While gold continues to frustrate the bulls and the bears alike, with its ongoing consolidation and false break out and break down attempts, silver is taking its lead from copper and palladium as it tries to break higher today.

Gold has been held back by the recent rally in the equity markets and sell-off in bonds, reducing the appeal of the safe-haven metal – even if its longer-term bullish price structure points to potentially higher prices eventually.

Silver, on the other, has benefited more from the positive sentiment towards risk. The white metal tends to be less prone to a sell-off when stocks rise than gold is, given that as well as a precious metal it has many industrial uses. At the same time, the fact that it is still viewed as a safe-haven metal means it could go up along with gold in the event of a risk-off period in the stock markets.

But more to the point, there are at least four reasons why we are turning bullish on silver. Let’s go through each in turn:

- With the Dollar Index falling for three consecutive weeks, thanks mainly to the euro and pound rallying on Brexit optimism, the dollar-denominated precious metal could rise further – especially if the dollar’s weakness is accompanied by a sell-off in stock markets.

- Meanwhile, judging by the rally in equity markets and the recent rebound in commodity dollars and copper, investors are apparently becoming more confident that the US and China will soon be able to strike a trade deal after agreeing to a partial arrangement the week before. If so, demand for silver in its physical form should, in theory, rise as manufacturing activity rebounds.

- The gold/silver ratio has continued to trend lower after topping out last year near historic highs around 93.35. At 84.10ish, the ratio is now back below the high from last year (at 86.54), thus suggesting this year’s earlier breakout attempt was a false move. In other words, silver is outperforming gold at the moment which makes it a better long candidate or a worse short candidate over gold.

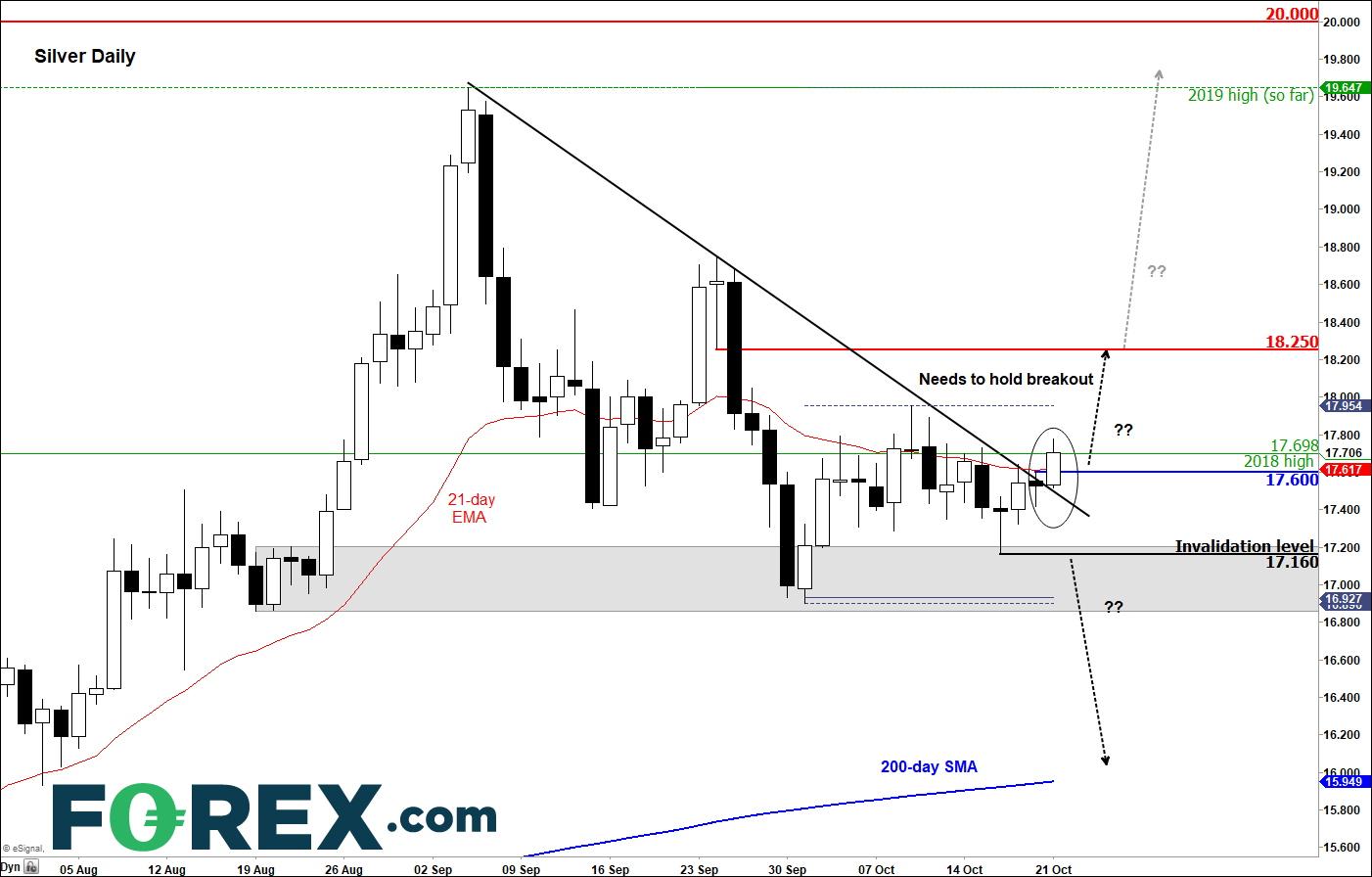

- In addition, and more significantly, this morning saw silver poke above its consolidative trend line plotted from connecting the recent lower highs. If the breakout is sustained and we close above resistance and last year’s high at $17.70, then this could lead to further technical buying in the days ahead.

Source: eSignal and FOREX.com.