Pay Attention to Me!!!

With the UK elections now behind us, there is less uncertainty surrounding an orderly Brexit come the end of January (or sooner). Although Boris Johnson still has a great deal of work ahead of him, FX market participants may begin to pay attention to the data once again moving forward. This week brings a plethora of data from the UK to use as a re-starting point, which will begin to bring everyone up to date from those summer days before the Brexit deal was a “done deal”. Today we saw our first look at December’s PMI data, and both the manufacturing PMI and services PMI were worse than expected. Here is the lineup for the rest of the week:

Tuesday: Employment Data for Nov, including Claimant Count and Unemployment Rate

Wednesday: Inflation Data for Nov, including Inflation Rate, PPI, and Retail Price Index

Thursday: Retail Sales for Nov and BOE (unchanged is expected)

Friday: GDP (Q3) Final

After the Bank of England meeting on Thursday, market participants will have a better idea of how the UK economy has been. Take this data with a grain of salt as the data is from November, which was the time leading up to the elections. Much of the country was “on hold” waiting for the election outcome. As we are currently mid-way through December, any real economic uptick or downtick will likely not be until January.

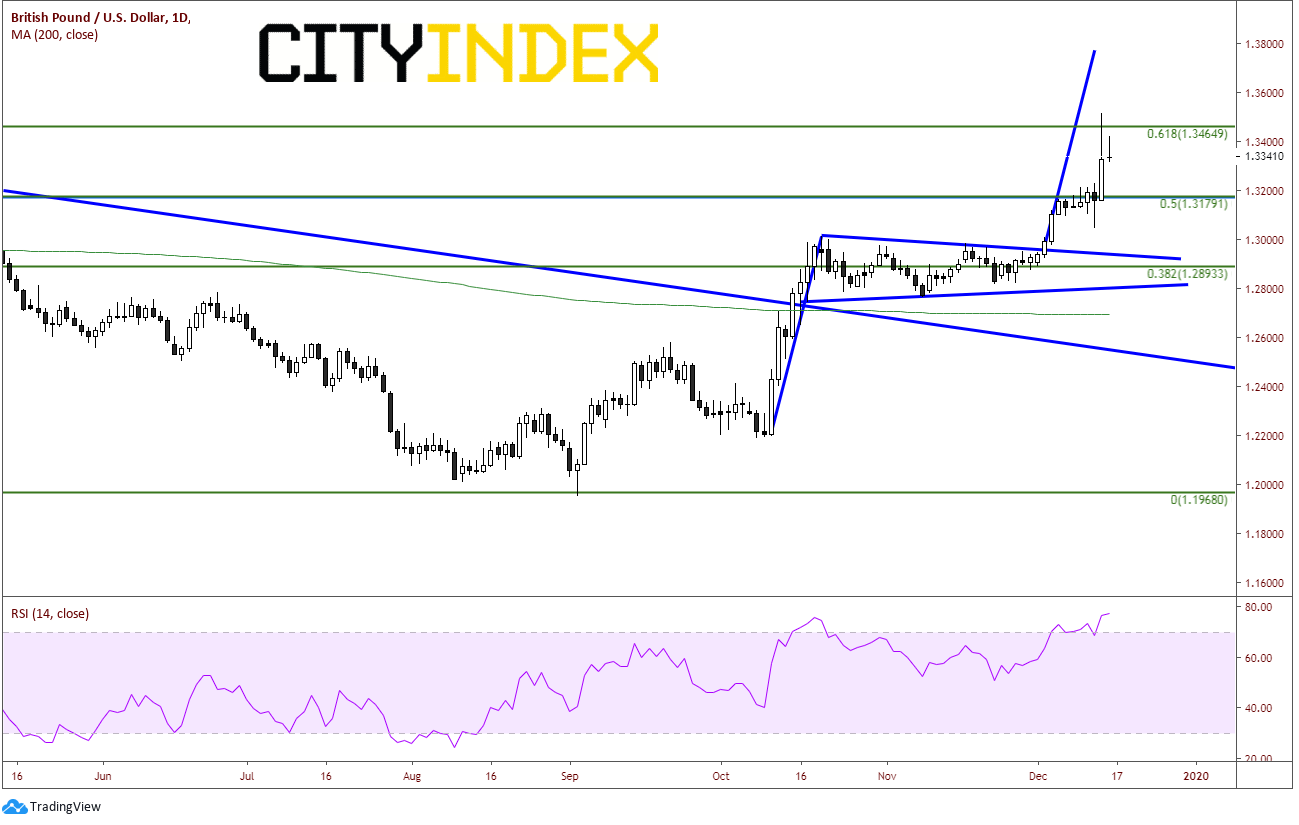

GBP/USD bulls will be looking for dips to 1.3200 to buy. After the breakout from the pennant and the extreme move higher on Friday, price is currently in overbought conditions, and seen on the RSI which is close to 80. With the move higher, price pierced the 1.3500 level and 61.8% retracement level from the April 2018 highs to the September 3rd, 2019 lows and pulled back. Today GBP/USD put in an inside day (as did most US Dollar pairs), as the market waits for more information.

Source: Tradingview, City Index

The target on the pennant is near 1.3775. Data this week, the BOE, or Brexit comments could continue to push price higher. Just keep in mind that economic activity may pick up going forward with the uncertainty of the election out of the way!