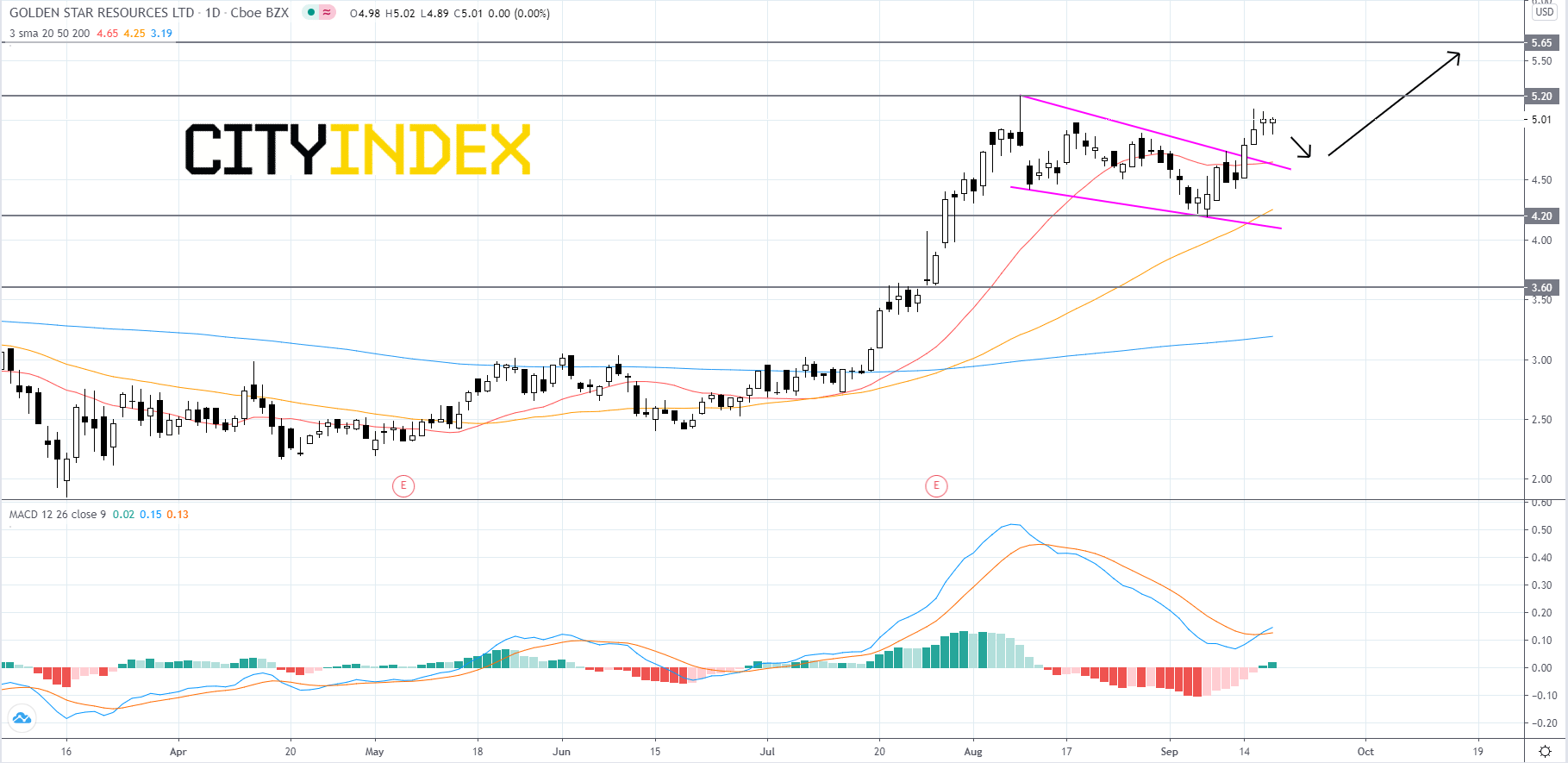

Pattern Play: Golden Star Resources

Golden Star Resources (GSS), a Canadian-based gold mining and exploration company, broke to the upside of a falling wedge pattern on Monday, September 14th. On September 16th, the MACD line crossed above the signal line, a bullish indicator. It appears that the majority of gold mining companies are showing similar patterns, which shows traders that there is positive sentiment in the precious metals sector. This is likely the result of U.S. markets showing signs of weakness in the past two weeks, as gold is viewed as a safe haven during poor market conditions.

Given the spinning top candle sticks in the last two days of trading, price action could be hinting that the breakout is stalling and bound for a throwback. Price will likely retrace to the upper trendline where is will probably find support and bounce to retest the 2020 high of 5.20. If 5.20 is penetrated, then price will likely grind higher to the 5.65 resistance level, a high last reached in mid-2016. If price ends up closing below the upper trendline it would be a troubling sign that could indicate that the pattern breakout was false. If that occurs price could slip back to the 4.20 support level, where a rebound may occur, but is less likely. If price breaks below the 4.20 support level it could slip further to 3.60.

