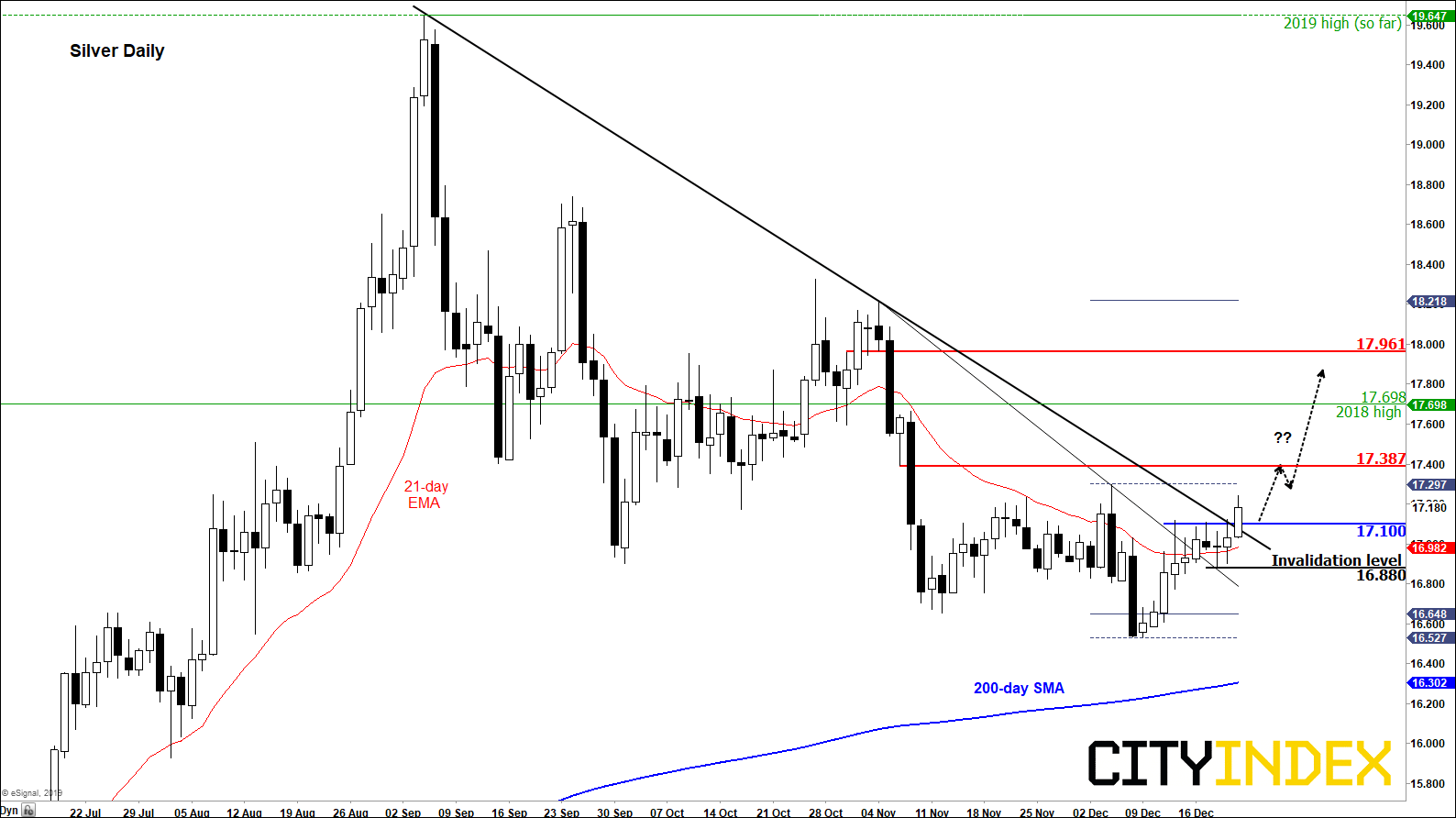

Despite Wall Street hitting yet another record high today and the Dollar Index extending its recovery, precious metals are still holding their own pretty well. This may reflect expectations of stronger Chinese demand for precious metals following the nation’s agreement to a phase one trade deal with the US. In fact, silver was doing particularly well after it managed to break through key resistance around $17.10, taking out in the process its bearish trend line. The breakout, if sustained, could lead to further follow-up technical buying heading towards year-end. Silver’s breakout also suggests gold may follow suit and break through its own key resistance at $1481, so watch out for that possibility. Some key levels to watch are included on the chart, below.

Source: eSignal and City Index.