BOOM: Jerome Powell gets re-appointed as Chairman of the Federal Reserve last week and in his first testimony in front of the Senate and Banking Committee as “reappointed” Chairman, he tells the world that inflation is no longer transitory! This statement is HUGE for the markets. The Fed has already told us that maximum employment has been reached. The Fed has been waiting for the inflation piece of the equation to pick up steam in order for them to begin tapering bond purchases and raising rates. The Fed has previously acknowledged that there is inflation, however, the inflation was “transitory”. However, many market participants have seen the inflation as “here to stay”, waiting for the Fed and Powell to play catch-up. And today, Powell finally has!

Powell also noted that the FOMC will discuss accelerating tapering by a few months at the next meeting, which is December 14th-15th. At the previous FOMC meeting, the Committee decided that it would be appropriate to begin tapering bond purchases at a pace of $15 billion per month, consisting of $10 billion in Treasury bonds and $5 billion in MBS. That meant that the Fed bought $105 billion in November and $90 billion in December. If the FOMC decides to increase tapering from $15 billion per month to $30 billion per month, tapering would end in March 2022. However, also at the November meeting, Powell said that the criteria to raise interest rates would be much more stringent than that of the criteria for tapering. Will this still be the case when the FOMC meetings in December?

One person who won’t be happy with the retirement or the word “transitory” is Christine Lagarde. The ECB president and members of the ECB Committee have been out in force discussing if there needs to be a new bond buying program in Europe once PEPP expires in March 2022. The Eurozone released CPI Flash data on Tuesday and the headline print was 4.9% YoY vs 4.5% YoY expected and 4.1% YoY in October. If confirmed in mid-December, this will be the highest reading since July 1991! It will now be even tougher for Lagarde to argue transitory inflation in Europe with such high inflation readings.

