The pound has tanked to three-week lows as BoE member Michael Saunders opened the door to a rate cut by the central bank.

Policy maker Michael Saunders said that the BoE may cut rates as the next move even in the case that a disorderly Brexit is avoided.

The comments from Saunders highlight the marked weakening of the UK economy over recent quarters; dragged down not only by Brexit uncertainty but also softer global growth.

Even if the UK did manage to pull the rabbit out the bag and leave the EU with a deal, the elevated levels of uncertainty are unlikely to end there. Uncertainty over future trade agreements with the EU and other countries could leave companies in the lurch and unsure how to prepare for the different possible outcomes of those trade agreements.

The other scenario, that Brexit is once again extended, would also mean continued uncertainty over the future. As BoE Governor Mark Carney pointed out earlier this month, this scenario could also lead to a rate cut.

And then finally, the no deal Brexit. Mark Carney and the government itself (think yellowhammer) have painted a pretty grim picture for the UK economy and under this scenario, which would inevitably be bad news for the pound.

Pound traders are finding little to be cheerful over this morning, Saunders’ comments dented an already weak sentiment surrounding the pound. Brexit talks later today are unlikely to be a source of optimism either.

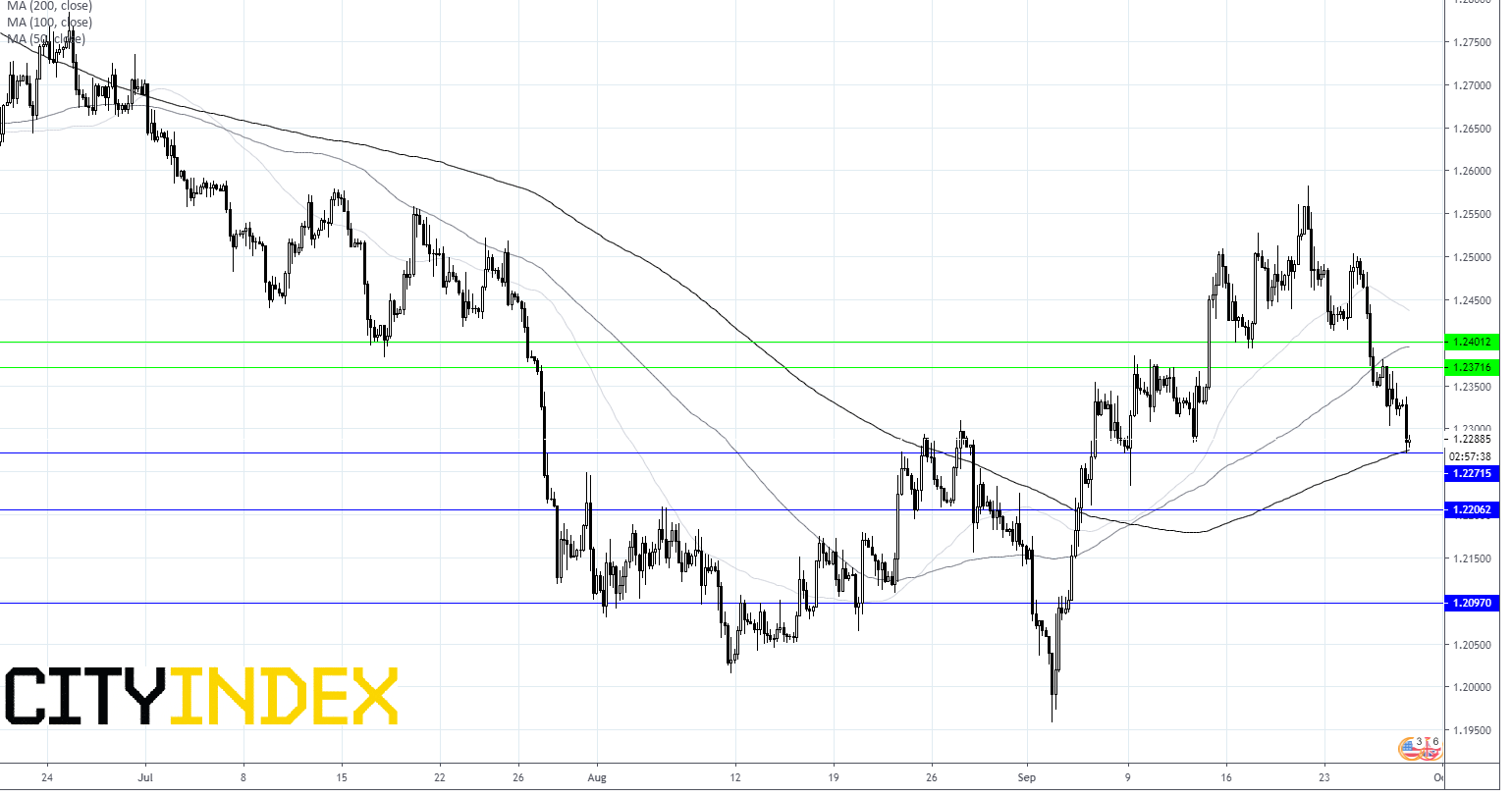

Levels to watch GBP/USD:

The pound dropped 0.3% and is trading at three-week lows. A break below $1.23 has set the stage for further depreciation to $1.2270. A breakthrough here could see the pair slip back towards $1.22. On the flip side, resistance can be seen at $1.2370 prior to $1.2400.