The World Economic Forum in Davos usually provides ample headlines for the oil industry, but this year one strategic player will be absent. Russia’s president Vladimir Putin plans on staying at home to see through a constitutional shake-up he launched in January designed to keep him in power after the 2024 election. Instead, he is expected to send an aide to represent him in sideline talks with other major oil producers.

Davos is more likely to turn again into a PR battle ground on climate change as environmental lobbyists make a stand against major oil firms which will also be present. Activist Greta Thunberg is already on her way to Switzerland for a pre-Davos protest on Sunday and other events are scheduled later in the week.

For CEOs of oil majors who will also be gathering in the Swiss ski resort, apart from the climate change headache, another issue will be trying to gauge if global economic growth will be strong enough to generate momentum in oil demand this year or whether prices more likely to stall at the current level.

President Trump will also attend the Forum while Iran’s foreign minister cancelled his trip.

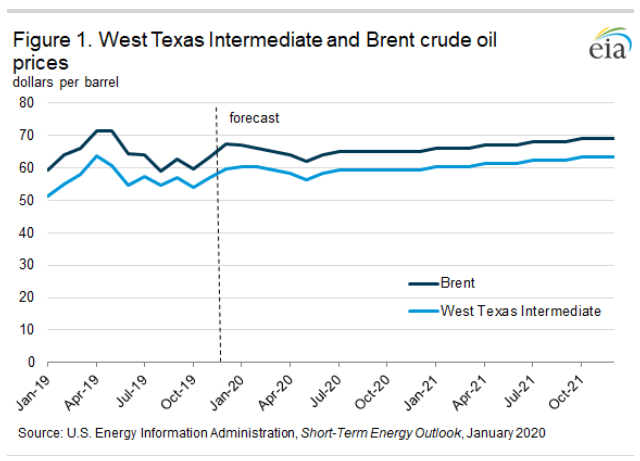

Despite the tumultuous start to the year with the flare up of tensions between Iran and the US, the bounce in prices proved to be short-lived. If anything, the months ahead could see a further decline in oil prices with proper recovery not settling in until 2021. In its latest report, the US Energy Information Agency forecast Brent crude spot prices to average $65/bbl this year and to rise only slightly in 2021 to $68. It pegged WTI on average at $59 in 2020 and at $62 in 2021.

|

When |

What |

Why is it important? |

|

Monday 20 Jan, 01.30 |

PBoC rate decision |

PBoC launched a new easing cycle in November |

|

Monday 20 Jan, 01.30 |

US Martin Luther King day |

Nasdaq, NYSE closed |

|

Tuesday 21 Jan |

World Economic Forum Davos till 24 Jan |

Oil issues will be discussed on the sidelines of the Forum |

|

Tuesday 21 Jan, 10.00 |

German ZEW Economic Sentiment |

Last at 10.7 |

|

Tuesday 21 Jan, 10.00 |

Eurozone ZEW Economic Sentiment |

Last at 11.2 |

|

Wednesday 22 Jan, 15.00 |

US existing home sales |

Last up 5.35m |

|

Wednesday 22 Jan, 21.00 |

API weekly crude oil stocks |

Last 1.1m |

|

Thursday 23 Jan, 13.30 |

US initial jobless claims |

Strength of the US job market |

|

Thursday 23 Jan, 16.00 |

EIA US crude oil stocks |

Last declined by 2.549 m bbl |

|

Friday 24 Jan, 08.30 |

Germany manufacturing PMI |

Expected to still be shrinking. Last at 43.7 |

|

Friday 24 Jan, 09.00 |

EU manufacturing PMI |

Last at 46.3 |

|

Friday 24 Jan, 14.45 |

US manufacturing PMI |

Buoyant in contrast to Europe, last at 52.4 |

|

Friday 24 Jan, 18.00 |

Baker Hughes US oil rig count |

|

|

Friday 24 Jan, 20.30 |

CTFC oil net positions |

Changes in money managers’ open positions |

Is US oil output really slowing down?

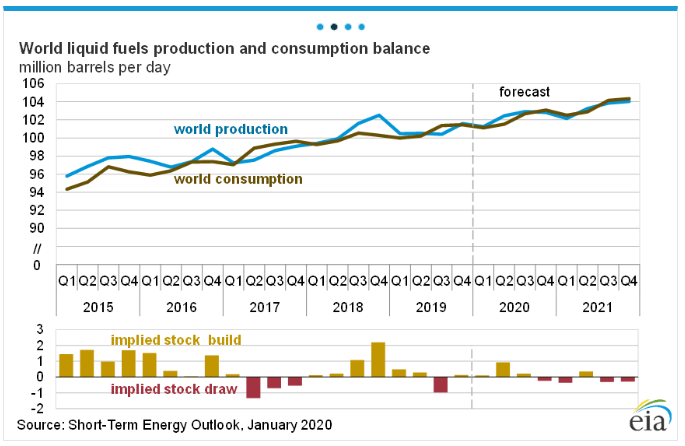

The latest data from the EIA is also showing that the rapid growth of US oil production, which at one point in 2019 reached over 21% per annum, is finally running out of steam. The agency now forecasts growth of only 4.5% year-on-year in the first quarter of 2020, dropping to 4.1% in the fourth quarter. However, it is far too soon to write off US shale oil growth; it is just that the pace of growth will be slower than before. Domestic economic growth continues at a good pace, as does demand from transport and from industry. Also, for the first time, the US is about to establish itself as a net exporter of crude during 2020. US trade data, particularly data from the US Department of Energy Statistics Office, may be a better indicator of this trend over the coming months than the weekly EIA and API crude oil stock updates.