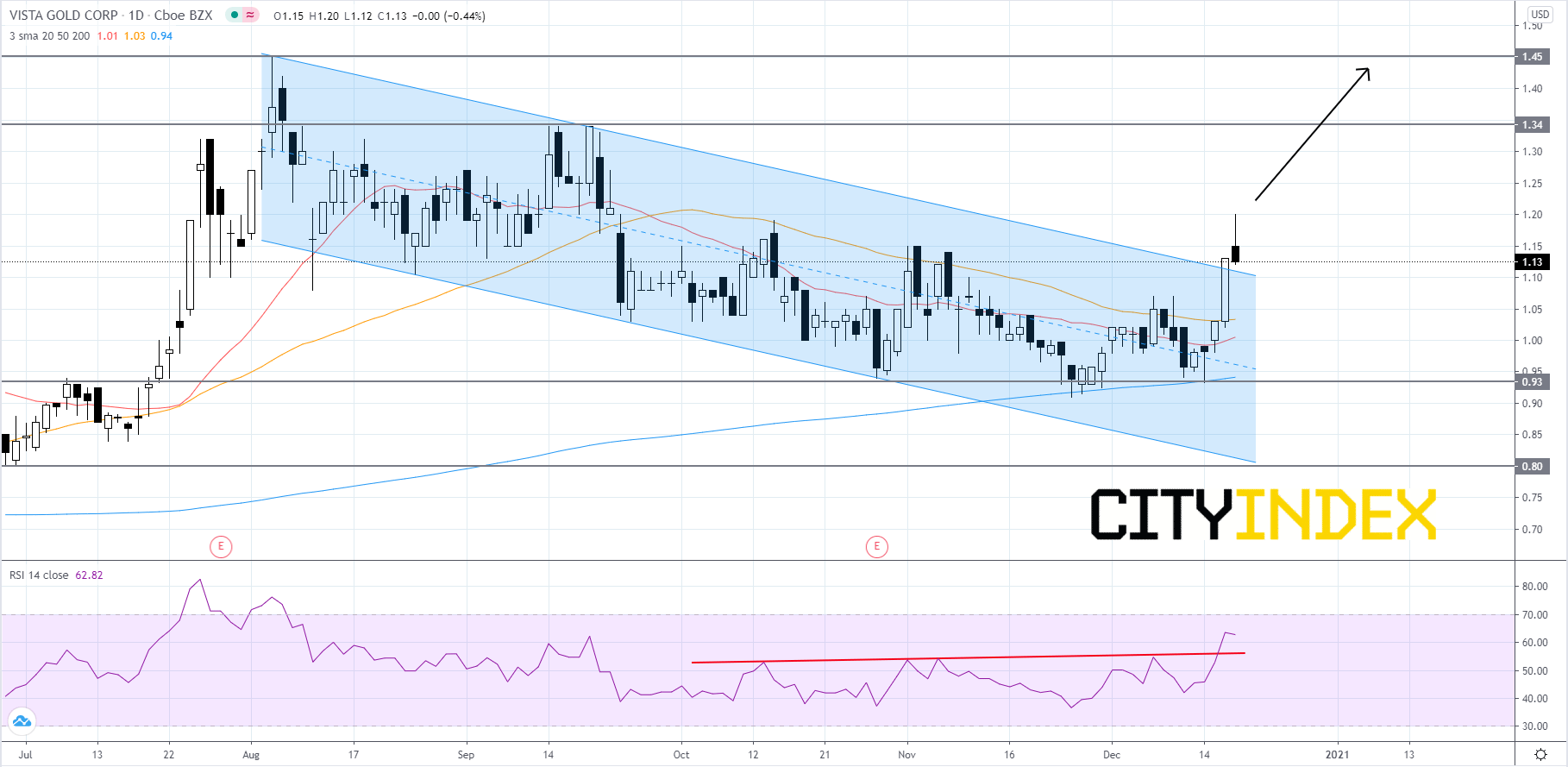

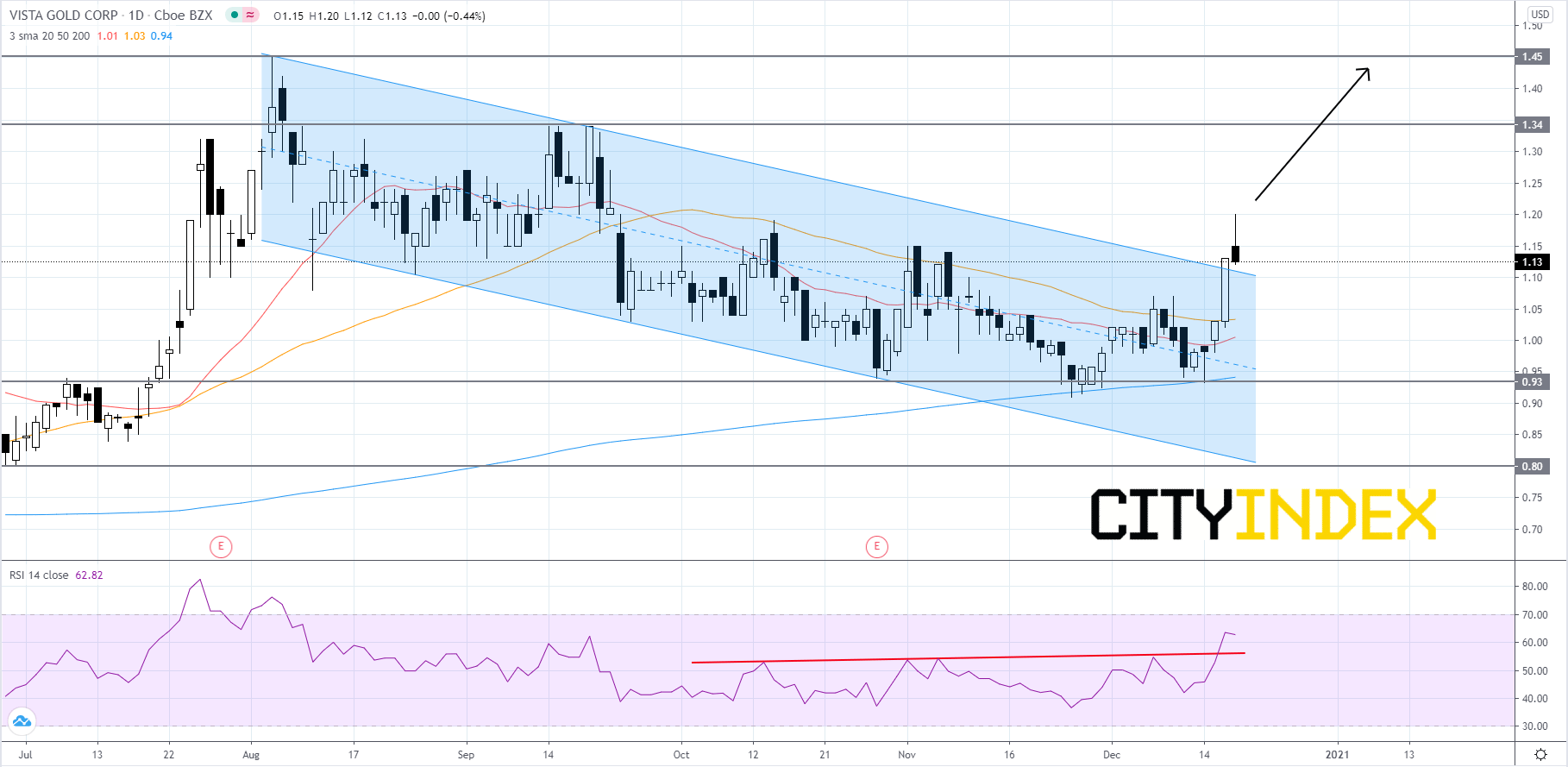

Pattern play: Vista Gold

Vista Gold (VGZ), a gold mining company, gapped up and broke out to the upside of a bearish channel that has been in place since early-August. The RSI is over 60 and has also crossed above a trendline. The simple moving averages (SMAs) are arranged in a mixed to bullish manner, as the 50-day SMA is above the 20-day SMA and the 20-day SMA is above the 200-day SMA. If the 20-day SMA can manage to cross above the 50-day SMA, it would be a bullish signal. It would seem that the catalyst is the price of Gold rising, which appears to be the result of the US Dollar making new 52-week lows. If price can manage to close above the upper trendline of the channel, it would be a bullish signal. If that occurs price could rise towards 1.34 and possibly 1.45. If price slips, traders should look to the 50-day SMA for support, considering that price was previously using it as resistance. If price fails to be supported at the 50-day SMA, then the last line of defense is 0.93. If price gets below 0.93, it could be a signal for a new down trend.

Source: GAIN Capital, TradingView

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM