Mexico’s currency may struggle to extend trade truce gains

U.S. President Donald Trump’s meeting with China’s Vice Premier Liu He, the leader of the Chinese delegation, has reportedly begun. Earlier, some news outlets reported that a limited U.S.-China trade deal along the lines of those widely reported had been agreed.

Continuing positive news flow is keeping the market’s bullish floodgates open. In currency terms, that’s another way of saying that the dollar’s correction from recent multi-month highs continues. The performance right now of the least buoyed north American currency for most of the year backs the view that the dollar’s free reign may be at an end. Friday sees Mexico’s Peso continuing a rally that has seen it gain 4.8% from late August lows.

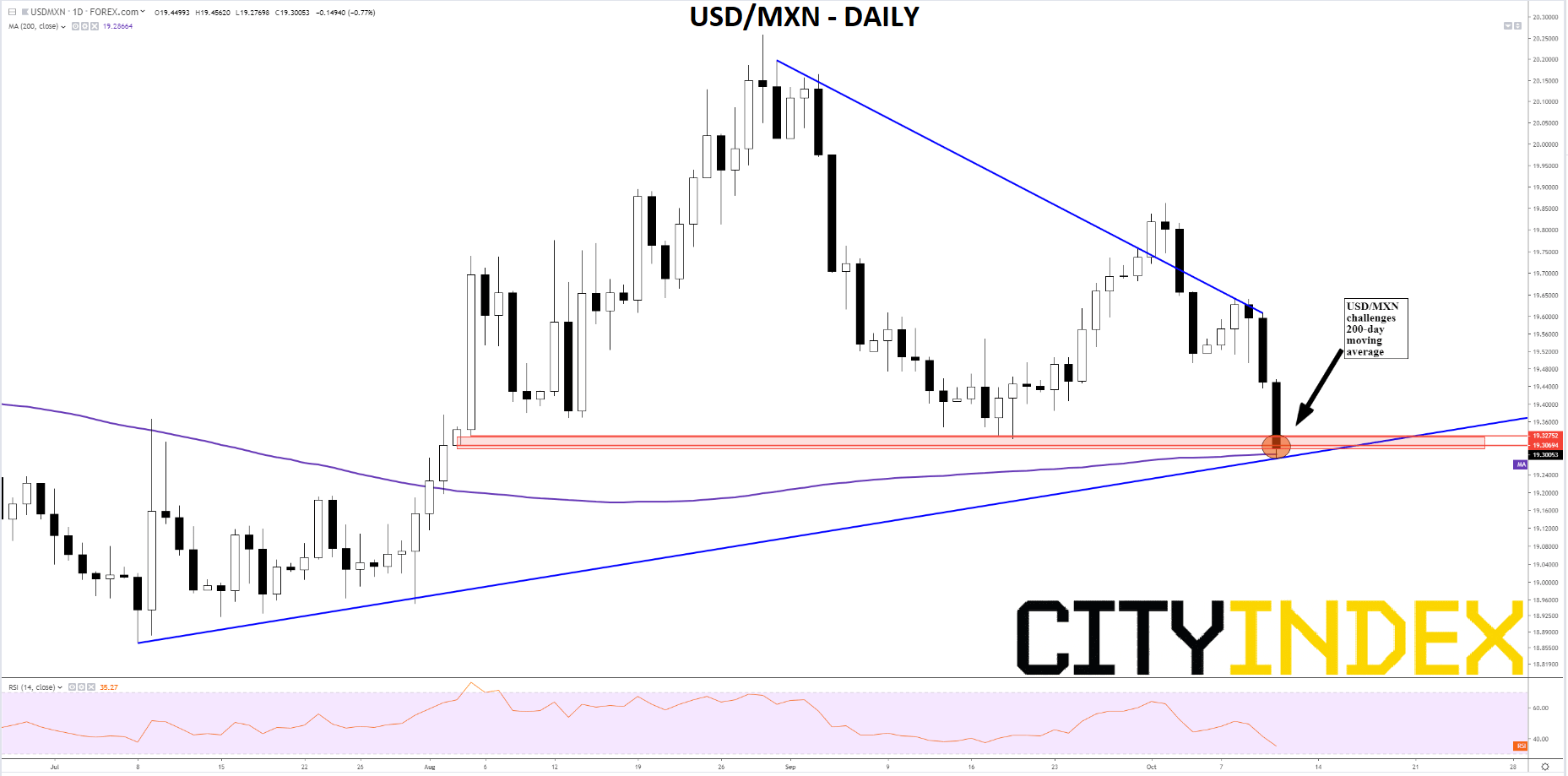

The peso is possibly notching an important confirmation as USD/MXN tests its 200-day moving average. (Note USD/MXN falls are in favour of the peso.) The 200-DMA break is in confluence with support established in early August and clearly tested around the middle of last month. The zone ranges across 19.306, 4th August low, up to 19.327, the low of a significant-looking break higher on the day after. The pair also touches a rising trend line between here and July’s low.

The 200-DMA has provided support or resistance four times this year. A confirmed U.S.-China trade deal could take the pair through these barriers, though perhaps only a break of the July low should confirm that a trend change has begun.

Furthermore, yesterday’s Bank of Mexico minutes suggested that policymakers remain concerned about high core inflation, a possible indication that further and larger cuts may be coming than the 25 basis-point reduction on 26th September to 7.75%. A stronger peso provides additional margin for easing, after all.

The tide may be turning for the dollar but that may still not be enough to establish a sustained uptrend for MXN. If so, there may be opportunities to fade false breaks ahead.

USD/MXN – Daily

Source: City Index