The month of March has begun as the last trading day of February finished. Speculation abounds that Central banks will move to cut interest rates to offset the impact of the coronavirus slowdown and halt the steepest stock market sell-off in history.

A comment late on Friday by Federal Chairman Powell “We will use our tools and act as appropriate to support the economy” has been interpreted as a call to arms by Chairman Powell to his Central bank cavalry. The U.S interest rate market is now 75% priced for a 50bp cut at the next FOMC meeting on the 19th of March.

Another round of central bank rate cuts will not help scientists find a cure to Covid-19. It will, however, provide a proven tonic to quell equity market volatility. Although in doing so it will open Central banks to criticism they are beholden to the whims of a stock market, simply back to the levels where it was trading last October.

Presuming there are no out of meeting interest rate cuts beforehand, the RBA will have the first opportunity to support Chairman Powell’s call at its monthly interest rate meeting tomorrow afternoon.

While there is a valid argument that the RBA should wait another month to assess incoming data and the impact of Covid-19, the market is now fully priced for a 25bp cut after well-connected journalist Terry McCrann wrote on Friday night “we will now all-but certainly get a rate cut from the Reserve Bank on Tuesday, if not also “other” action”.

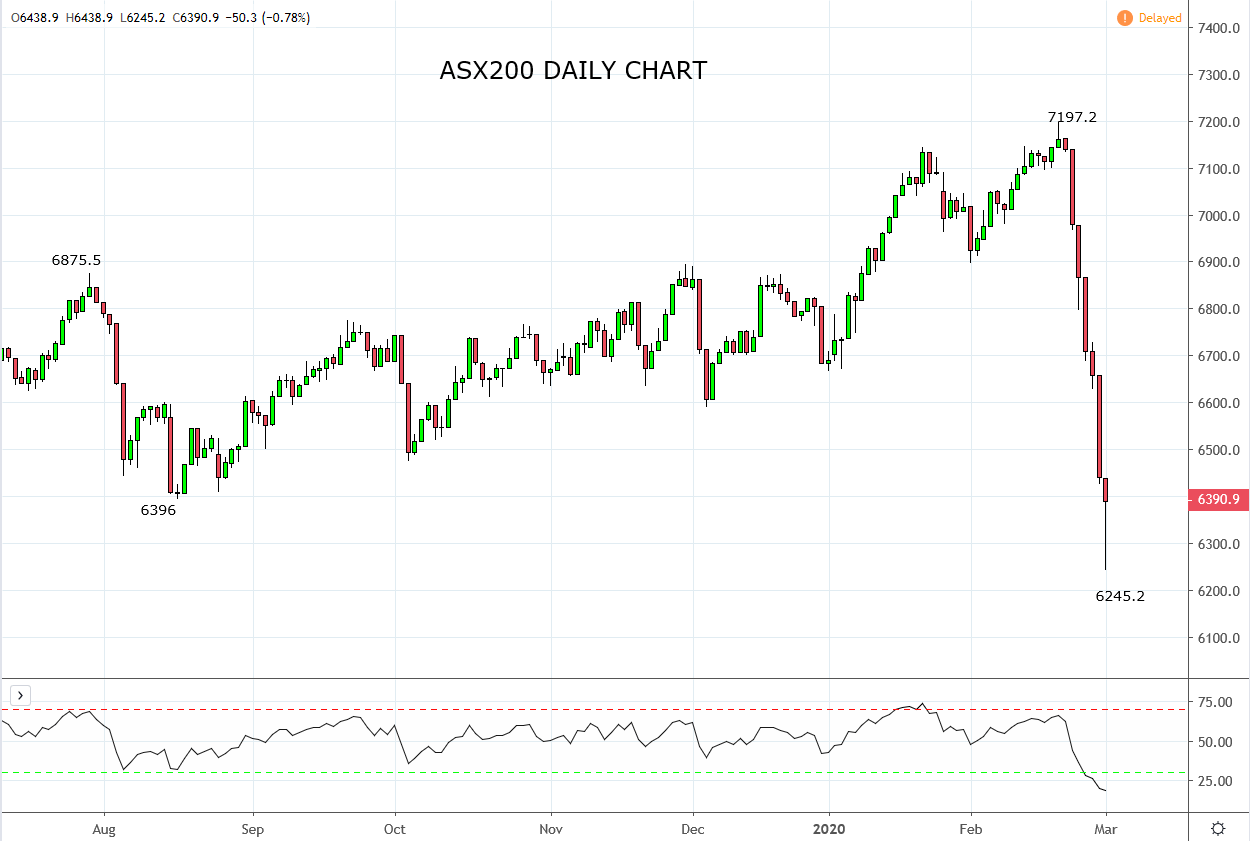

As can viewed on the chart below, the prospect of rate cuts has bought some much needed stability to the ASX200, and the catalyst for the sharp bounce from today’s 6245.2 intraday low. Potentially there is scope for the rally to continue towards 6600, keeping in mind if the RBA cavalry don’t arrive tomorrow it would likely lead to intense disappointment and expose the ASX200 to another round of selling.

Source Tradingview. The figures stated areas of the 2nd of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation