PetroChina (857.HK), the oil and gas giant in China, does not post a sustainable rebound as crude oil. Crude oil futures reached the 9-month high recently, but the share prices of PetroChina even broke below the low of March to HK$2.20 in October and recorded a new 52-week low at HK$2.15.

Recently, the company's subsidiary Kunlun Energy (135.HK) announced that it has agreed to sell 60% stake in a Beijing natural gas pipeline and 75% stake in its Dalian LNG company for 40.9 billion yuan to the new state-owned company China Oil & Gas Pipeline Network Corporation.

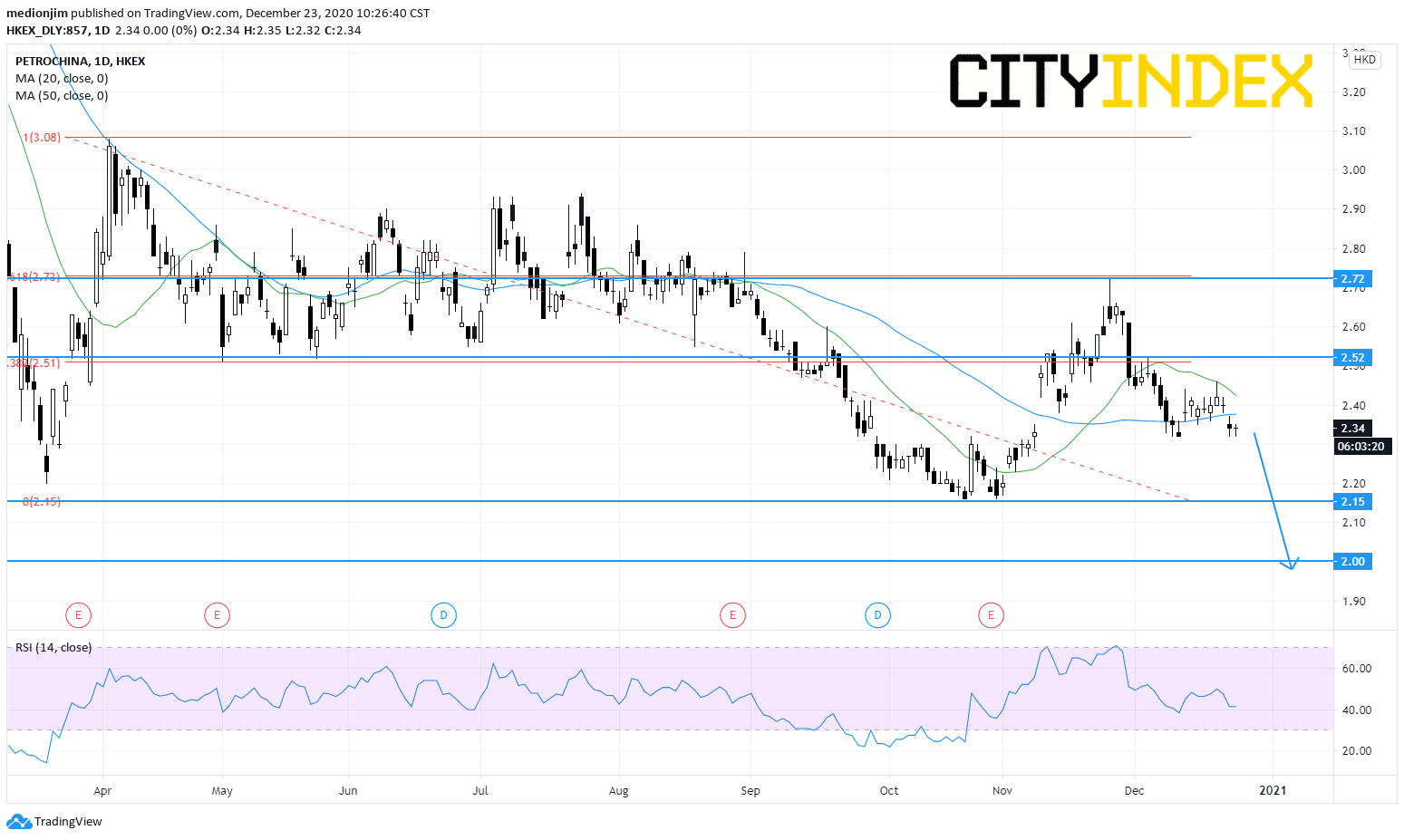

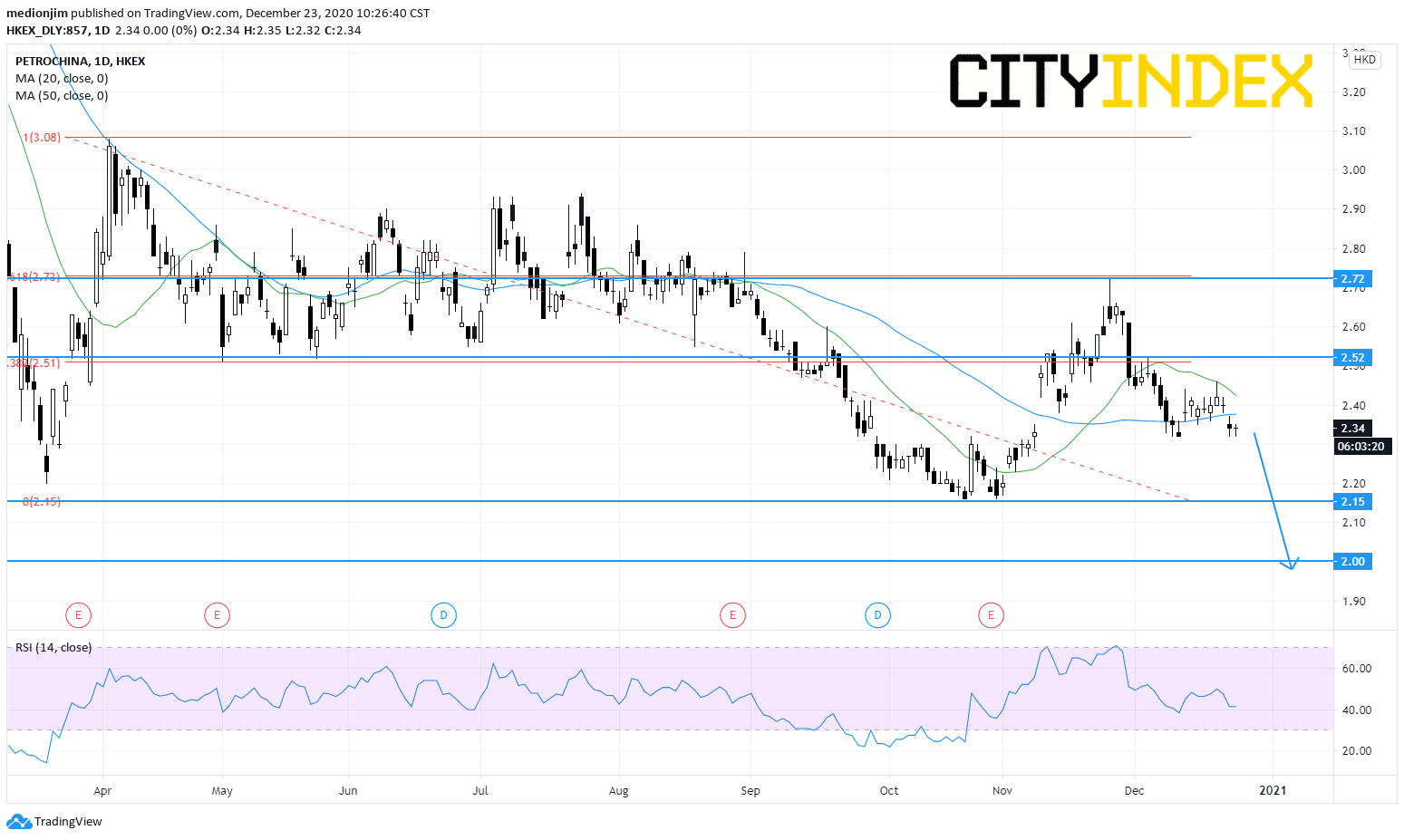

From a technical point of view, the stock retreated after rebounding to the 61.8% retracement level. Currently, the prices returned to the level below both 20-day and 50-day moving averages. Bearish readers could set the resistance level at HK$2.52, while support levels would be located at HK$2.15 and HK$2.00.

Source: GAIN Capital, TradingView

Recently, the company's subsidiary Kunlun Energy (135.HK) announced that it has agreed to sell 60% stake in a Beijing natural gas pipeline and 75% stake in its Dalian LNG company for 40.9 billion yuan to the new state-owned company China Oil & Gas Pipeline Network Corporation.

From a technical point of view, the stock retreated after rebounding to the 61.8% retracement level. Currently, the prices returned to the level below both 20-day and 50-day moving averages. Bearish readers could set the resistance level at HK$2.52, while support levels would be located at HK$2.15 and HK$2.00.

Source: GAIN Capital, TradingView

Latest market news

Today 08:33 AM