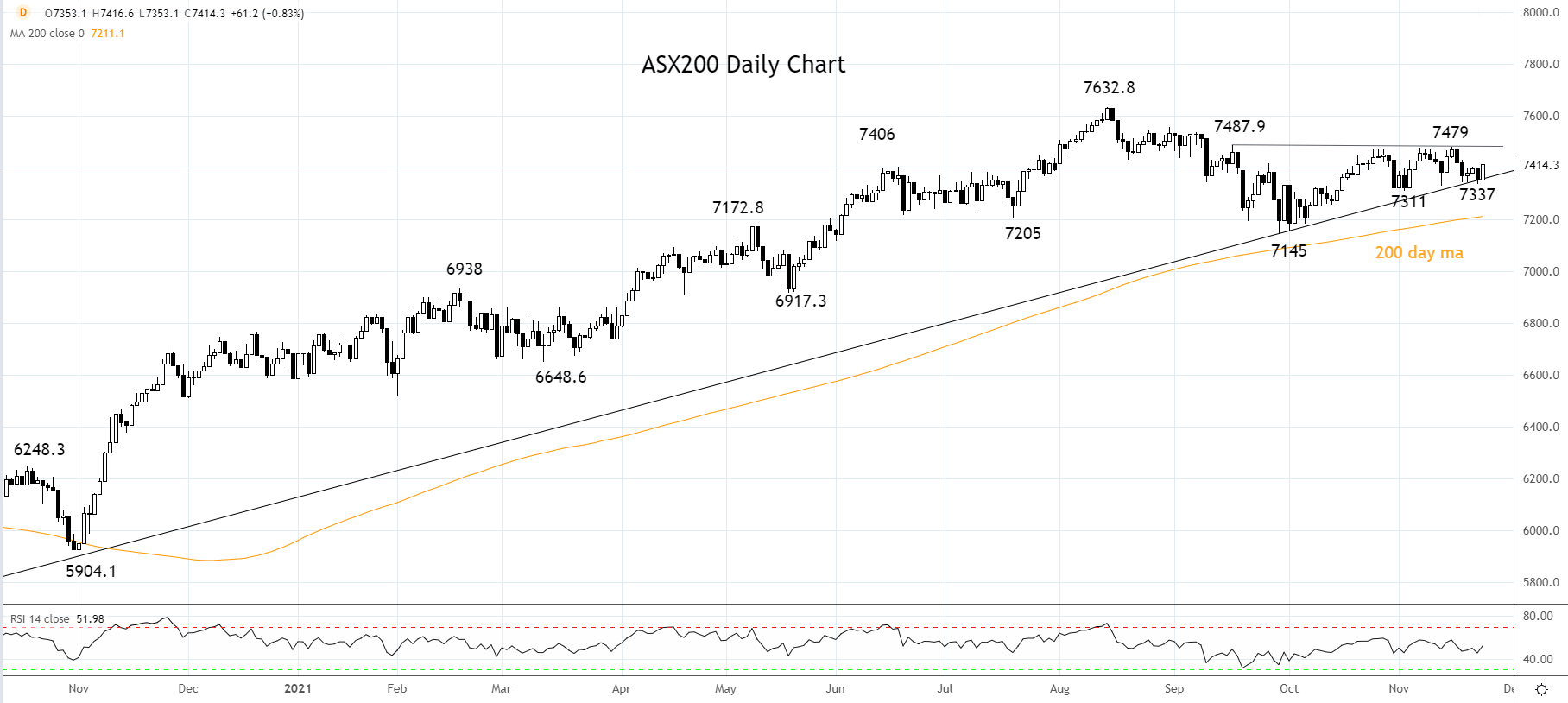

As the chart below shows, the ASX200 has been capped of late by the seemingly impenetrable layer of horizontal resistance at 7480/88. On the downside, the index has tested and appears to have held uptrend support at 7340/30, coming from the October 2020, 5779 low, reinforced by the early November 7311 quadruple low.

While we retain a bias to the upside in expectation of a retest and break of the August 7632 high, a break/close of either of these range extremes would signal an end to the recent choppy range trading conditions of late and for price continuation in the order of 2-3%.

Source Tradingview. The figures stated areas of November 23rd, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade