Pound shows strength after weak manufacturing data

The US dollar is still holding strong against most currencies. With the FOMC minutes due out tonight, we could see a very cautious dollar until […]

The US dollar is still holding strong against most currencies. With the FOMC minutes due out tonight, we could see a very cautious dollar until […]

The US dollar is still holding strong against most currencies. With the FOMC minutes due out tonight, we could see a very cautious dollar until the announcement. The main points will be on the speculation around a rate rise. If this is hinted at, the USD should have a big rally but as the Fed and Yellen are always slightly dovish, we believe that we will be left hanging on every meeting for some time yet.

It will be hard to ignore the strength shown in recent data from the US, notably the jobs data last week. There were comments last night from Fed’s Lacker that inflation is moving towards the Fed’s target rate.

In the Asian session, Chinese June CPI was released weaker than expected, creating speculation that more stimulus will be needed. This has had little effect on Asian currencies, except that it has kept the Kiwi up at a three-year high. The main bulk of the Kiwi move was due to ratings agency Fitch raising the outlook to positive for New Zealand.

The yen broke a big support yesterday at 101.70 – now a resistance level. The next big level on the downside would be 100.75. It should be interesting to see what the reaction will be to the FOMC tonight.

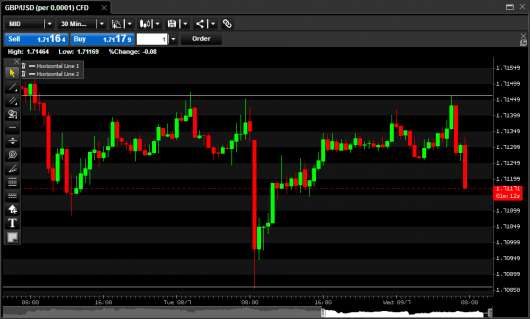

The pound had a little slip yesterday, with manufacturing slumping to its most in 16 months. It was short lived, however, as the bulls came out in force to push it back to flat for the day, disregarding the data.

Today Halifax released a slowdown in house prices, but this seems to have a null effect on the market as the previous was revised up slightly. Even though year-on-year data was weaker than expected, it still shows a growth in prices from the previous.

The euro is still in the hands of the ECB, with little data out today to help it along. But Draghi, the main person in all of this, is talking tonight and this could be one to watch with inflation issues and QE on everyone’s minds.

Chart of the GBPUSD fall after manufacturing data.

![]()

![]()

EUR/USD

Supports 1.3605 1.3580 1.3540 | Resistance 1.3630 1.3645 1.3700

![]()

![]()

USD/JPY

Supports 101.20 100.75 100.50 Resistance 101.70 102.30 102.50

![]()

![]()

GBP/USD

Supports 1.7100 1.7080 1.7065 Resistance 1.7180 1.7200 1.7265