This In the current market downturn, traders are scanning the markets for stocks which are outperforming and riding against the tide. Peloton, is achieving just this. Furthermore, there is a good chance that its strong ride will continue even after the current restriction on movement end.

With the number of people in lock down increasing and the potential length of the imposed lock down’s also being stretched, people are turning to home workouts to keep fit and occupied during these testing times.

This is good news for Peloton, which sells home workout equipment and streamed exercise classes through a subscription service. It also offers, through an app, workouts for people without its exercise equipment. Total downloads of this app have increased 5 fold in March compared to February. According to analysts at Evercore ISI the conversion rate from the app to equipment is just shy of 10%. The Peloton stores in New York and London may be closed, but deliveries to new customers are still being made.

Whilst indications are pointing to blowout quarter thanks to the coronavirus lock down, figures were impressive even before the outbreak despite a lukewarm IPO. In Q2, reported in December 2019, revenue rose +77% to $446.3 million up from $269.9 million. Recent review activity and scores indicate that consumers’ attitudes towards peloton continue to improve despite its hefty price tag.

Peloton for life not just for quarantine

The bikes are expensive at around £1900. If someone invests that amount of money into exercise equipment, the chances are it is because they are looking to continue using the equipment and streaming services going forward after the quarantine ends. The same could be said for the app, if people have tried out home exercising and enjoyed the experience there is a good chance that they may try to continue the habit after the lock down period ends.

The bikes are expensive at around £1900. If someone invests that amount of money into exercise equipment, the chances are it is because they are looking to continue using the equipment and streaming services going forward after the quarantine ends. The same could be said for the app, if people have tried out home exercising and enjoyed the experience there is a good chance that they may try to continue the habit after the lock down period ends.

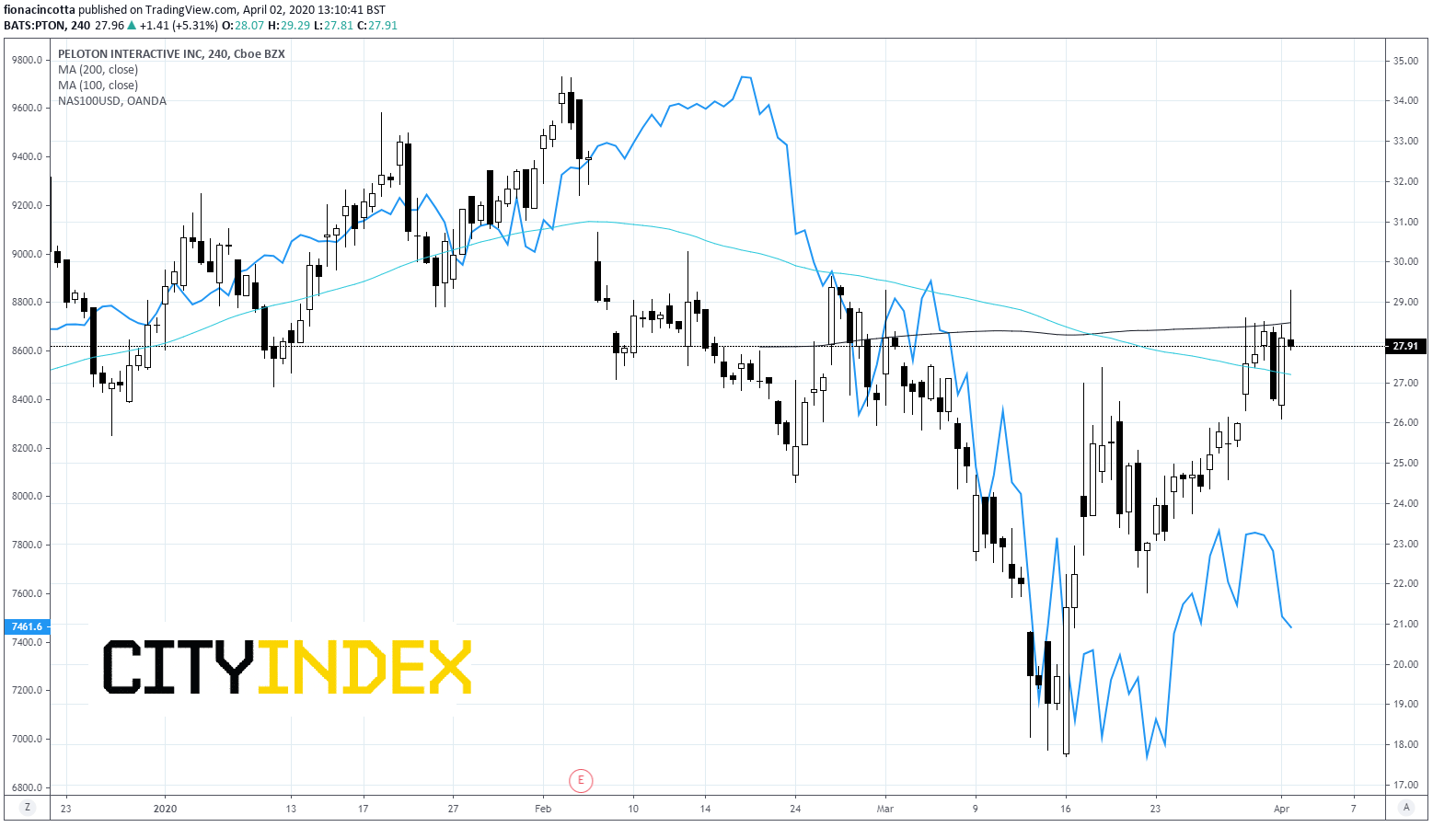

Chart thoughts

After dropping to a low of $17.70 (16th March) the stock has surged over 55% in just two weeks to its current price of $27.96. Far outperforming the Nasdaq, which has gained just 7%.

A meaningful move over its 100 sma (4 hour chart) at $28.50 could see more bulls jump in.

Latest market news

Yesterday 11:48 PM

Yesterday 11:16 PM

Yesterday 05:00 PM

Yesterday 01:13 PM