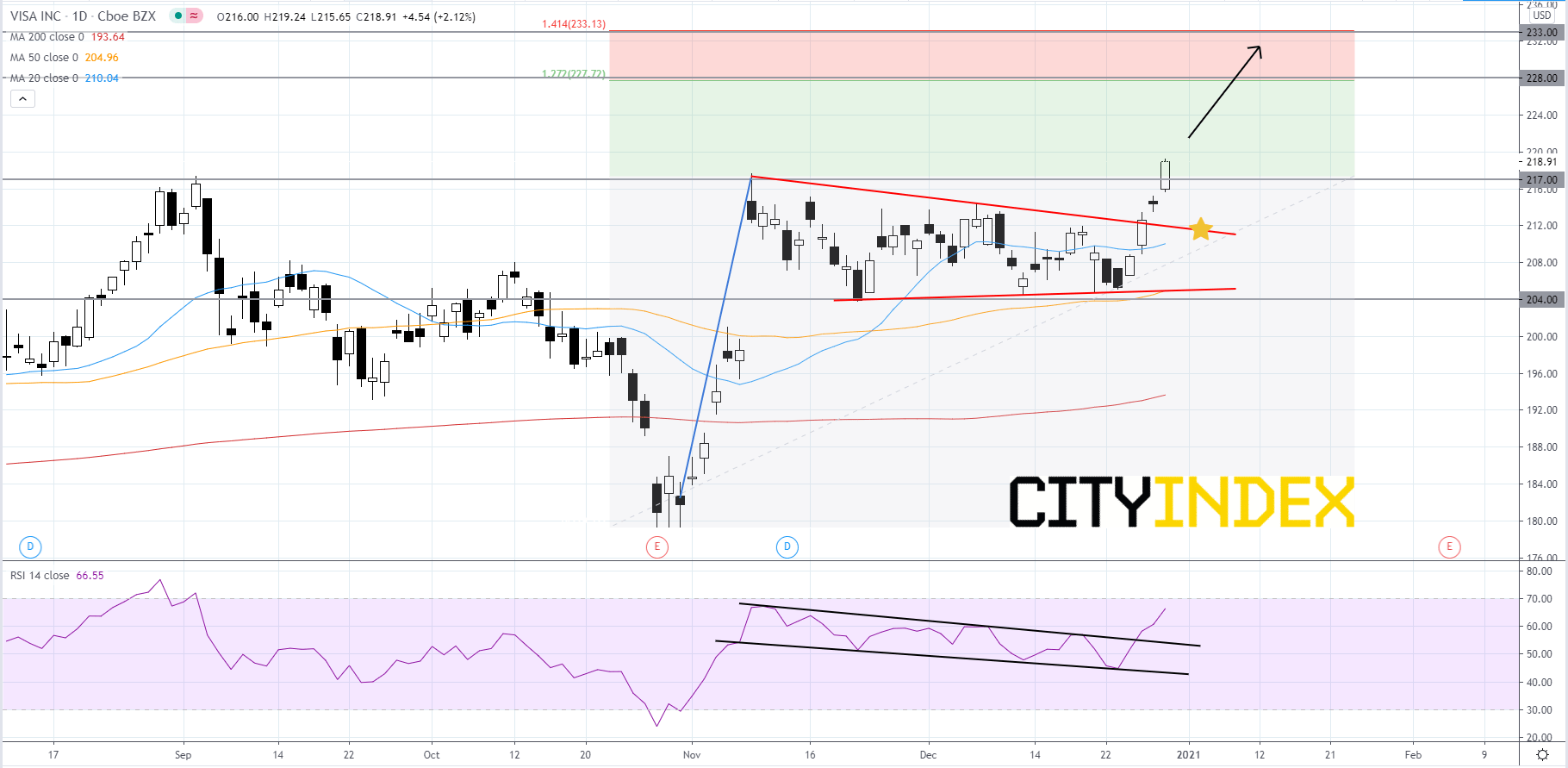

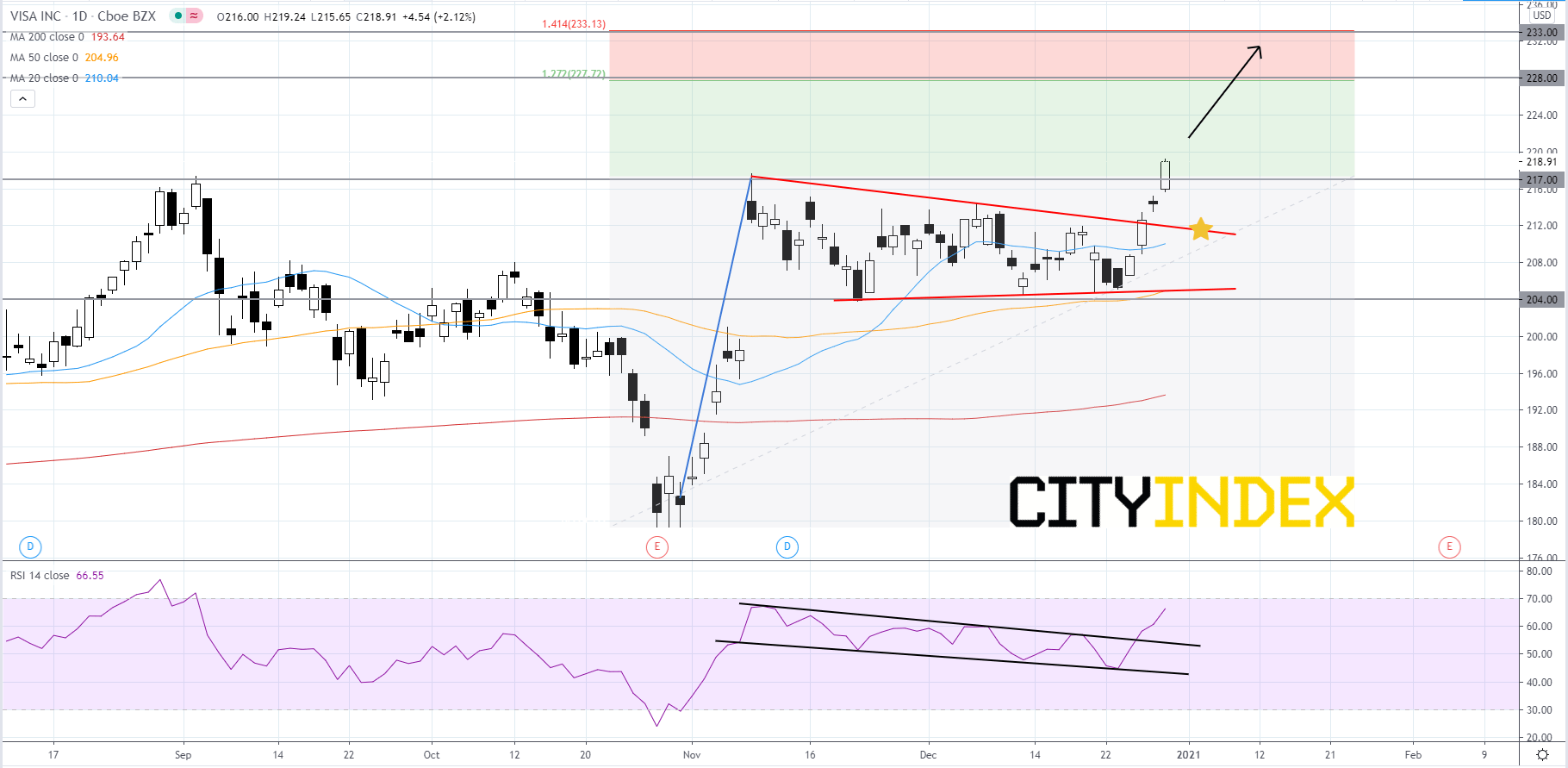

Pattern play: Visa

Visa (V), the credit card company, broke out to the upside of a bullish pennant pattern that price has been consolidating within since early-November. The RSI is over 60 and broke out to the upside of a bearish channel. The simple moving averages (SMAs) are positioned in a bullish manner, as the 20-day SMA is above the 50-day SMA and the 50-day SMA is above the 200-day SMA. The Fibonacci targets are roughly 228.00 and 233.00. If price pulls back then traders should look to the upper trendline of the pattern for support. If the upper trendline fails to hold price, then 204.00 would be the last line of support. If price falls below 204.00 it would be a bearish signal.

Source: GAIN Capital, TradingView

Source: GAIN Capital, TradingView