The next test comes tomorrow. Each of the remaining candidates need to secure at least 33 votes in Tuesday’s ballot in order to remain in the race to become Tory leader. Whilst the bookies are pointing to Rory Stewart managing this, he does need to pick up at least 14 votes to be in with a chance. Jeremy Hunt had 43 votes in the first round and Michael Gove 37.

Yet regardless of whether Rory Stewart or Jeremy Hunt make it to second place, the firm favourite is still Boris Johnson; supporter of Brexit come rain or shine, deal or no deal. With the increased prospect of the a no deal Brexit it’s unlikely the pound will manage any meaningful move higher, even if inflation data on Wednesday comes in better than forecast. Any moves higher right now should be viewed as a selling opportunity, rather than the start of a new upward trend.

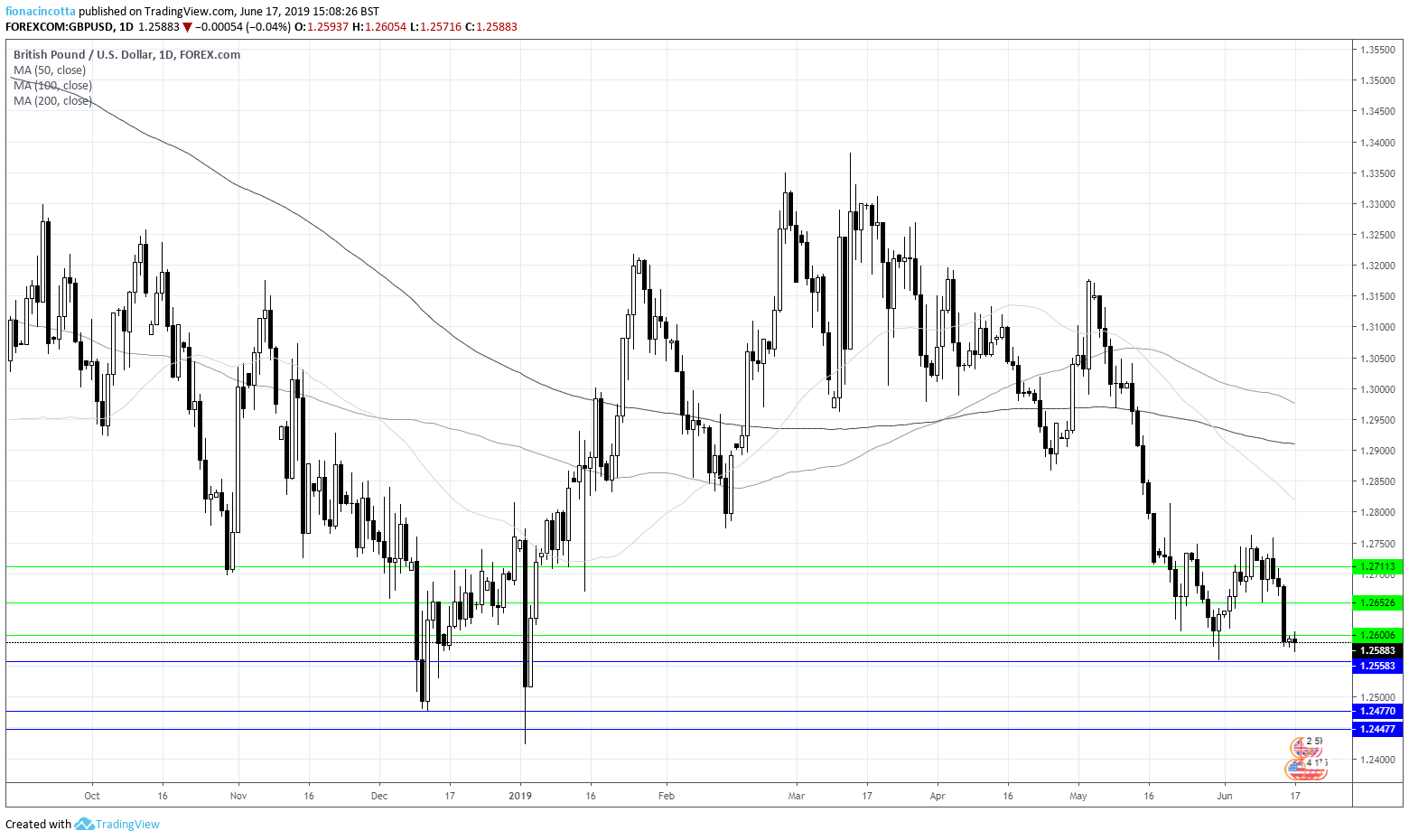

The pound is currently hovering just shy of $1.26, flat on the day on the day. That is mainly down to a dollar weakness story rather than any notable strength in the pound.

GBP/USD Levels to watch:

The pound hit a low of $1.2571 today, just 13 points off$1.2558 its lowest level since January. So, will it break through or bounce off this level?

Downside momentum is strong as GBP/USD trades below its 50, 100 and 200 SMA. A breakthrough $1.2558 could led to further declines with $1.2475 and $1.2445, lows in January to watch for. On the upside resistance can be seen at $1.2600, $1.2650 and $1.2710.