Poor US Data won't Help the Risk Off Move Today

When US traders woke up this morning, S&P 500 futures were already down 35 handles. Whatever the reason, whether it was a blame game about the coronavirus or expectations of disappointing US data, the markets were in risk off mode. When the US data was released, it wasn’t the reading economists were looking for. Below is the important US data released this morning, along with their expectations, last reading, and whether the data was better or worse:

Data Actual Expected Last Better or Worse than Expected

Retail Sales: -8.7% 8.0% -0.4% Worse

Retail Sales (Ex -Auto): -4.5% -4.8% -0.4% Better

NY Empire State Manu: -78.2% -35 -21.5 Worse

Industrial Prod: -5.4% -4% 0.5% Worse

Manufacturing Prod: -6.3% -3.2% -0.1% Worse

Capacity Utilization: 72.7% 73.8% 77% Worse

NAHB House Mkt Index: 30 55 72 Worse

Two things jump out from this data picture:

1) Retail sales data and the NY Empire State Manufacturing Index were THE WORST ON RECORD

2) Most of the data was much worse than the survey of economists had expected.

This comes on the heels of the 3 worst weeks of initial jobless claims data ever, totaling nearly 17,000,000. And expectations for tomorrows initial claims data is for another -5,000,000.

However, one thing we know about markets is that they are always trying to “price in” future data. So, traders will look at this data in one of 2 ways, both of which depend on the outlook of the coronavirus:

1) Ignore the data, its old and we are past the peak of the coronavirus, so buy risk

2) this data is horrible, even worse than economists thought, and there is more to come because the coronavirus has not yet peaked. No one knows when the US will “re-open”, therefore sell risk.

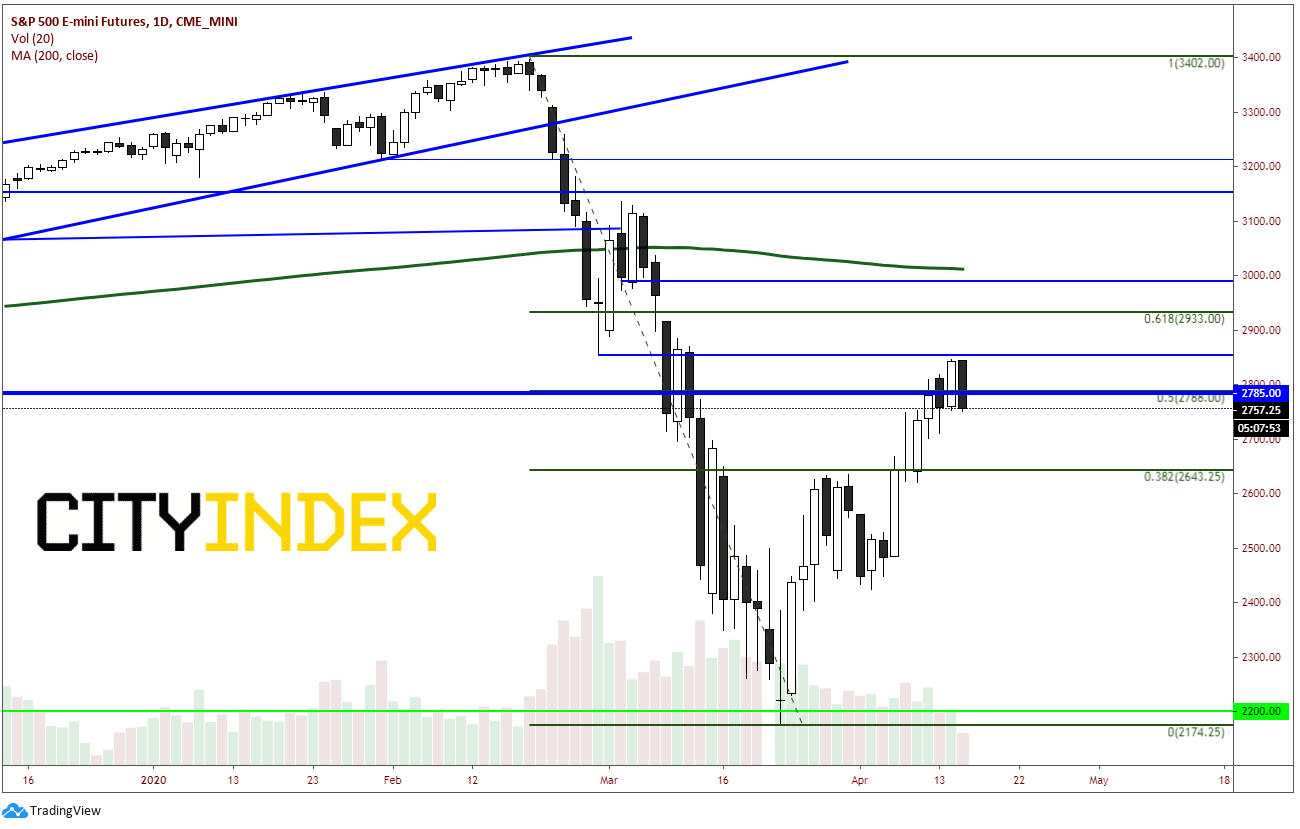

So far today, it appears as though stock prices don’t believe the worst is over yet and the latest rally was just a “bear market rally”. The S&P 500 traded up to near 2850 and stalled as price is currently forming a marubozo black candle. This candle formation has little or no upper and lower wicks, which means the opening price is the same as the high and the closing price is the same as the low. This is a very bearish formation.

Source: Tradingview, CME, City Index

Traders will need to continue to watch the daily coronavirus briefings and the weekly initial jobless claims data to determine where we are along the coronavirus path.