Thanks to further improvement in risk appetite, precious metals were easing back after yesterday’s big rally that saw gold surged through $1500 for the first time in six years and silver took out $17.00. However, this could just be a hiccup as the fundamental backdrop remains supportive for precious metals.

The bond market sell-off has paused for breath, allowing yields to bounce a little. The slightly firmer yields have helped to undermine the noninterest-bearing metals today. Also weighing on prices is the rebound in stock markets, reducing the need for safe-haven precious metals.

However, nothing has changed fundamentally with regards to the US-China situation, or the global economic outlook with today’s positive trade figures from China coming in on the back of very weak German industrial data from the day before. Although the probabilities of a further 25 basis point cut in the Fed’s September meeting as implied by Fed fund futures may have fallen from as much as 85%, the markets are still pricing in a 76.5% chance of a cut. Further rate cuts should help to boost precious metals.

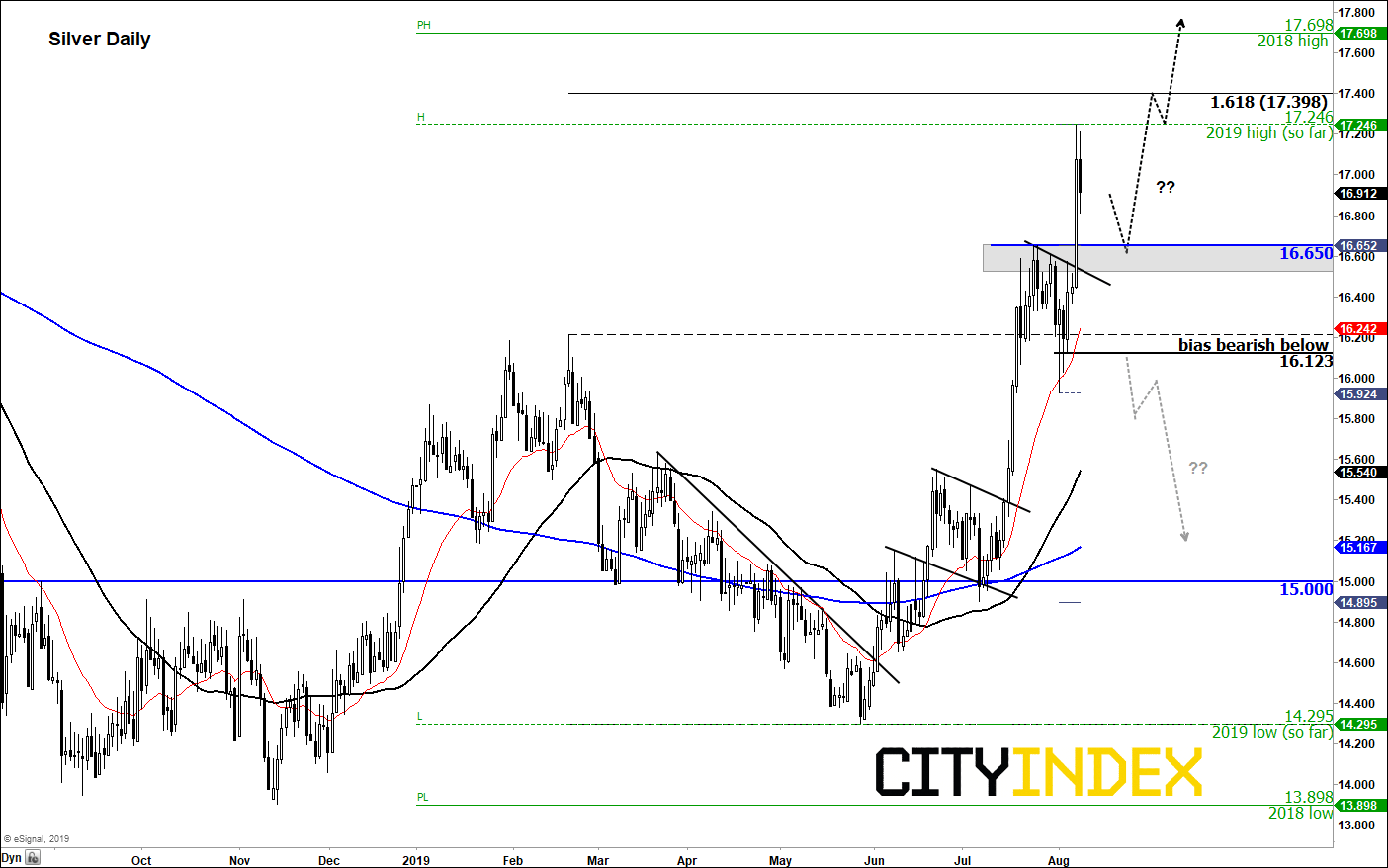

From a purely technical point of view, silver’s pullback today comes as no surprise given the extent of yesterday’s outsized-rally. The metal remains in a bullish trend for now, so we continue to prefer looking for bullish signs to emerge around support than bearish near resistance. Key support comes in around $16.65, or slightly lower. We will maintain out bullish view on the metal until and unless it forms a key reversal.

Source: eSignal and City Index