In yesterday’s note, we previewed the release of tomorrows New Zealand Q4 GDP data that is expected to show that the New Zealand economy has stalled due to the impact of international border closures on tourism.

The Australian economy is less reliant on tourism and following the Australian Government’s announcement earlier this week of a $1.2 billion package to support the tourism industry, is expected to remain less so.

Earlier this month, Australian Q4 GDP exceeded expectations, prompting economists to raise 2021 Australian GDP forecasts to ~4.5%, accentuating the widening growth prospects between the two Antipodean economies.

The release tomorrow at 11.30 am AEDT of Australian Labour Force data is expected to further reinforce the positive growth prospects of the Australian economy, via the addition of 30k new jobs and as the unemployment rate edges lower to 6.3%, from 6.4%.

Providing tomorrow mornings FOMC doesn’t deliver any untoward surprises and that New Zealand GDP and Australian employment data drops as outlined above, there may be an opportunity for traders in the AUD/NZD cross rate.

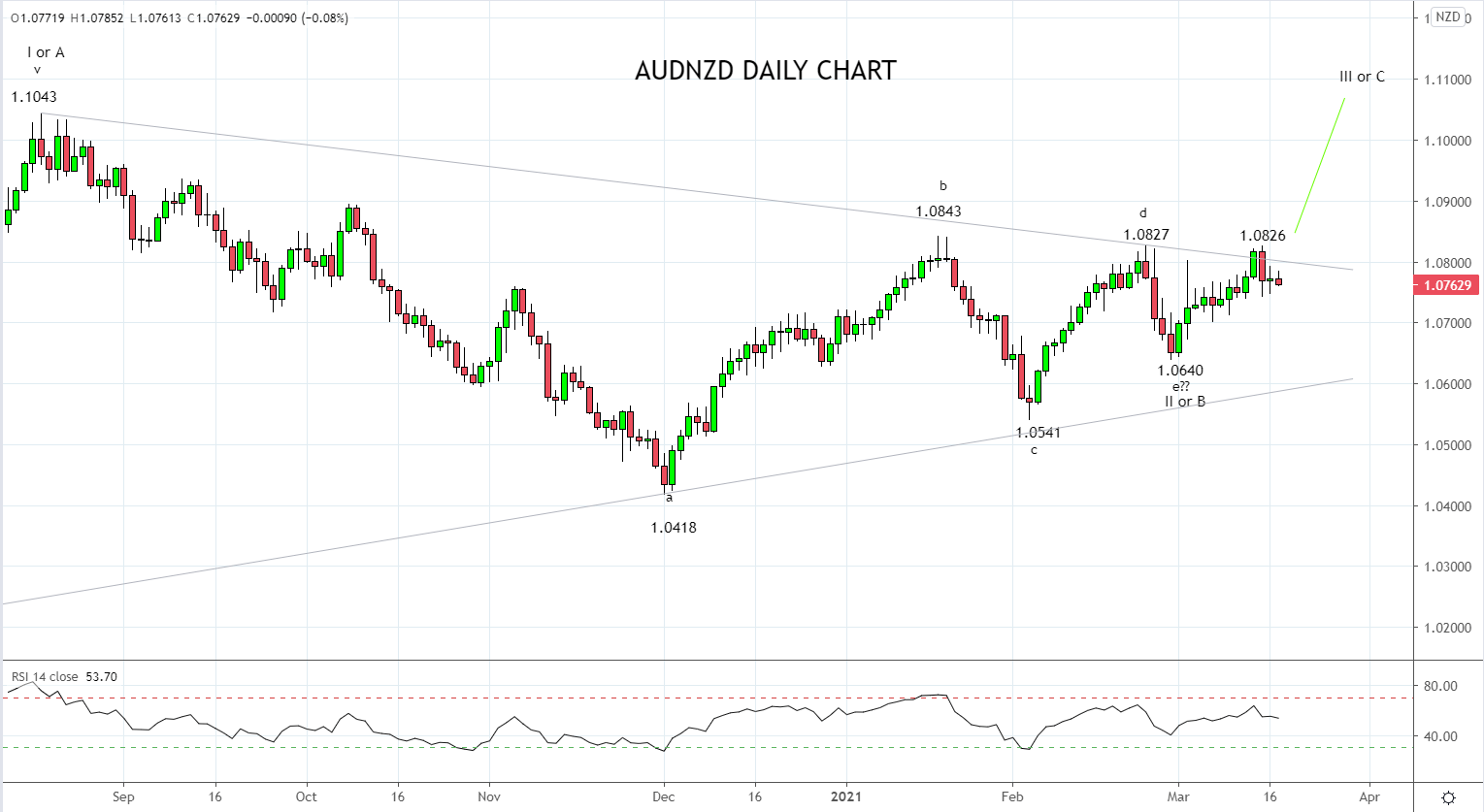

Technically a break and close above triangle resistance and the recent double high at 1.0825/30 would provide an initial indication that the correction from the August 2020, 1.1043 high is complete and that the uptrend had resumed.

To take advantage of this and only after the release of both NZ GDP and Australian employment data, I will look to enter AUD/NZD longs at 1.0836 using a stop entry, leaving room to add to the position if the daily close is above 1.0825.

The stop loss would be placed initially at 1.0735 and the target is a retest and break of the 1.1043 high.

Source Tradingview. The figures stated areas of the 16th of March 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation