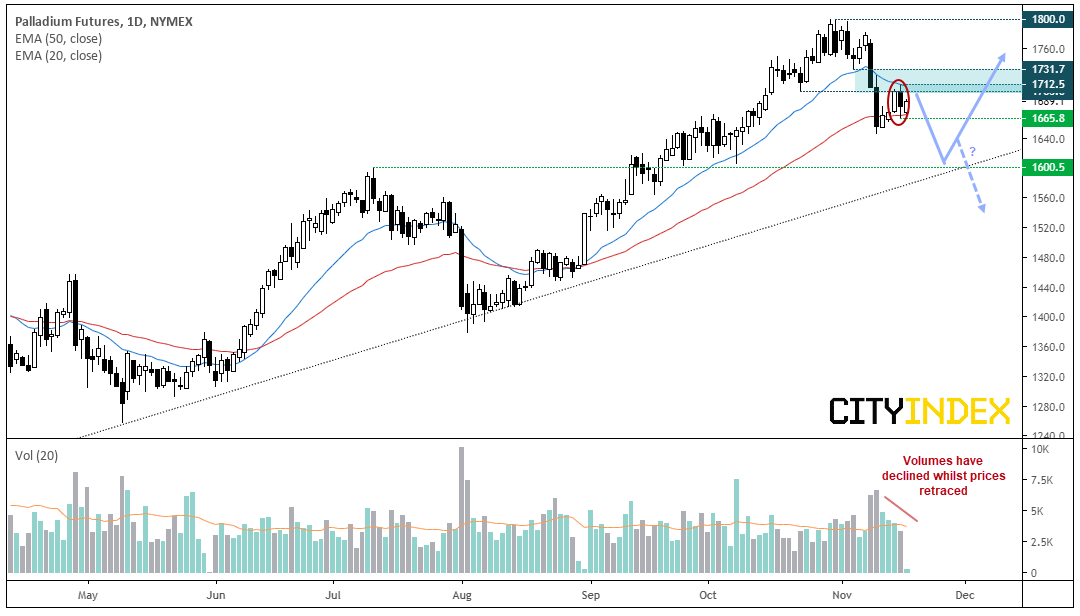

Palladium prices have pulled back into a resistance zone, making it appealing to bearish swing traders.

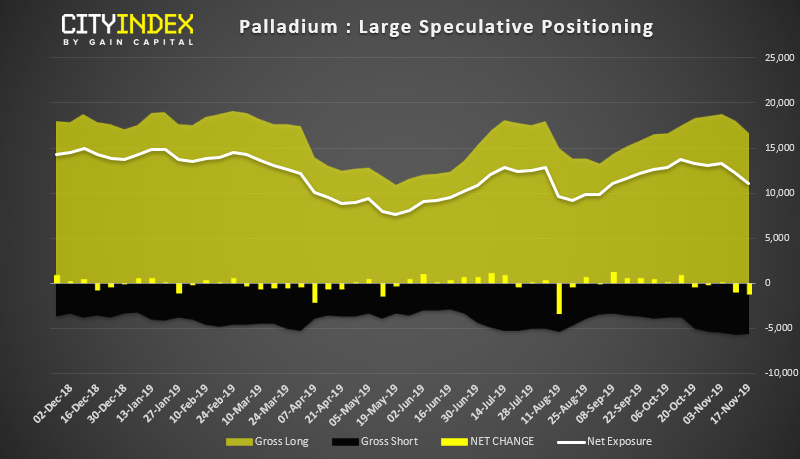

As mentioned in this week’s COT report, net-long exposure for Palladium has fallen to a 2-month low and we see potential for it to fall further, along with prices. According to Reuters polls, the median forecast for palladium prices in Q4 is 1620, and then for it to fall to 1495 by Q2, with the lowest forecast over this period falling to as low as 1200.

Prices have retraced to the 1700 low and formed a 2-bear reversal pattern on Friday (a dark cloud cover). Volumes have also depleted during this minor rebound, which points towards it being a retracement against bearish momentum and for prices to roll over for another leg lower. The 20-day eMA is capping as resistance, although we could also use the 1731.70 low to aid with risk management, given the 50-day eMA is providing support.

- Whilst the near-term bias is bearish, it’s still part of a long-term bull trend so we’re also looking for signs the current correction is over.

- Bears could look to fade into rallies beneath 1731.70. Alternatively, they could wait for a break beneath 1665.80, which then confirms the bearish reversal pattern (dark cloud cover). This also means the 50-day eMA would have been broken.

- The initial target is around 1600, near the July high. Although the bullish trendline could also act as support along the way, depending on how long this move takes to unfold.

- If the target is achieved, we can then reassess its potential to either extend losses or mark the end of a correction.

Related Analysis:

Did Palladium Fly Too Close To The Sun?

Gold’s Worst Week in 3 Years Sees Bears Firmly Back In Control

Gold drops to key support