Oil Storage, the Crude Reality?

The travel bans and national lockdowns caused a massive demand shock to the energy sector as a result of the COVID-19 pandemic. According to the EIA, in the first quarter (January 1st to March 31st) of 2020 roughly 94.4 million barrels of oil were used per day, which means that approximately $1.9 billion dollars worth of oil was used per day at an average of $20.00 per barrel.

Oil is the backbone of today's global economy and is used in the life cycle of almost every product. As a society we rely to heavily on oil to cut production by a significant amount, and in some countries economies depend largely on the energy sector, including a few OPEC members. With the idea that oil will be building up until demand returns, there may be a way to take advantage of growing oil reserves. Once land based storage facilities fill up, the next method would most likely be storing the oil on a marine vessel until delivery.

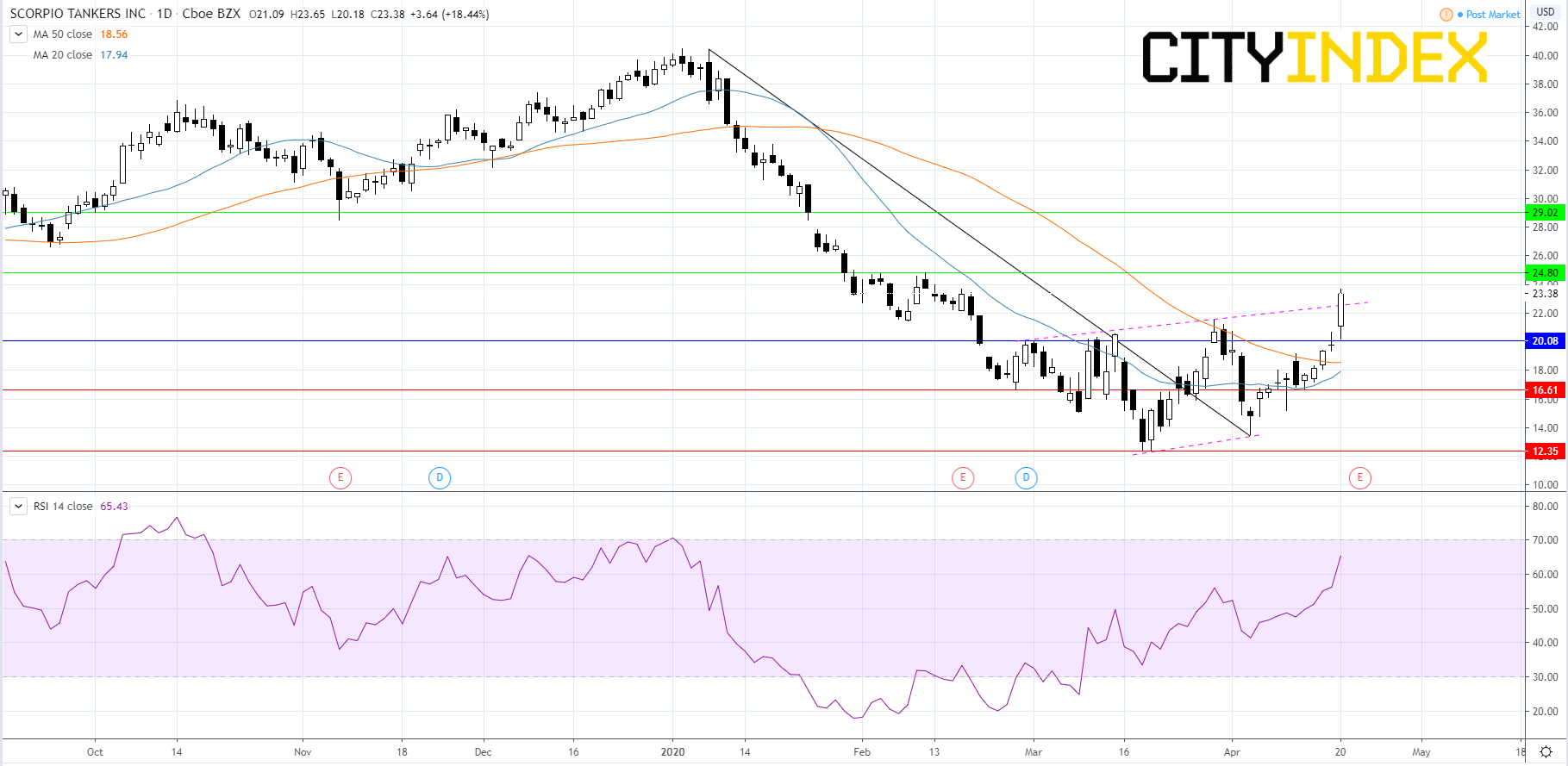

Scorpio Tankers Inc. (STNG) is an energy marine transport company based in the Republic of the Marshall Islands. The company's market capitalization is 1.3 billion dollars. Looking at a daily chart, the RSI is above its neutrality area at 65. Price is above both the 20 day and 50 day moving average. Price recently broke out of a 3 month downtrend and entered an uptrend based on its market structure of higher highs and higher lows. Price could continue upwards to test $24.80 or possibly retrace back to about $20.08. In the event of a pullback, if price were to bounce at roughly $20.08, it would confirm the breakout. If price drops below $20.08, it may be headed back down to $16.61. The company is set to report first quarter earnings on May 1st.

Oil is the backbone of today's global economy and is used in the life cycle of almost every product. As a society we rely to heavily on oil to cut production by a significant amount, and in some countries economies depend largely on the energy sector, including a few OPEC members. With the idea that oil will be building up until demand returns, there may be a way to take advantage of growing oil reserves. Once land based storage facilities fill up, the next method would most likely be storing the oil on a marine vessel until delivery.

Scorpio Tankers Inc. (STNG) is an energy marine transport company based in the Republic of the Marshall Islands. The company's market capitalization is 1.3 billion dollars. Looking at a daily chart, the RSI is above its neutrality area at 65. Price is above both the 20 day and 50 day moving average. Price recently broke out of a 3 month downtrend and entered an uptrend based on its market structure of higher highs and higher lows. Price could continue upwards to test $24.80 or possibly retrace back to about $20.08. In the event of a pullback, if price were to bounce at roughly $20.08, it would confirm the breakout. If price drops below $20.08, it may be headed back down to $16.61. The company is set to report first quarter earnings on May 1st.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM