EIA reported weekly declines of 1.1 million in crude stocks, versus the 3 million draw down forecast and the 5 million barrels reported the previous day by the API.

US refineries consumed less oil crude than the previous week and 2% less than a year ago, despite summer being a traditionally strong season for demand. The most obvious reason for this is slowing demand in the US, which would tie into the weakening US economy story, particularly after data showed that US factory order slumped -0.7% in May.

Investors will now look towards the non-farm payroll data tomorrow for further clues over the health of the US economy. A weak reading could see the price of oil dip as it would further fuel concerns over future demand expectation.

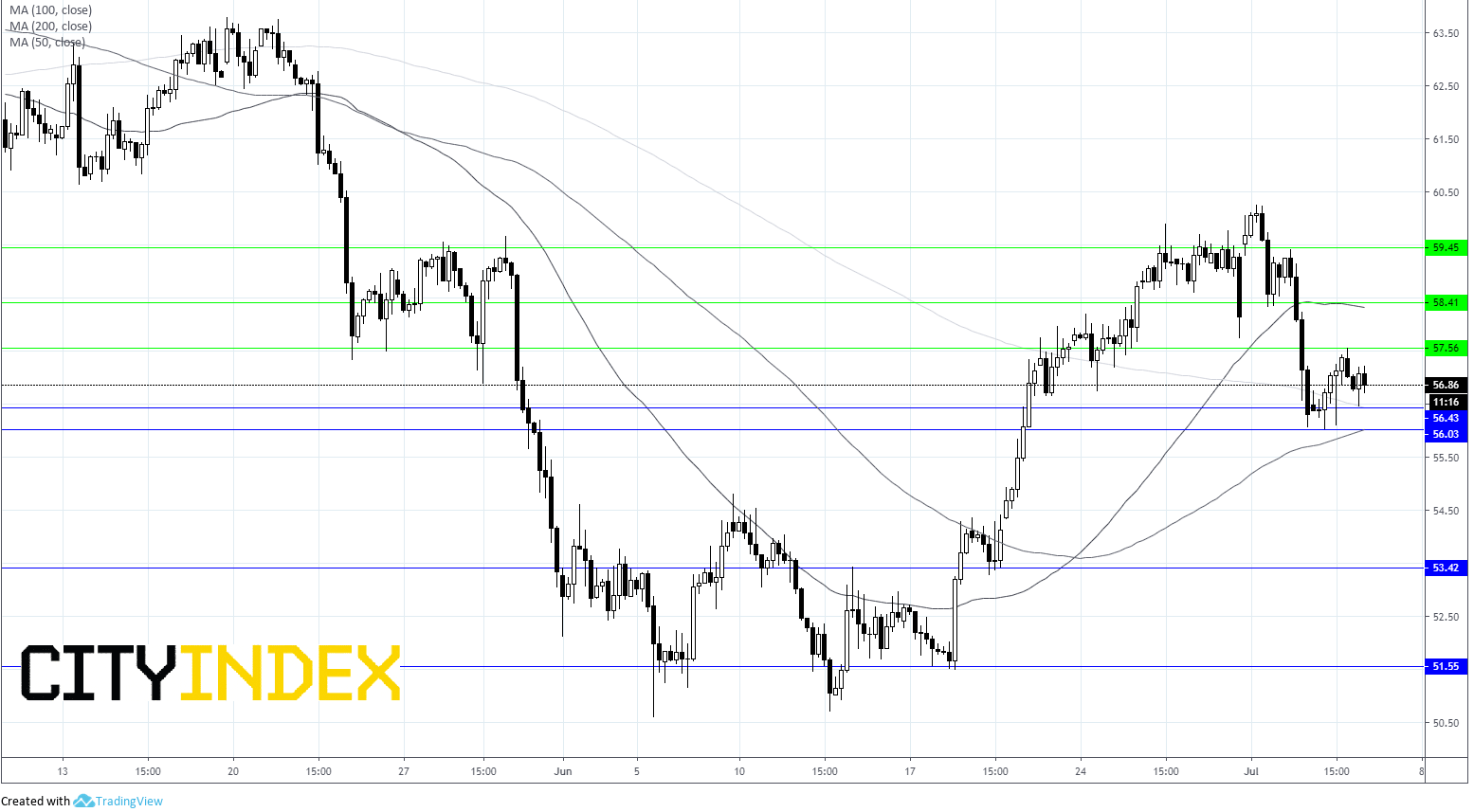

Levels to watch:

We would look for a break above $57.50 to open the door to resistance at 58.30/40. Beyond this $59.45/50 would come into play. On the downside, the bears would need to break down support at $56.50 to progress to $56.00 and down back towards $53.40.