Ping An Insurance (2318.HK): Consolidation in Place Before Next Rally

Ping An Insurance (2318), a top Chinese insurer, announced that 3Q net income grew 7.8% on year to 34.4 billion yuan on net earned premiums of 172.85 billion yuan, up 8.6%. The annualized operating ROE was 20.9%, down by 2.0 pps on year. After announcing the result, the company opened 1.4% lower.

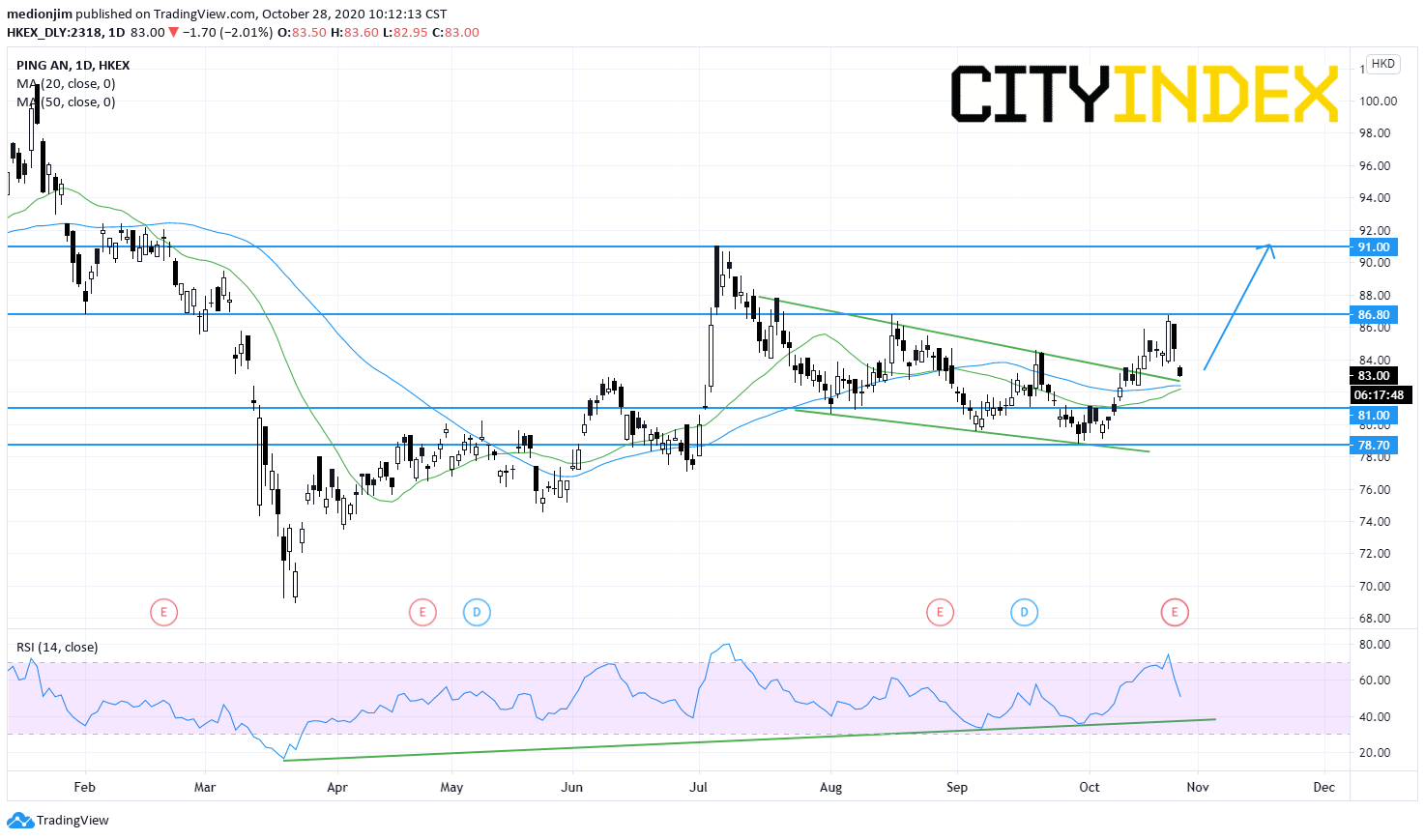

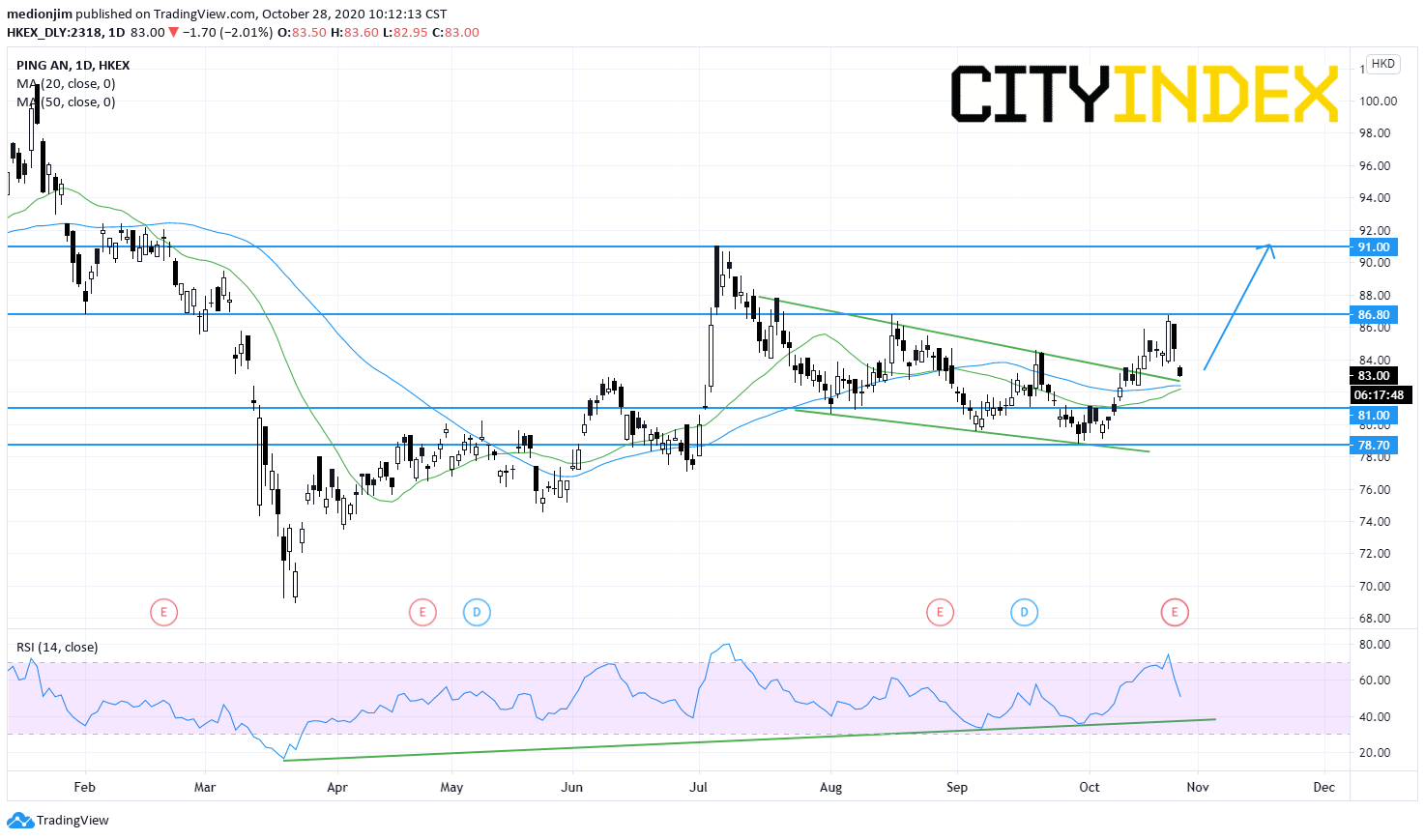

From a technical point of view, although the stock posted a pullback from HK$86.80, it is still trading above the former declining trend line. In fact, the stock remains staying above both 20-day and 50-day moving average. The RSI is also supported by a rising trend line drawn from March. Currently, readers could look for a candlestick reversal signal to confirm the stabilzation of the stock prices.

Bullish readers could set the support level at HK$81.00, while resistance levels would be located at HK$86.80 and HK$91.00

Source: GAIN Capital, TradingView

From a technical point of view, although the stock posted a pullback from HK$86.80, it is still trading above the former declining trend line. In fact, the stock remains staying above both 20-day and 50-day moving average. The RSI is also supported by a rising trend line drawn from March. Currently, readers could look for a candlestick reversal signal to confirm the stabilzation of the stock prices.

Bullish readers could set the support level at HK$81.00, while resistance levels would be located at HK$86.80 and HK$91.00

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM