FTSE has kicked off trading on the front foot amid growing optimism over the signing of the US -China phase one trade deal on 15th January and on the back of a weaker pound, pushing below $1.30.

UK economy contracts

The pound was already softer heading into the new week. However, dismal GDP data has since fuelled the selloff in sterling. GDP printed at -0.3% in November, well below October's 0% and short of expectations, as manufacturing proved to be the biggest drag on the economy. Following Mark Carney’s dovish comments at the end of last week pound traders are upping bets of a rate cut from the central bank. With no further clarity on a Brexit due for many months, the outlook for 2020 looks weak at best and a recession in the UK shouldn't be ruled out.

The pound was already softer heading into the new week. However, dismal GDP data has since fuelled the selloff in sterling. GDP printed at -0.3% in November, well below October's 0% and short of expectations, as manufacturing proved to be the biggest drag on the economy. Following Mark Carney’s dovish comments at the end of last week pound traders are upping bets of a rate cut from the central bank. With no further clarity on a Brexit due for many months, the outlook for 2020 looks weak at best and a recession in the UK shouldn't be ruled out.

Trade deal optimism

This week’s signing of the US – China trade deal has boosted sentiment across the globe. Investors will pour over the 86-page document for more details on the deal. Traders will be keen to understand the next steps for phase two, although Trump has already said that this could be after the US elections.

Geopolitical risk between US and Iran has eased helping boost the mod towards riskier assets. After 6% losses across the previous week, crude oil is consolidating losses below $60 per barrel.

This week’s signing of the US – China trade deal has boosted sentiment across the globe. Investors will pour over the 86-page document for more details on the deal. Traders will be keen to understand the next steps for phase two, although Trump has already said that this could be after the US elections.

Geopolitical risk between US and Iran has eased helping boost the mod towards riskier assets. After 6% losses across the previous week, crude oil is consolidating losses below $60 per barrel.

Levels to watch:

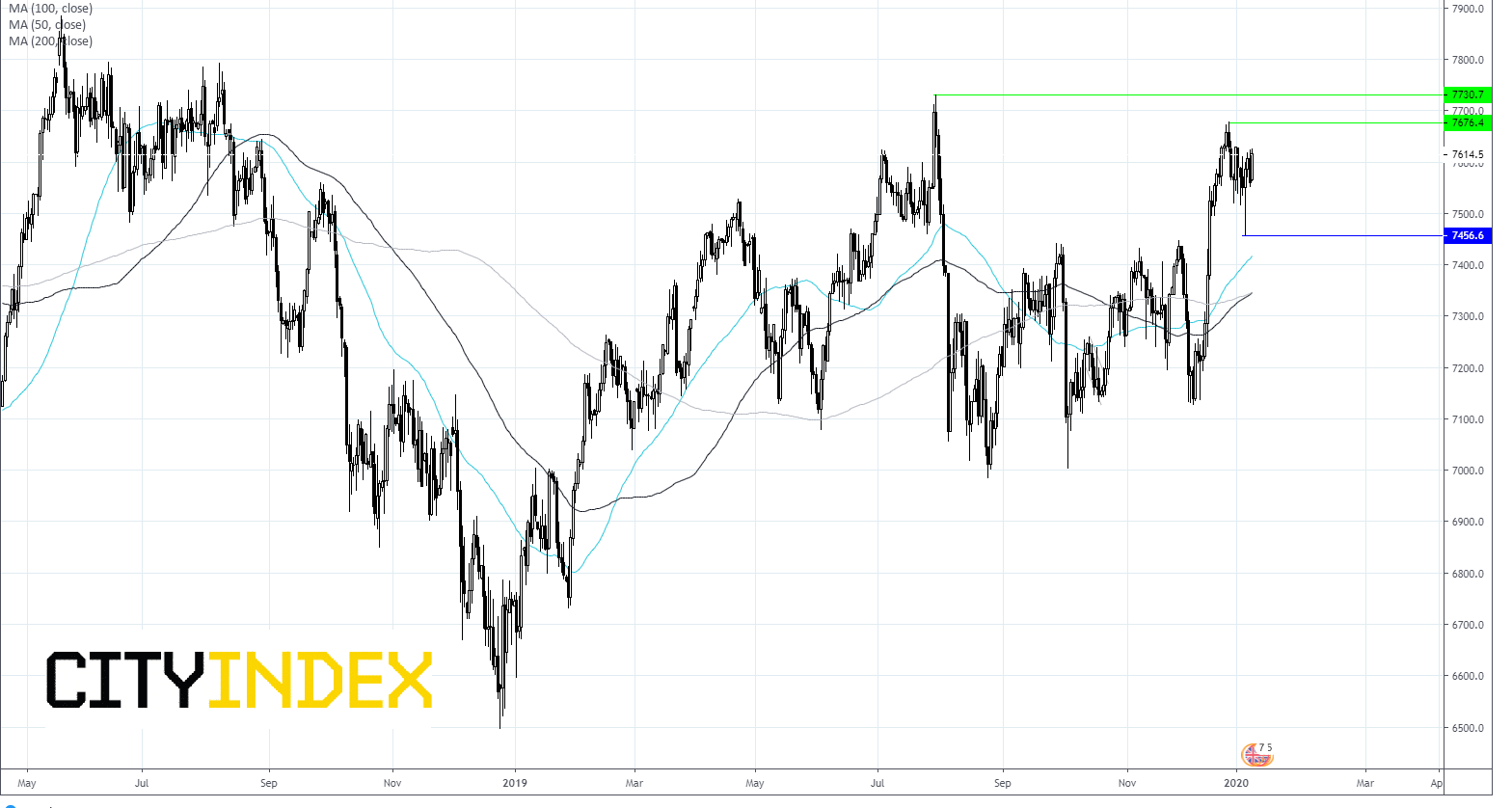

The FTSE is up 0.5% at 7630, approaching its 5-month high. Trading above its 50, 100 and 200 sma to chart is clearly bullish.

Resistance can be seen at 7676 (Dec 27th high), before opening the door to 7730 (July 30th high).

On the downside support stands at 7450 (Jan 8th low) prior to 7408 (50 sma).

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM