The FTSE was in line to rise for the 11th straight session on Friday however the soaring pound rained on the FTSE’s parade. The UK index pared gains and is heading towards the close on Friday on the flat line, even as the Santa rally showed no signs of slowing elsewhere. US stocks reached for fresh all-time highs on the open.

Pound surges

However, gains on the FTSE pared as the pound surged through $1.31 handle, thanks to a weaker dollar as risk sentiment leads the way. Fears over no deal Brexit are likely to cap the rally but given the thin trading the moves we are seeing are more exaggerated than in a standard session.

Looking ahead investors will be keen for a date to be confirmed for the signing of the US – China phase one trade deal. Developments surrounding further stages to the trade deal will also drive risk sentiment in the coming year, as will the UK’s negotiations with the EU over a free trade deal.

Levels to watch:

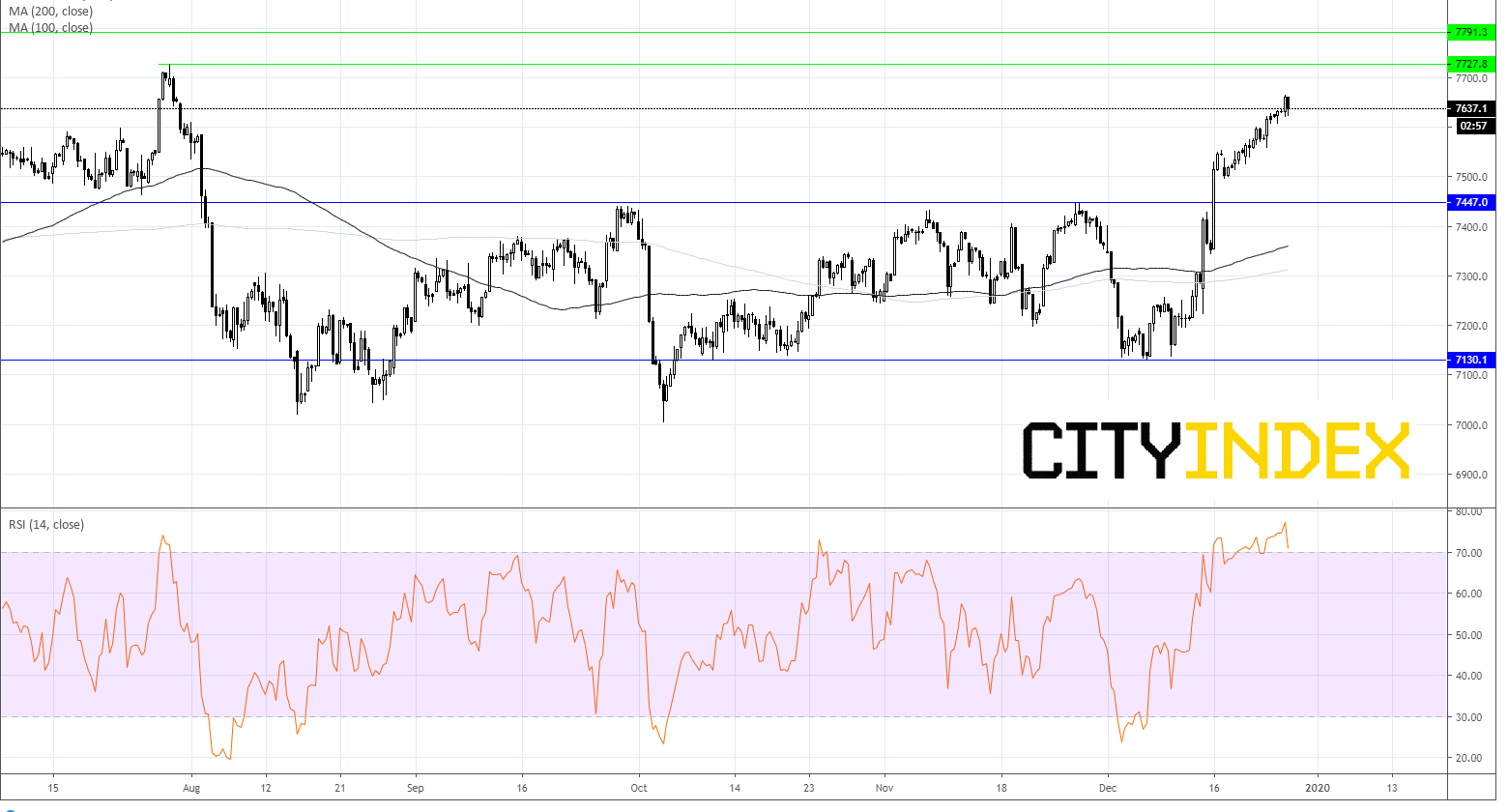

The FTSE has been in a strong up trend since the beginning of December. It trades firmly above its 50, 100 and 200 sma. However, the index is overbought according to RSI, so could lead to a downward move.

A breakthrough resistance at 7727 (YTD high) could open the door to 7790 (Aug’18 high). On the downside, support can be seen at 7446 (Nov resistance turned support) prior to 7130 (Dec low).