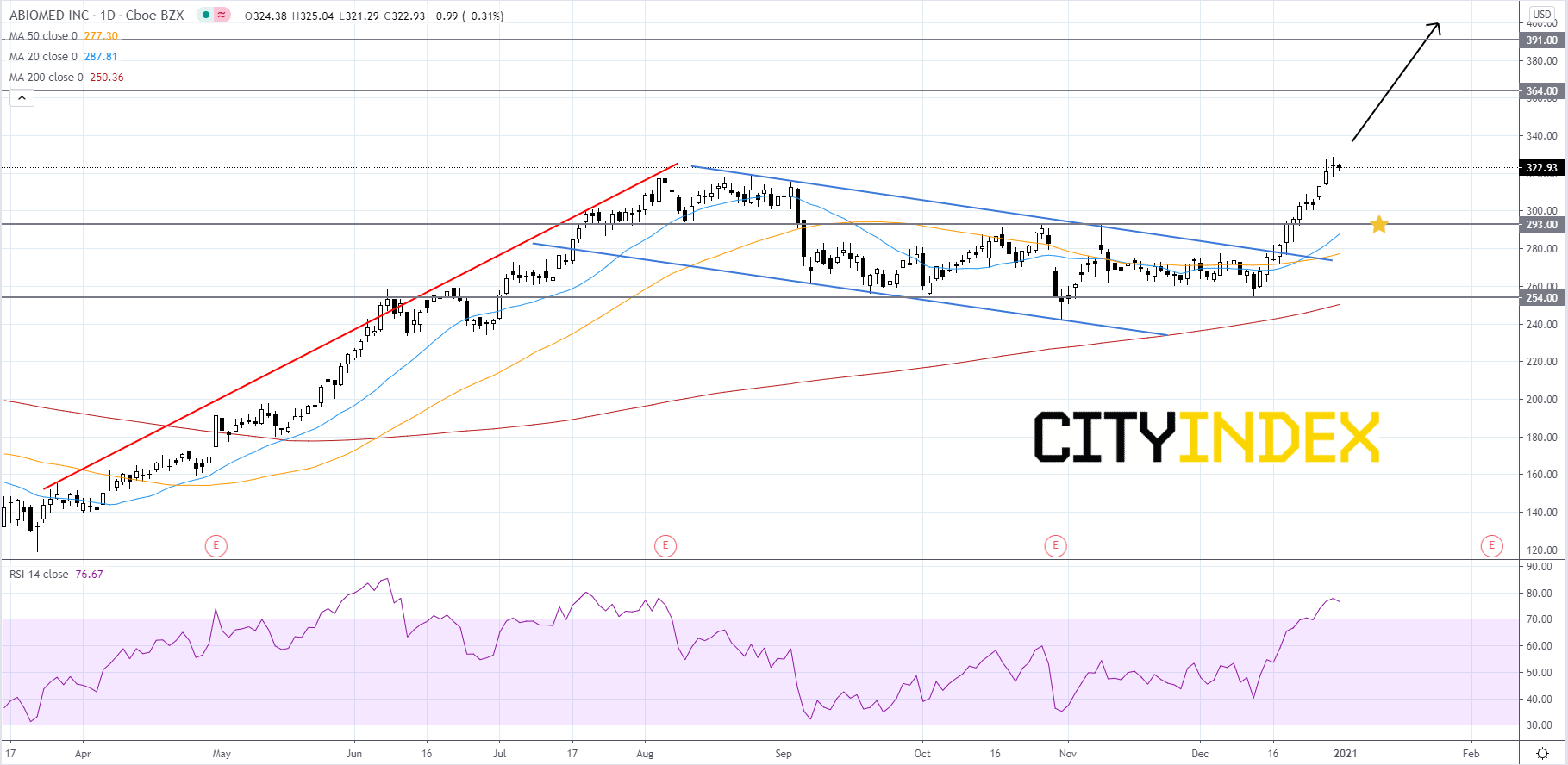

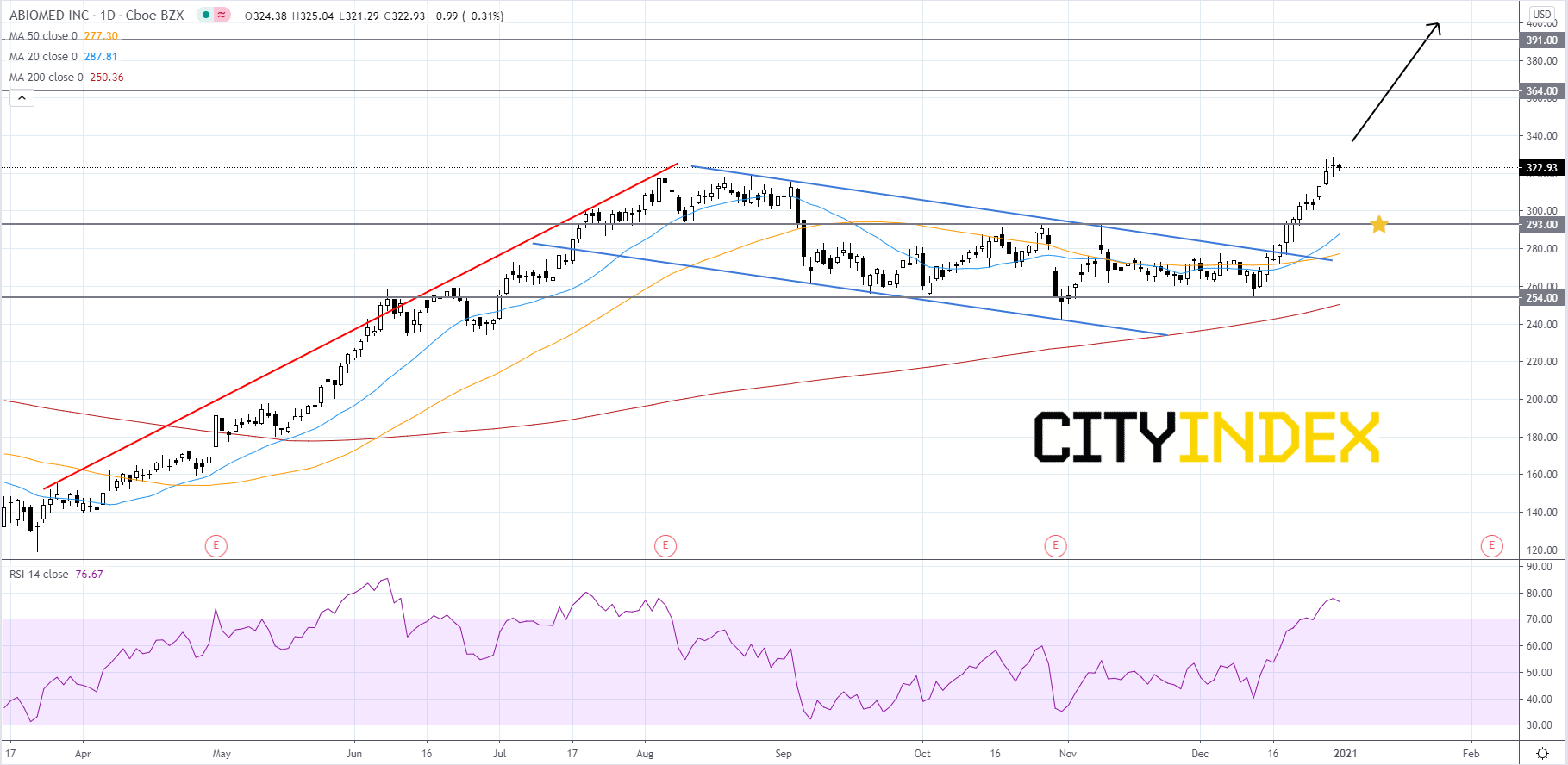

Pattern play: Abiomed

Abiomed (ABMD), a developer of medical devices for cardiovascular conditions, is currently holding around a new 52-week high after breaking out to the upside of an intermediate-term bull flag in mid-December. The RSI is currently in overbought territory at 76. The simple moving averages (SMAs) just turned bullish, as the 20-day SMA just crossed to the upside of the 50-day SMA and the 50-day SMA is above the 200-day SMA. The overbought reading on the RSI could be hinting at a price consolidation. If price can manage to stay above 293.00, then its next targets would be 364.00 and 391.00. On the other hand, if price slips below 293.00, it would be a bearish signal that could send price back to 254.00. If price cannot manage to rebound off of 254.00 then it could be the beginning of a new downtrend.

Source: GAIN Capital, TradingView

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM