Peugeot: Technicals point to recovery

Peugeot and Fiat Chrysler Automobiles have decided to amend certain terms of their merger agreement in order to strengthen their balance sheet in the face of the health crisis, "while preserving the economic value and fundamental balance of the initial merger agreement". PSA's 46% stake in equipment maker Faurecia will be distributed to all shareholders of the new entity, named Stellantis, and FCA will reduce its exceptional dividend to €2.9 billion instead of the €5.5 billion envisaged.

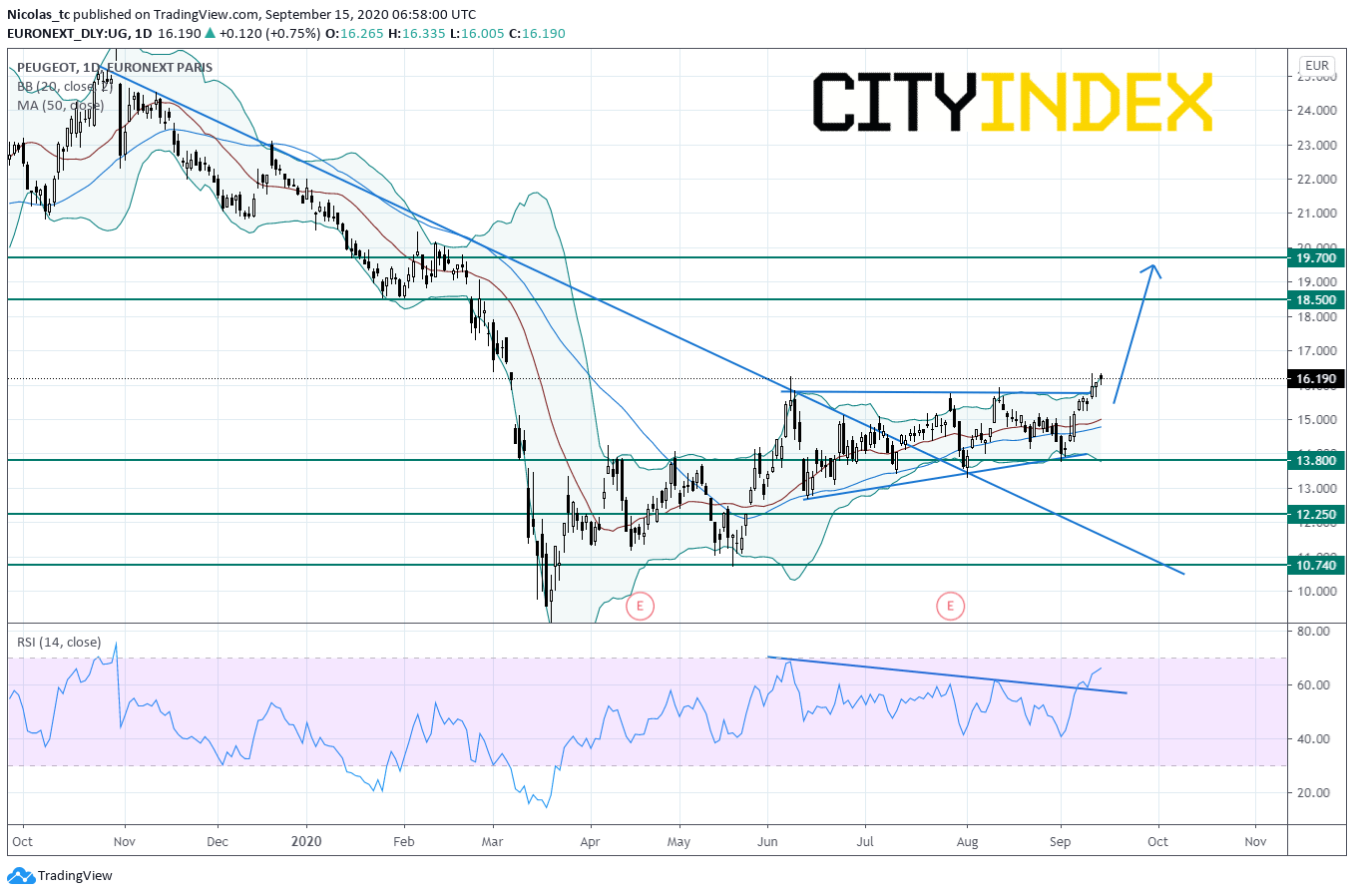

From a technical point of view, Peugeot may post a rebound as prices escaped from an ascending triangle pattern by pushing above the threshold at 15.7E. The daily Relative Strength Index (RSI, 14) has broken above a declining trend line and is not overbought. Bollinger bands are widening. This could indicate that a short term recovery is on the way. Readers may want to consider the potential for opening Long positions above the threshold at 13.8E with 18.5E and 19.7E as targets. Alternatively, a push below 13.8E would invalidate the bullish view and would call for a slump towards 12.25E and 10.74E.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM