To refresh, at its last meeting in early August, the RBA “decided to maintain the current policy settings, including the targets for the cash rate and the yield on 3-year Australian Government bonds of 25 basis points.”

Since then, the market has heard from RBA Governor Lowe and colleagues on three notable occasions. Firstly, in the Quarterly Statement of Monetary Policy (SoMP) on the 7th of August. Then during a testimony to the House of Representatives Standing Committee Economics on the 14th of August. Finally, in the minutes from the RBA’s August meeting, released on the 18th of August.

The key points from the SoMP were:

- The unemployment rate to peak at 10% in late 2020.

- Underlying inflation is forecast to increase from 1% in December 2020 to 1.5% in December 2021.

- Wage Price Index is expected to ease to around 1.25% by end 2020, the slowest growth on record.

- The RBA is expecting the economy to contract by 6% in 2020, before a 5% rebound in 2021.

At the address to the House of Representatives, Governor Lowe clarified his position on two key policy positions.

- The value of cutting already ultra-low-interest rates by 0.1-0.2% would have minimal impact.

- The Governor indicated that negative rates are “extraordinarily unlikely” without entirely ruling them out.

Taking into consideration the points above, the RBA is expected to make no change to its current monetary policy settings at its meeting next Tuesday or indeed in the foreseeable future.

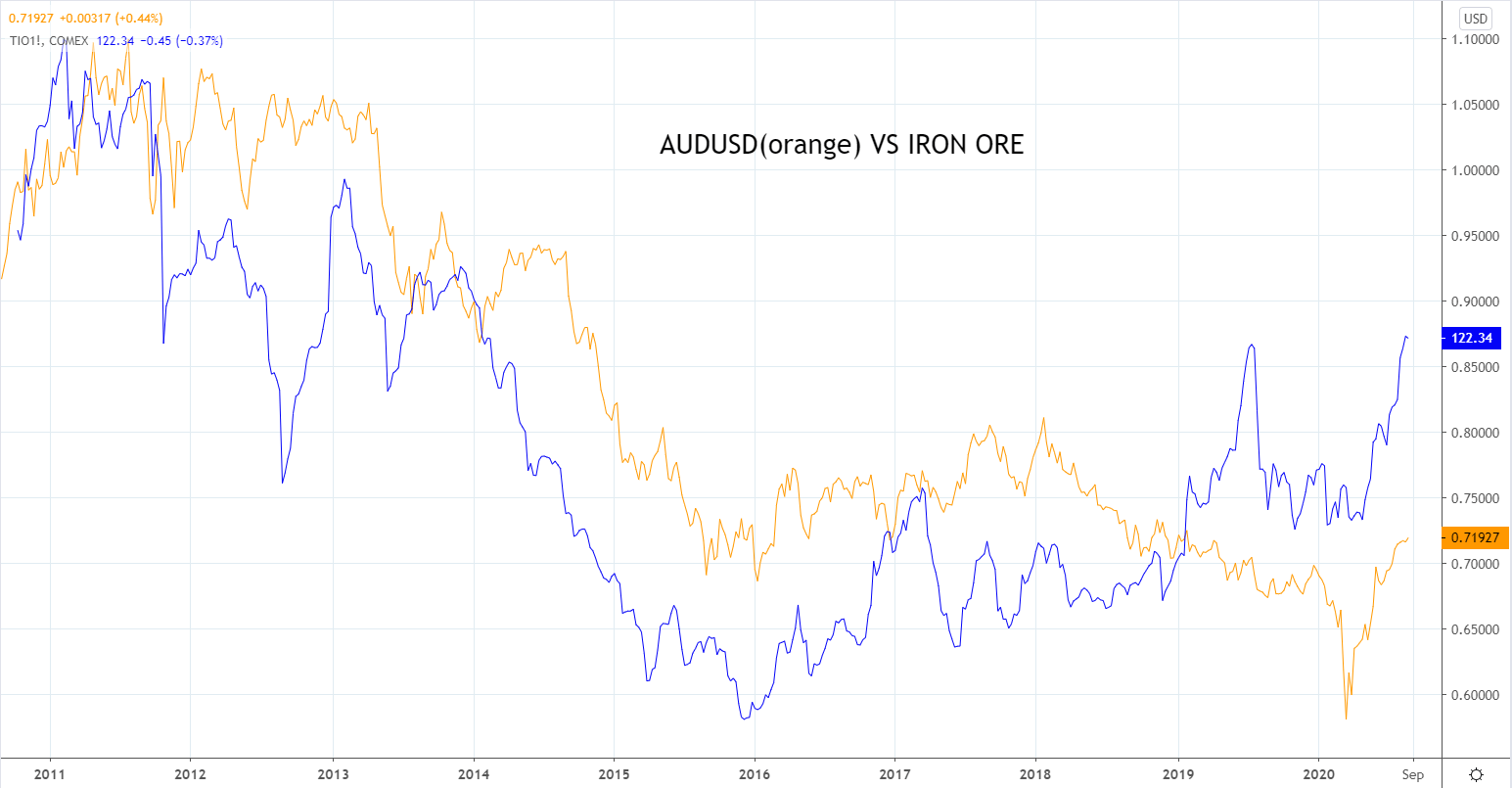

Possible catalysts for settings to change would be an extremely overvalued currency in which case currency intervention and or negative rates may be considered. However, as the chart below shows, the AUDUSD is currently trading slightly cheaply when compared to the price of iron ore, Australia’s largest export.

Alternatively, progress towards the Bank's employment and inflation objectives would result in the RBA raising the cash rate.

Source Tradingview. The figures stated areas of the 26th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation