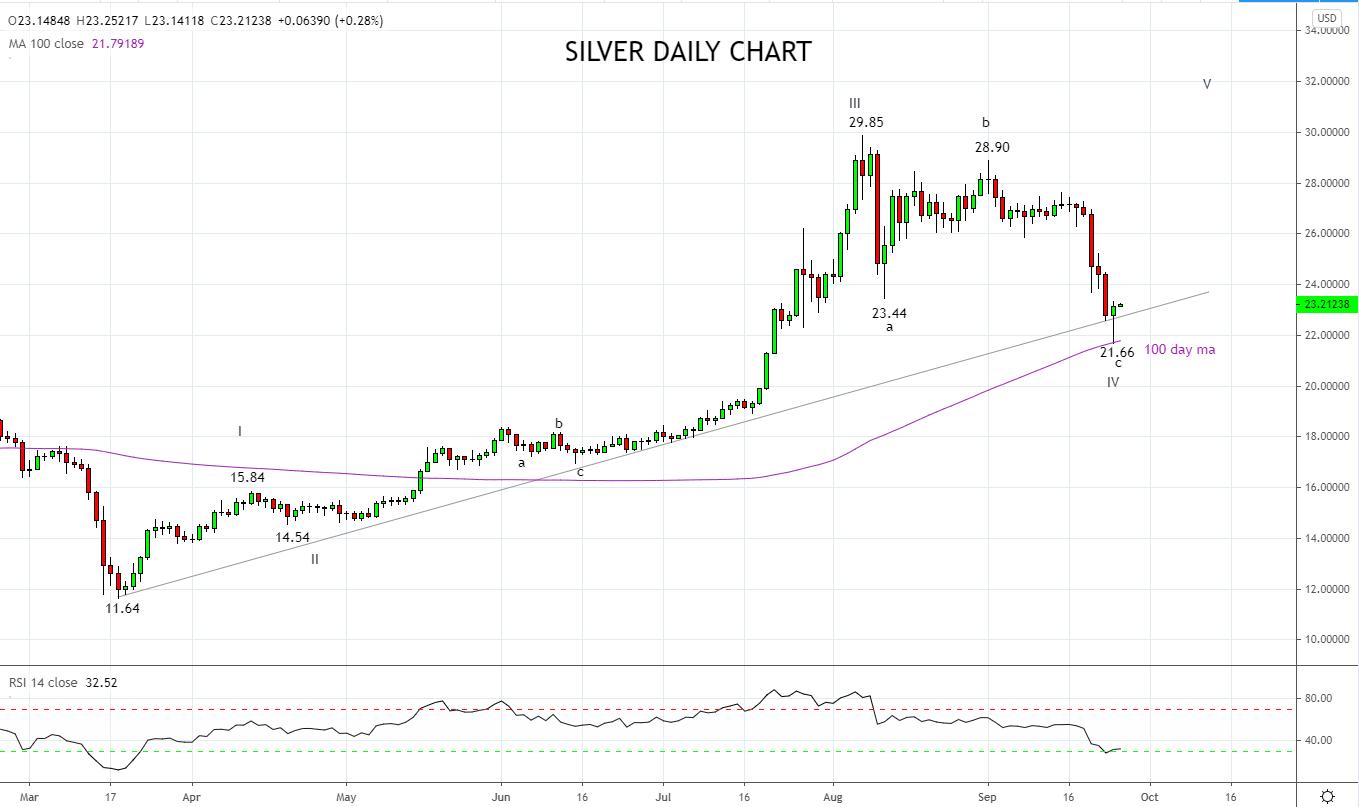

In some ways, the September storm bought a much-needed wash out of the extreme excesses that had built in recent months. Few markets exhibited quite as bullish exuberance as Silver, up over 150% in 6 months!

Enthusiasts of textbook definitions will note that Silver entered bear market territory overnight. However as can be viewed on the chart below, it may turn out to be one of the quickest bear markets in history.

The pullback from the August $29.85 high is viewed as a correction. The false break lower overnight neatly tagged the support coming from the 100-day moving average. The daily close back above trendline support and the potentially bullish daily reversal candle providing initial confirmation the corrective pullback is complete.

Should Silver, remain above the overnight low and then break and close above the band of resistance $23.50/24.00, it would suggest the uptrend has resumed (Wave V). In this instance, the expectation would be for a retest and break of the $29.85 high into year-end.

Silvers high beta characteristics makes it a leader in the precious metal space, similar to the way the Nasdaq is for other U.S equity indices. However, Silvers volatility means that it is one that only the bravest will trade.

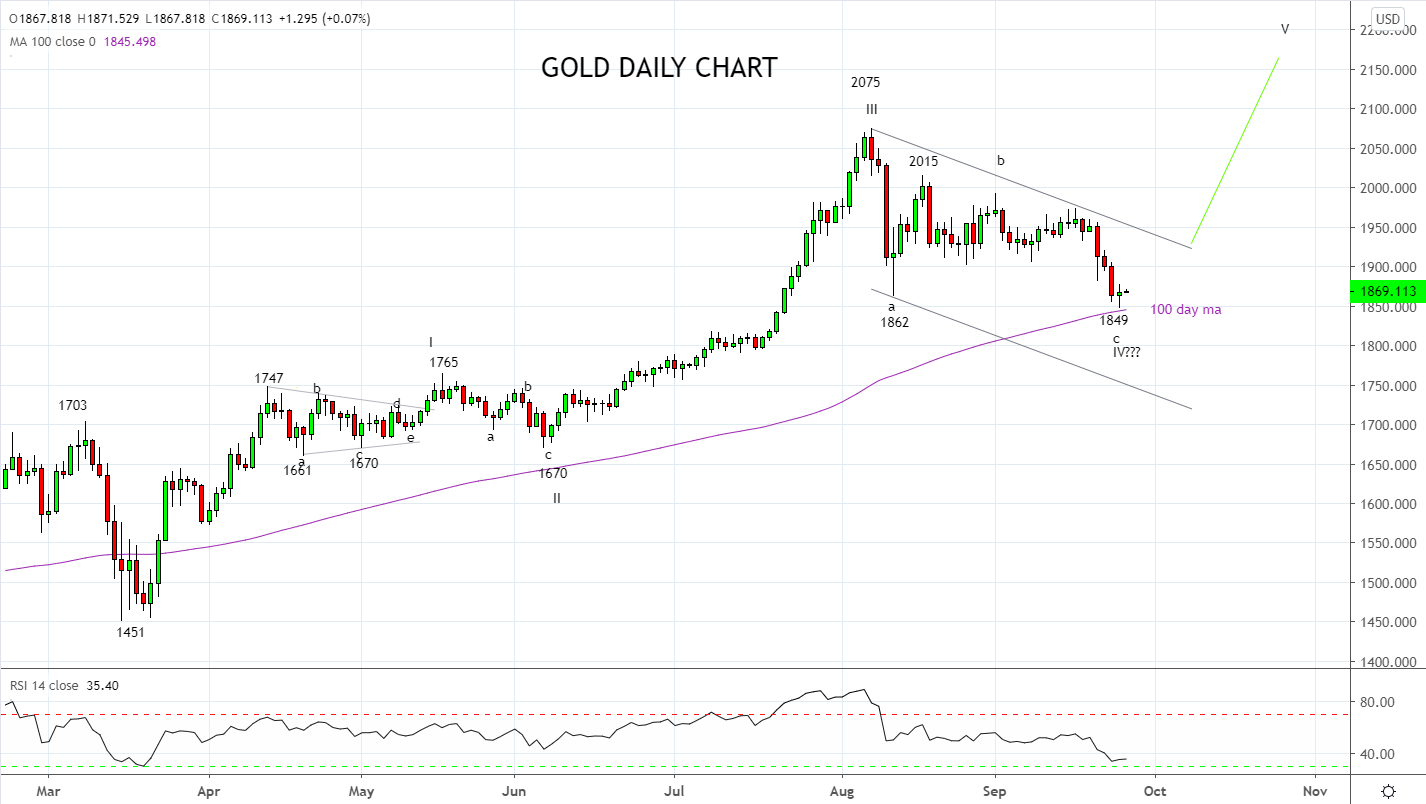

In this respect, gold is viewed as the preferred precious metal vehicle to trade and displays a similar technical structure to Silver.

While the pullback in Gold fell well short of wave equality at $1800, it also tagged the support provided by the 100 day moving average, before a potentially bullish daily candle formed.

Should gold hold above the overnight lows at $1849 and then trade above $1883.00 ($6.00 above the overnight high of $1877), I would consider opening a small long trade with a stop loss placed at $1841. The target for is a retest and break of the $2075 high, before $2400.

Keeping in mind, a break and close above the band of resistance $1910/20 would be further confirmation the uptrend has resumed.

Source Tradingview. The figures stated areas of the 25th of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation