OPEC data juices West Texas Intermediate (WTI) oil to 1-year highs: Where next?

With so-called “meme stonks” like Gamestop (GME) and AMC Entertainment (AMC) trading down by more than -50% at the US open, traders are turning their attention back to developments in more traditional financial markets.

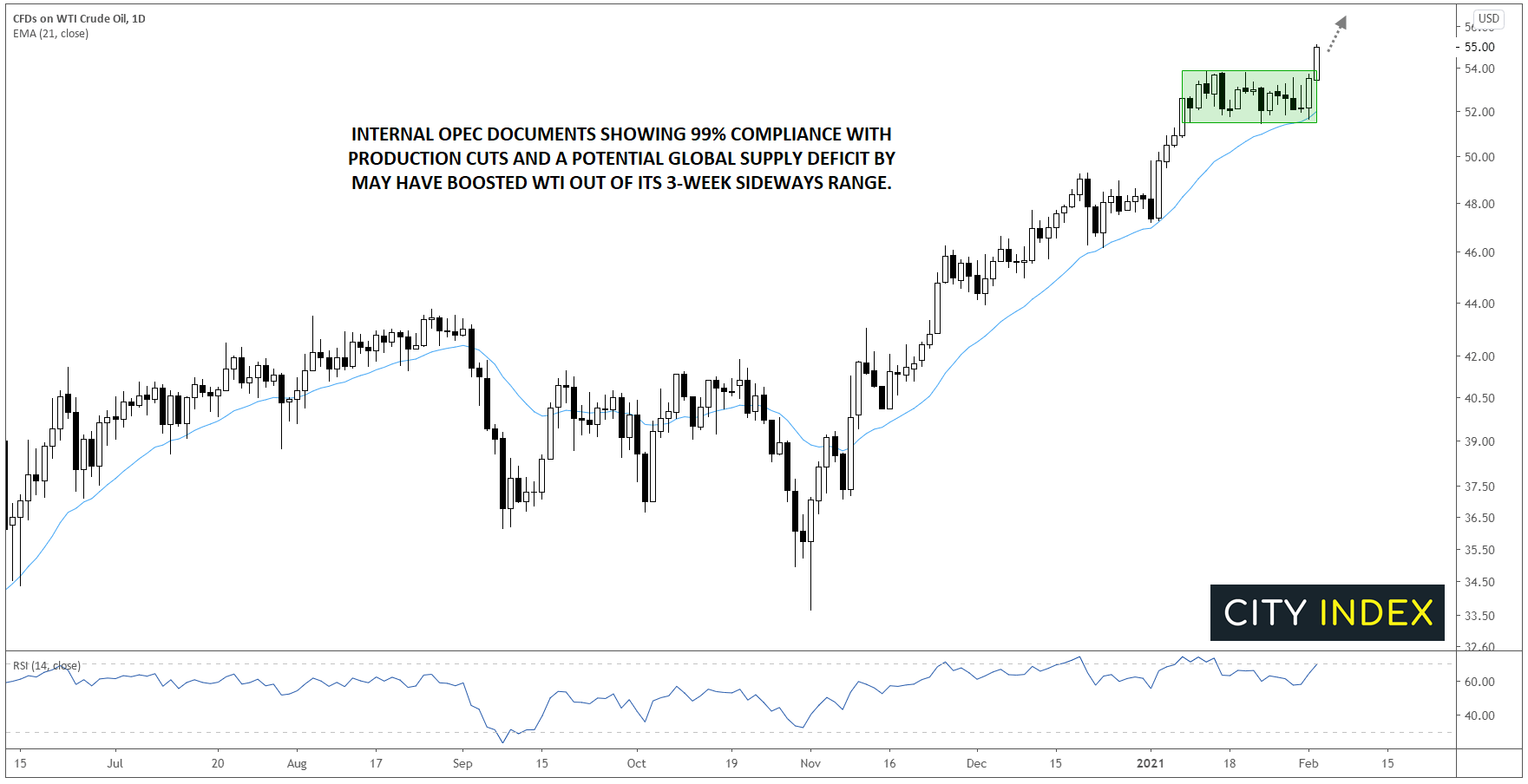

In that vein, one of today’s biggest developments was the leak of an internal OPEC document. Per a copy obtained by Reuters, the oil cartel found compliance with last month’s production cuts was 99%, leading OPEC to forecast that the oil market will be in a 2M b/d deficit by May. In other words, the intentional reduction in supply of oil is working as expected, with the market expected to be balanced in the coming months.

While the group did cut its forecast for demand by 300k b/d, the positive news on the supply front was the far more significant development for traders.

WTI technical analysis

Prices for West Texas Intermediate (WTI) crude oil have responded to the bullish news, breaking out of the 3-week sideways range to hit the highest level in more than a year. From a technical perspective, the commodity has been consistently riding its 21-day EMA higher since mid-November, signaling a healthy uptrend. Meanwhile, the recent sideways consolidation has taken the RSI indicator back out of overbought territory, potentially clearing the way for a continuation higher as we move through February:

Source: TradingView, GAIN Capital

In the short term, the bias for WTI will remain bullish as long prices can hold the breakout above $54.00. After providing strong resistance over the last three weeks, this level should serve as support moving forward. To the topside, there’s little in the way of resistance until a minor high and psychological resistance at $60.00.

Learn more about oil trading opportunities.