Prices Don’t Always Move in a Straight Line: S&P 500, EUR/USD, AUD/USD

Stocks are lower today and the US Dollar is higher today as fears of contagion from the coronavirus and the possibility of more national lockdowns are taking hold (It was just recently released that Germany’s lockdown will begin on Monday and France is preparing a Stay-at-Home order). This may also be some unwinding of long positions heading into the election next week. Yesterday, we discussed how the Yen is considered a flight to safety. The US Dollar is also considered a flight to safety has increased today with the breakdown in stocks.

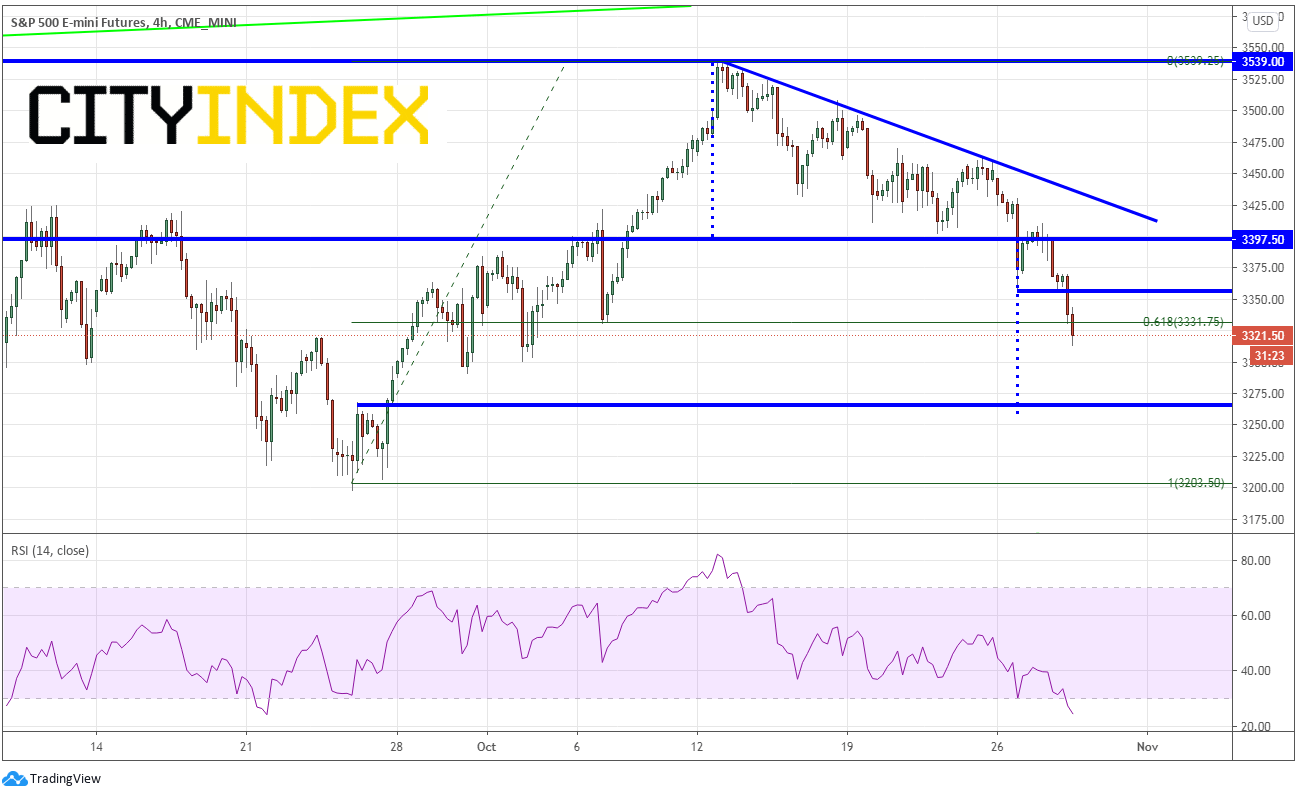

S&P 500

S&P Futures broke below horizontal support and a descending triangle on Monday. Today, the index broke below the 61.8% Fibonacci retracement level from the lows of September 24th to the highs of October 12th, near 3331.72. The target or the breakdown of a descending triangle is the height of the triangle added to the breakdown point, which is near 3260. Horizontal support also crosses near that level. However, the RSI is in oversold conditions on a 240-minute timeframe and may be getting ready for a bounce. If so, sellers will be looking to enter short positions near resistance at 3355 and near 3400.

Source: Tradingview, City Index, CME

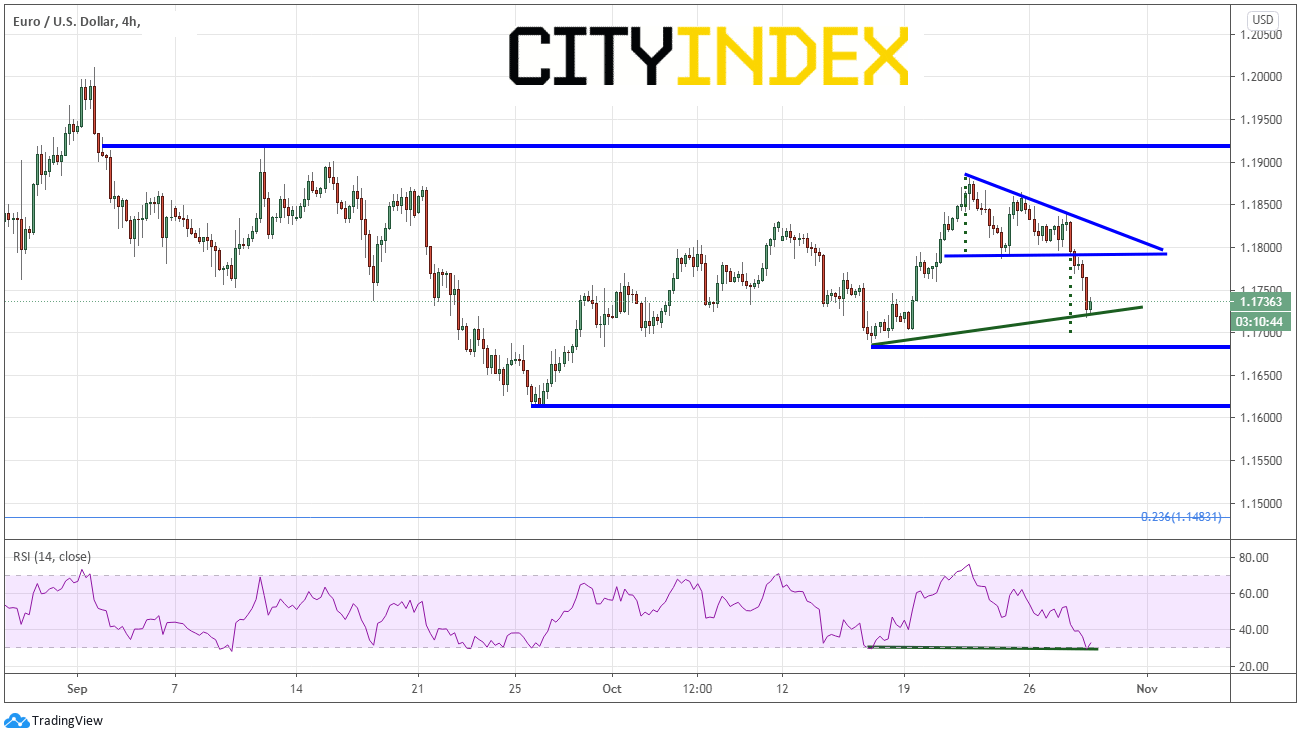

EUR/USD

Going back to early September, EUR/USD has been confined to a range between roughly 1.1600 and 1.2000. However, as we mentioned the US Dollar is considered a flight to safety, and as a result is heading higher (EUR/USD lower) within that channel. The pair is currently breaking down from a descending triangle as well, and its target is 1.1700 with support just below at 1.1680. However, the RSI is diverging, and the pair may be ready for a bounce. If so, sellers will be looking to enter short positions near 1.1800.

