Philips faces challenging resistance after Q2 update

Philips, the Dutch conglomerate, announced that Q2 net income dropped 15% on year to 210 million euros and EBITA fell 12% to 388 million euros on revenue of 4.40 billion euros, down 6% (-6% comparable growth). Regarding the outlook, the company said: "We expect to return to growth and improved profitability for the Group in the second half of the year, (...) Consequently, for the full year 2020 we continue to aim for a modest comparable sales growth and Adjusted EBITA margin improvement."

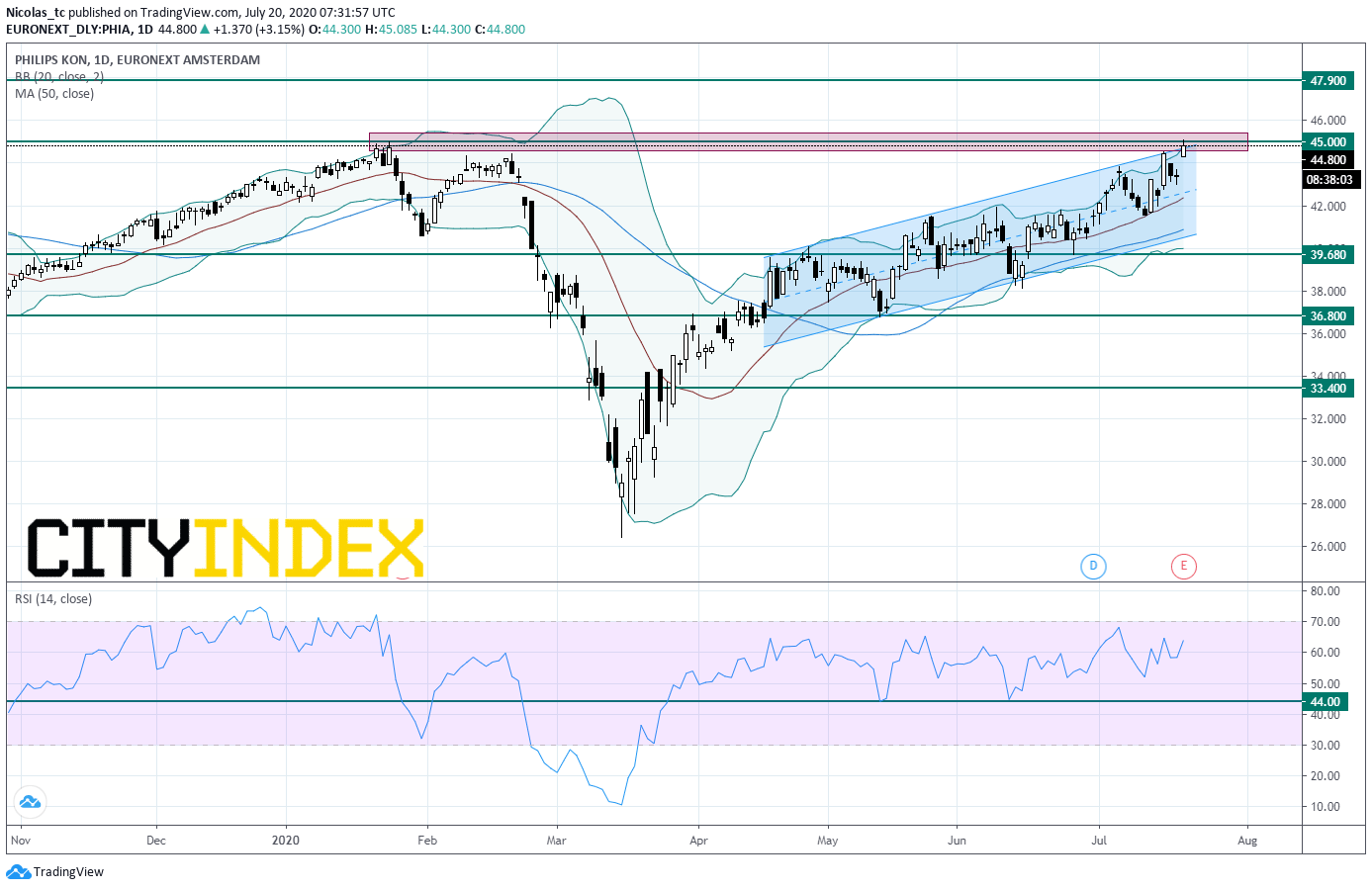

From a chartist point of view, the stock price is posting a rebound and remains supported by its rising 20DMA currently at 42.38E. The daily Relative Strength Index (RSI, 14) is bullish and not overbought. However, the stock price faces a challenging resistance at 45E (January 2020 high). Investors have to remain cautious as these levels may trigger profit taking. The bias remains bullish above 36.68E. A break above 45E would open a path to see 47.9E (Fibonacci projection). Alternatively, a push below 39.68E would call for a reversal down trend towards 36.8E and 33.4E.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM