With Brexit just one month away, the sector benefited from some firms building inventories. However, the vast majority of European customers are eliminating their reliance on UK manufacturing an rerouting their supply chains away from the UK. With no Brexit deal in sight, UK manufacturing sector could be faced with a more challenging climate before any signs of improvement.

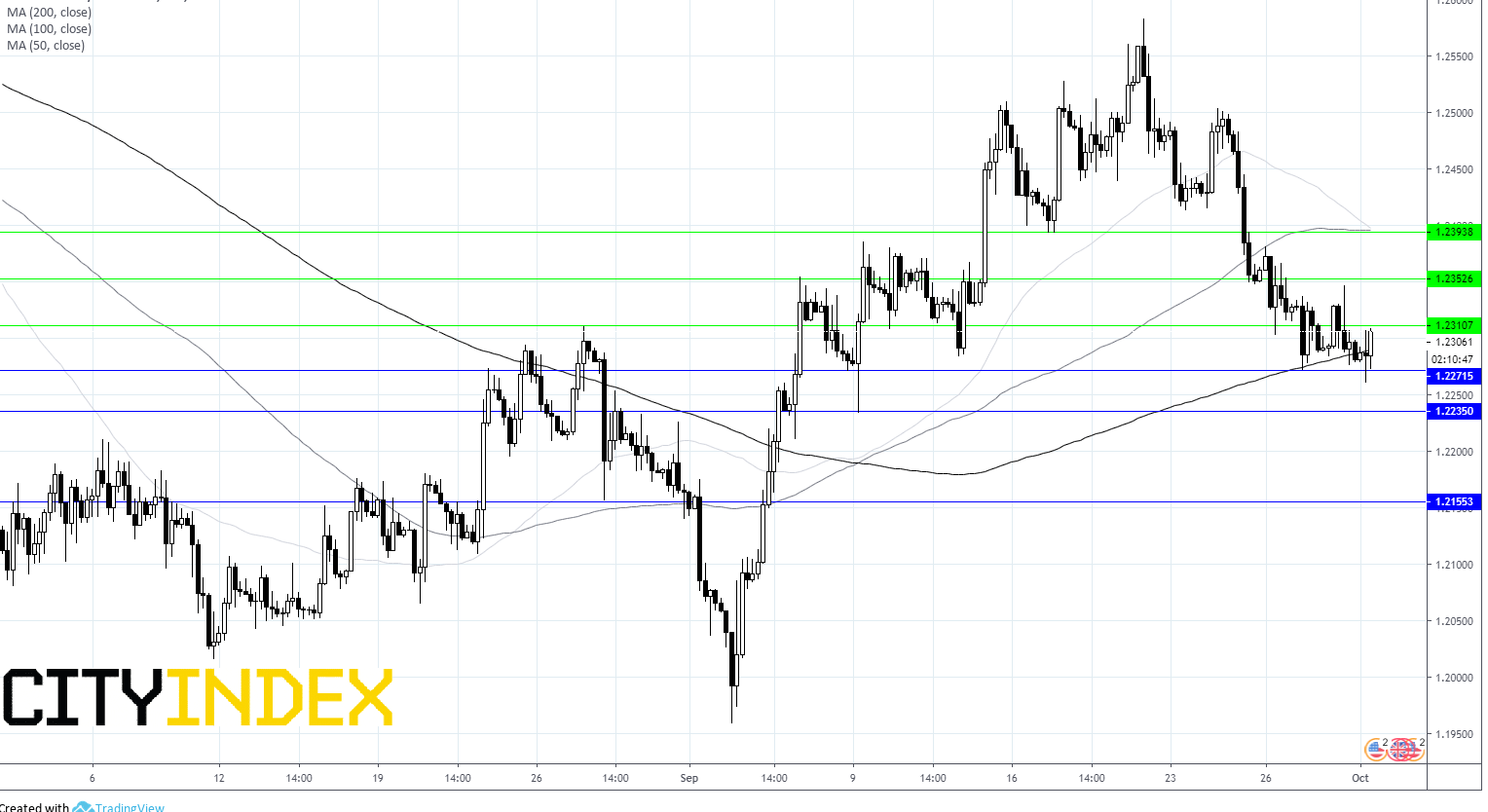

Pound traders will turn their attention back to Brexit, with Boris Johnson expected to submit formal proposals to for an alternative to the Irish backstop on Wednesday. Any sign of acceptance from the EU could propel the pound back towards US$1.25.

Dollar traders eye manufacturing data

On the other side of the equation, the dollar stands solid. Whilst recent US data hasn’t been outstanding, it hasn’t been bad either. In short, the US economy has remained resilient amid the ongoing US – Sino trade war. The fact that the Fed are in no rush to cut rates, which central banks across the globe ease policy is also supporting the buck.

Attention now turns to US manufacturing data, which is expected to show that the sector rebounded in September, back into expansion after slipping into contraction in August. A strong reading could lift the dollar higher and pull cable back below $1.23