Source: Tradingview, City Index

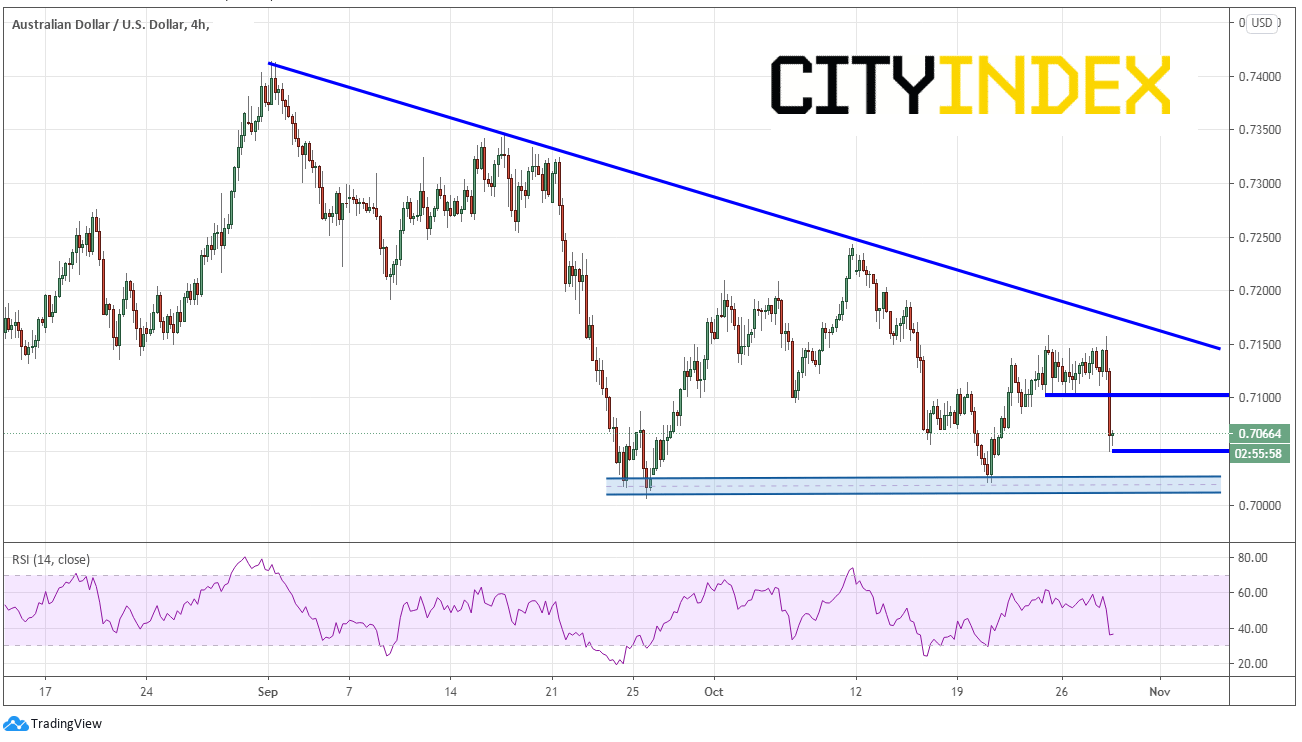

AUD/USD

After a beat last night for Australian CPI, the Aussie initially went bid. However, as coronavirus fears began to spread around the globe, AUD/USD caved to the pressure and the US Dollar began moving higher (AUD/USD lower). As a result, the pair is looking to push through a descending triangle of its own. The RSI is not yet in oversold territory; however, AUD/USD is already down 100 pips off its highs. The pair may bounce before trying to break though support near .7000. Sellers will be looking to enter short positions near .7100.

Source: Tradingview, City Index

After expanded moves already today in many of the US Dollar pairs, traders may wish to wait for a bounce (or retracement) entering long US Dollar positions (short counter-currencies). However, with coronavirus fears spreading, national lockdowns pending, and US election and Brexit uncertainty, traders need to be nimble and ready for headline risk. Make sure to use proper risk/reward management.