Trade EUR/USD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

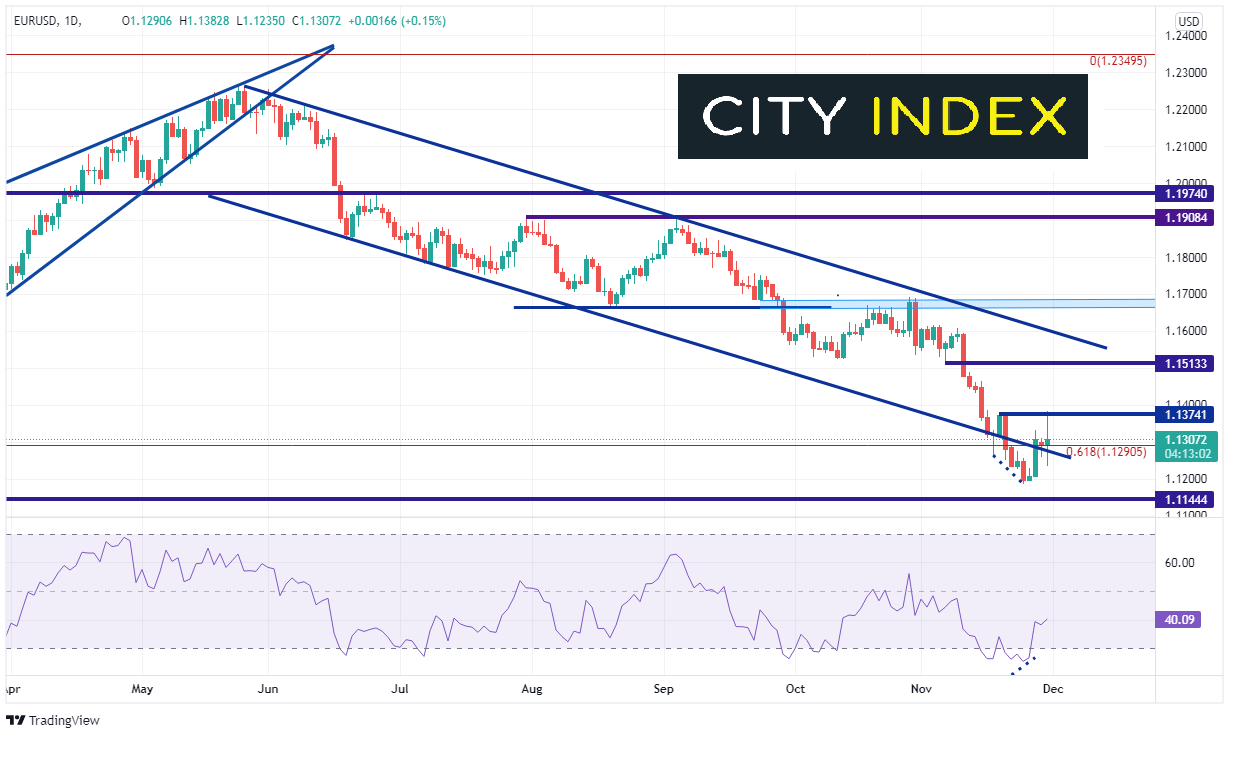

Traders have already been anticipating a more hawkish Fed vs a more dovish ECB. EUR/USD has been selling off since May in an orderly downward sloping channel from 1.2266 down to 1.1186, as the pair busted through the bottom of the channel on November 19th. However, on November 26th, price bounced back into the channel. Despite a volatile day today, EUR/USD is hovering near the 61.8% Fibonacci retracement from the March 2020 lows to the January 6th highs, near 1.1291.

Source: Tradingview, Stone X

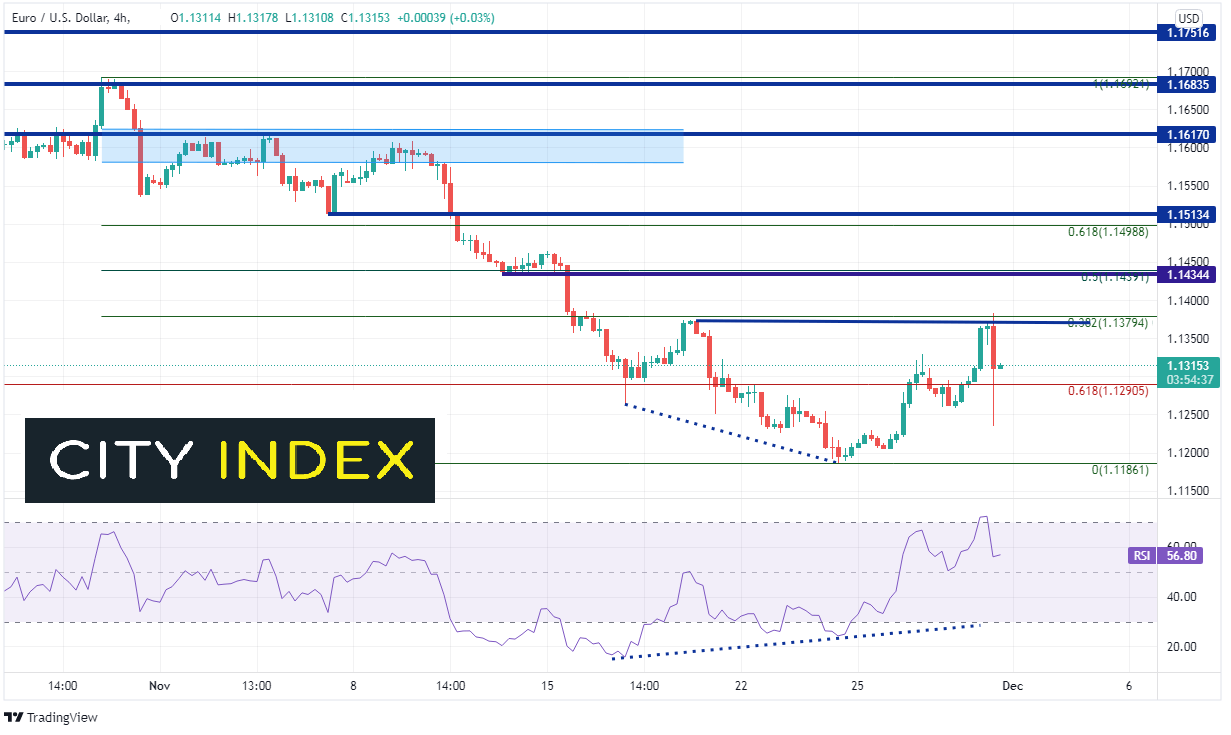

On a 240-minute timeframe, EUR/USD has bounced from the recent lows to the 38.2% Fibonacci retracement level at the October 28th highs, near 1.1379. (It is also easier to see the red 61.8% Fibonacci retracement discussed on the daily timeframe). The range on the day thus far has been nearly 150 pips! Resistance above 1.1380 is at the 50% retracement level and horizontal resistance near 1.1435, then the 61.8% Fibonacci retracement level, near 1.1500. Support is at the day’s low of 1.1235, then the November 24th lows of 1.1186. Below there is support from prior highs in March 2020 at 1.1144

Source: Tradingview, Stone X

Will the trend lower continue? If Powell continues to lean hawkish while Christine Lagarde continues to be dovish, EUR/USD could continue lower. The pair bounced from oversold levels back into the channel as the RSI moved back into neutral territory. This also may have just been profit taking as November moved to month end. Now that month end is over, watch for the previous trend lower to resume.

Learn more about forex trading opportunities.