Theresa May will attempt to push her Brexit deal through Parliament at the beginning of June. With Labour refusing to support the deal in its current state, the chances of Theresa May achieving her goal are extremely slim. Should she fail for a fourth time to get the necessary support for her Brexit withdrawal agreement, then it looks as if her time is up. June 15th is being circulated as a potential exit date.

The concern for the pound is who comes next? A hard-line Brexiteer is the most probable candidate, meaning hopes of a softer version of Brexit are fading quickly. It is no coincidence that the pound fell as Boris Johnson announced that he was ready to pounce into Theresa May’s position should it become available.

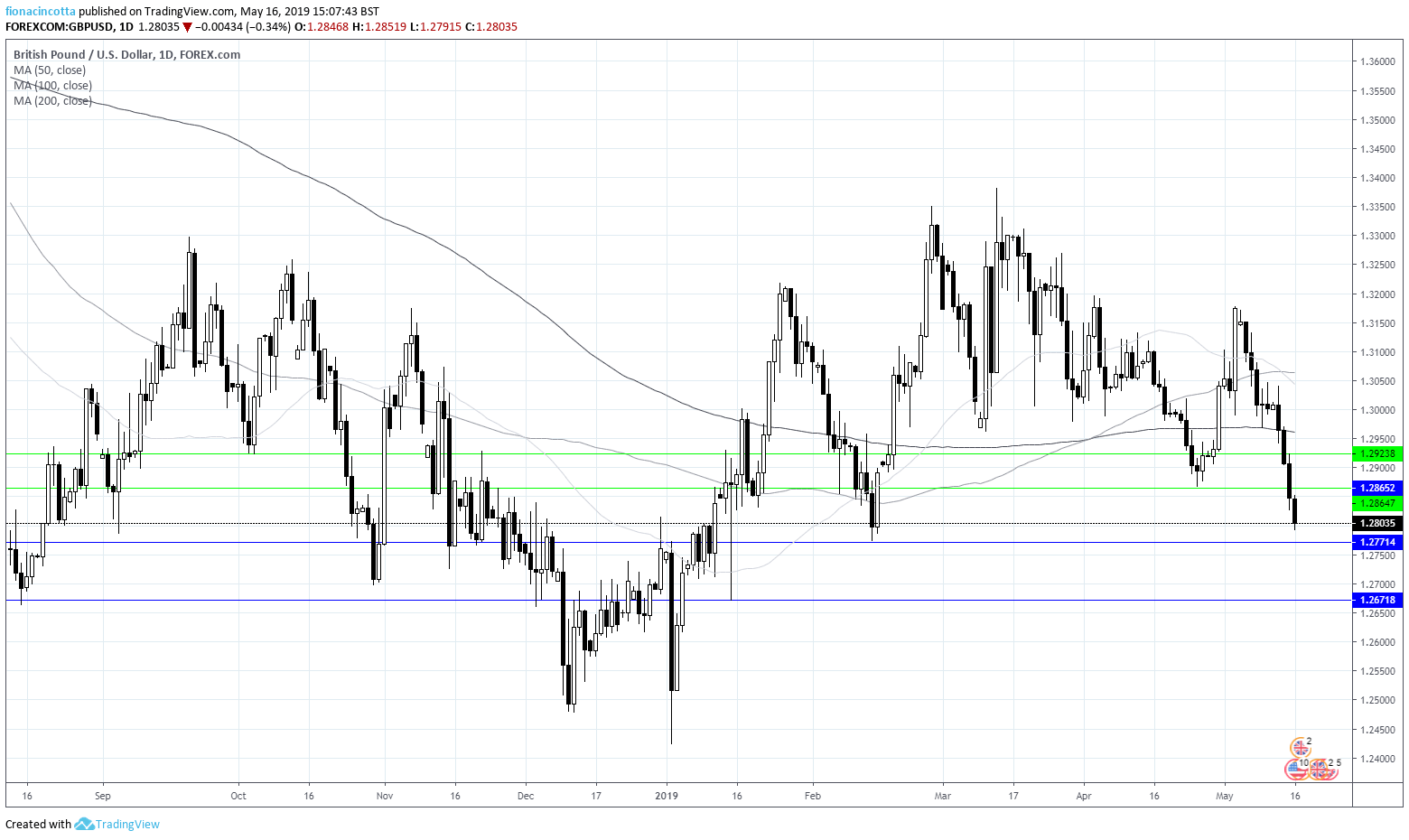

The pound broken through support at $1.2830 earlier today and is looking to test support at $1.2775. A meaningful break through this level could see the pound extend losses towards $1.2670. On the upside resistance can be seen at $1.2870 before $1.2925.