Source: GAIN Capital, TradingView

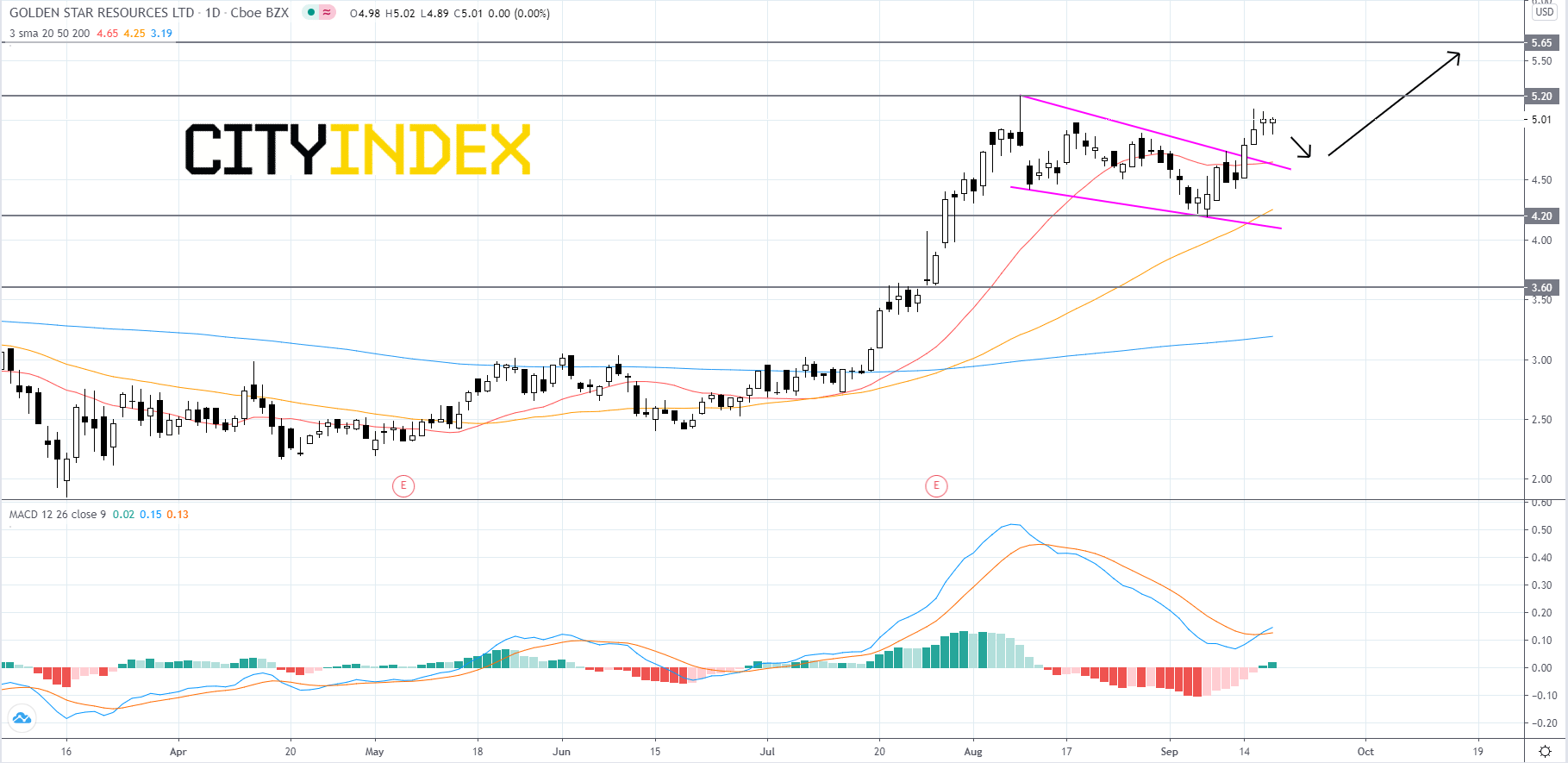

Given the spinning top candle sticks in the last two days of trading, price action could be hinting that the breakout is stalling and bound for a throwback. Price will likely retrace to the upper trendline where is will probably find support and bounce to retest the 2020 high of 5.20. If 5.20 is penetrated, then price will likely grind higher to the 5.65 resistance level, a high last reached in mid-2016. If price ends up closing below the upper trendline it would be a troubling sign that could indicate that the pattern breakout was false. If that occurs price could slip back to the 4.20 support level, where a rebound may occur, but is less likely. If price breaks below the 4.20 support level it could slip further to 3.60.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM