One of the Biggest Gainers at the Opening Bell: HP

On Friday morning, HP (HPQ), a provider of computers, printers and printer supplies, gapped up over 2.8% at the open. On Thursday, after market, the company reported third quarter adjusted EPS of 0.49 dollar, above the estimate, down from 0.58 dollar a year ago on net revenue of 14.3 billion dollars, higher than expected, down from 14.6 billion dollars last year.

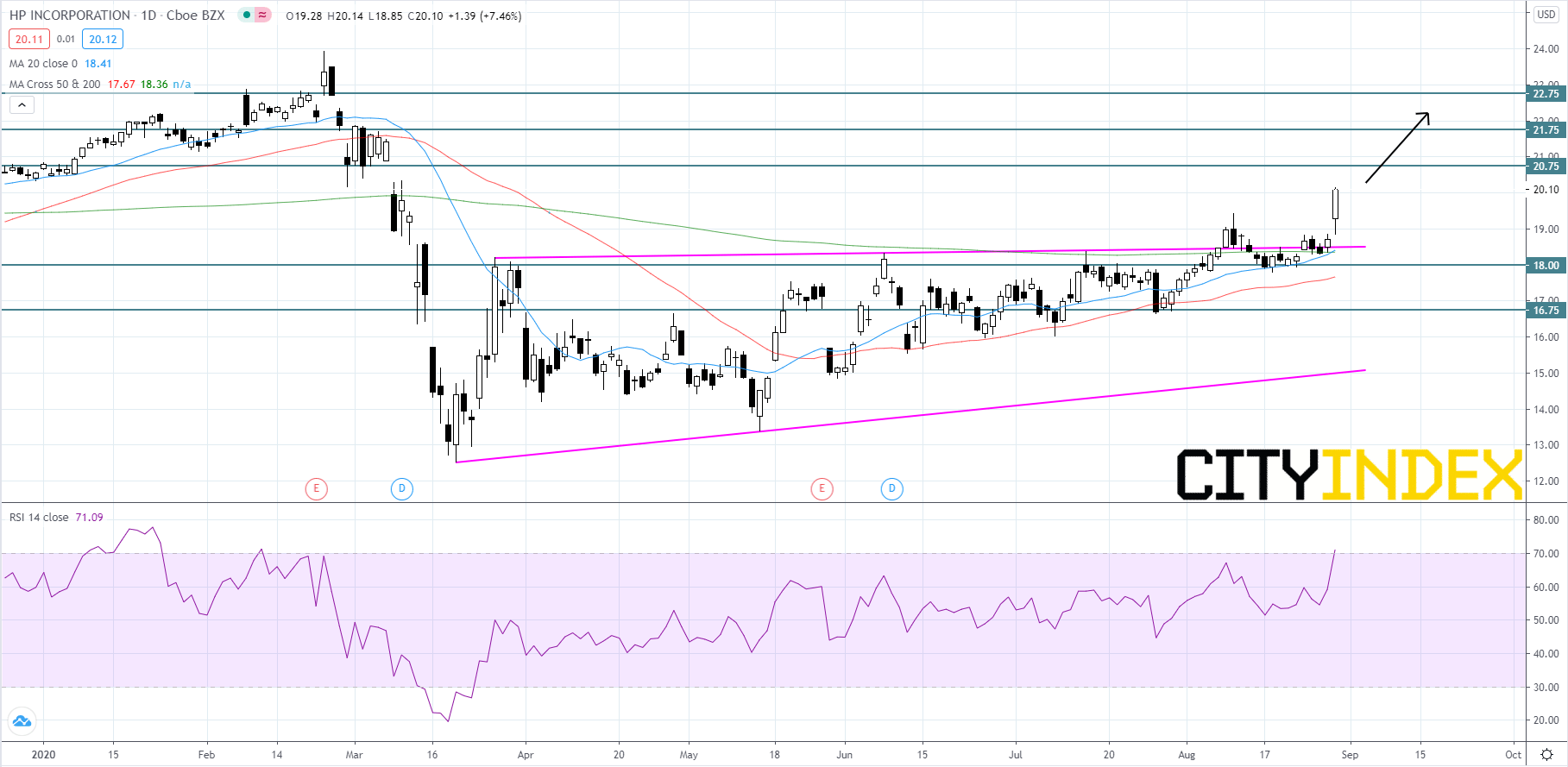

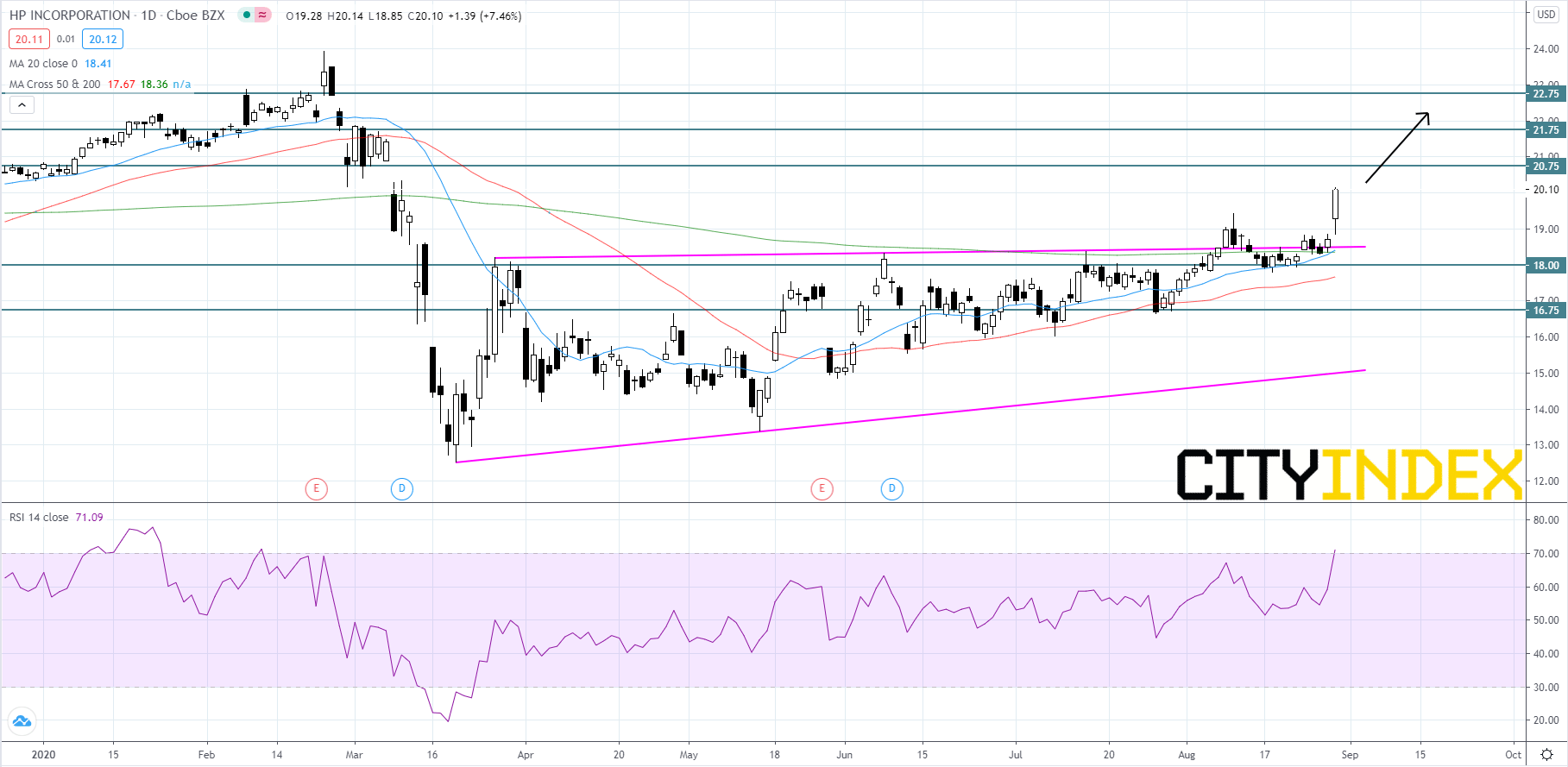

Looking at a daily chart, HP's stock price has been rising inside of an ascending wedge pattern since late-March. For the majority of August price has been chopping above and below the upper trendline. This morning, price opened above and away from the upper trendline, a bullish signal. The RSI is bullish and has just entered overbought territory at 71. Given that we are in a bull market and that the tech sector is still the best performing group, price could maintain an overbought reading for a long period of time. Price will likely continue to push towards the next resistance of 20.75, break through it and continue advancing towards 21.75. If price pulls back, traders should look to the upper trendline as support. If the trendline fails to support price, there is a chance it could hold at 18.00. If price falls below 18.00, it could tumble back to 16.75.

Source: GAIN Capital, TradingView

Looking at a daily chart, HP's stock price has been rising inside of an ascending wedge pattern since late-March. For the majority of August price has been chopping above and below the upper trendline. This morning, price opened above and away from the upper trendline, a bullish signal. The RSI is bullish and has just entered overbought territory at 71. Given that we are in a bull market and that the tech sector is still the best performing group, price could maintain an overbought reading for a long period of time. Price will likely continue to push towards the next resistance of 20.75, break through it and continue advancing towards 21.75. If price pulls back, traders should look to the upper trendline as support. If the trendline fails to support price, there is a chance it could hold at 18.00. If price falls below 18.00, it could tumble back to 16.75.

Source: GAIN Capital, TradingView

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM