Provident Financial: tentative rebound

Provident Financial, a provider of credit products, posted 1H results: "Group adjusted loss before tax of £32.6m (H1'19 PBT restated: £80.4m) is favourable when compared to internal plans but lower year-on-year driven by lower revenues, driven by lower receivables, and higher impairment charges driven by Covid-19. The Group reported a basic loss per share of 9.1p for the period down from a basic earnings per share of 9.7p in H1'19."

The home credit provider decided not to resume paying a dividend yet but results are not as bad as feared.

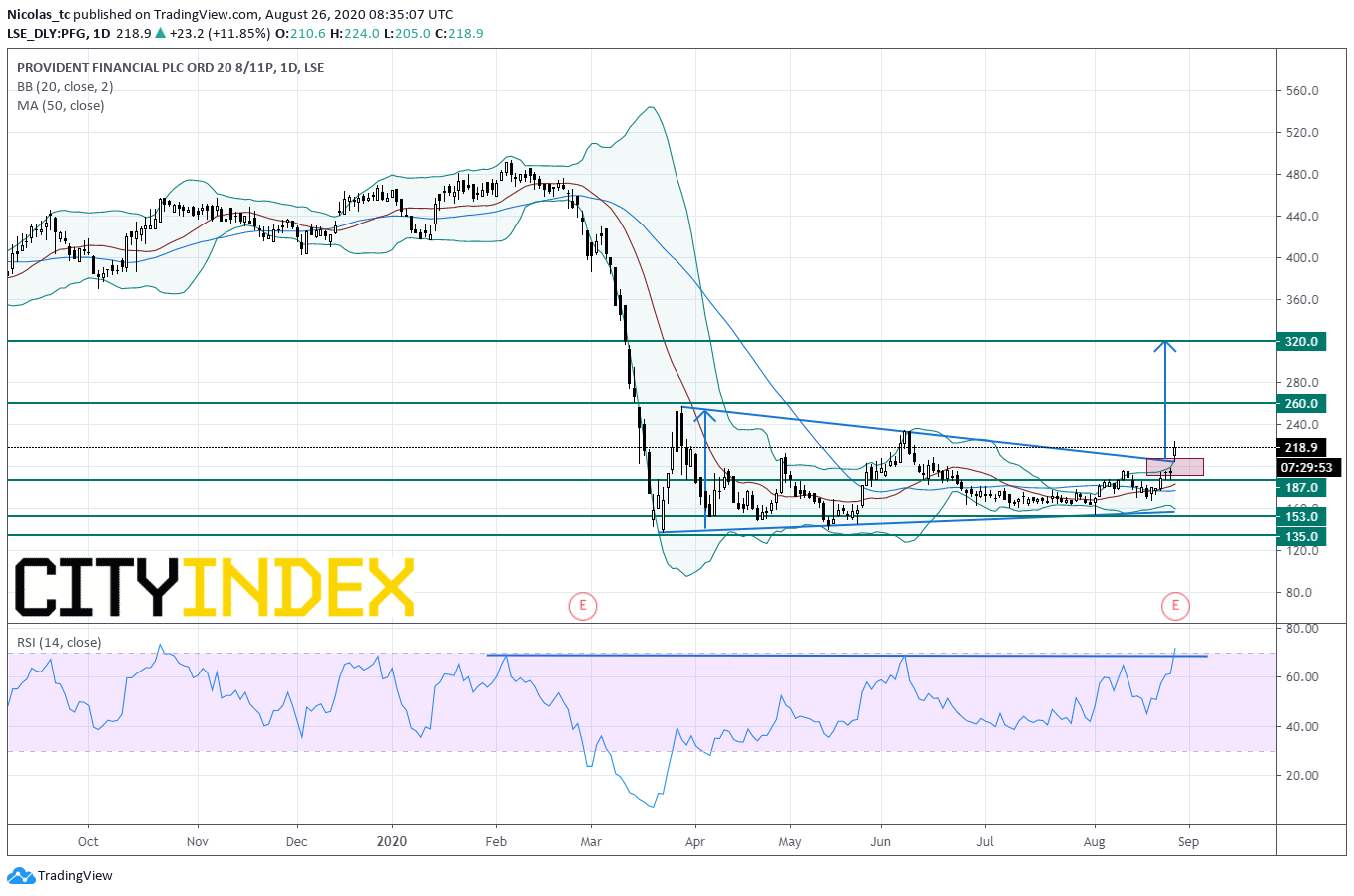

From a chartist’s point of view, the stock price is trying to escape from a medium term symmetrical triangle pattern thanks to a bullish gap. The volatility breakout on Bollinger bands is a positive signal. If confirmed, this would open the way to a technical recovery towards the resistance level at 260p and 320p in ext (Measured up move target). Alternatively, a break below 187p would invalidate the bullish bias and would call for a new down leg towards 153p and 135p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM