Oil prices rise snapping 7 day losing streak

Oil prices are on the rise snapping a 7 day losing streak. Today’s move higher comes after oil prices tumbled over 5% last week on concerns over rising covid cases hitting oil demand and a stronger US Dollar following the more hawkish FOMC minutes.

The weaker US Dollar at the start of the week is offering some relief to commodities across the board. Fed Kaplan, a usual hawk, dialed back his hawkish tone in a speech owing to uncertainty surrounding the covid Delta variant. Attention will turn to the Jackson Hole Symposium on Thursday and Friday for further US Dollar direction.

News that China record zero locally transmitted COVID cases for the first time since early July boosted optimism towards the black gold. However, with cases still rising globally questions still remain over the fuel demand outlook. Japan, for example is in its 4th state of emergency with 60% of the population under restrictions. Greater Sydney is also extending its lockdown restrictions until September. Increasing pandemic restrictions come at a time when supply is also steadily rising.

Not only did OPEC agree to raise output at the last meeting, the Baker Hughes rig count also revealed that drilling firms in the US added rigs for a third consecutive week.

Near term the oil market will eye PMI data for further clues over the health of the economic recovery.

Where next for WTI oil prices?

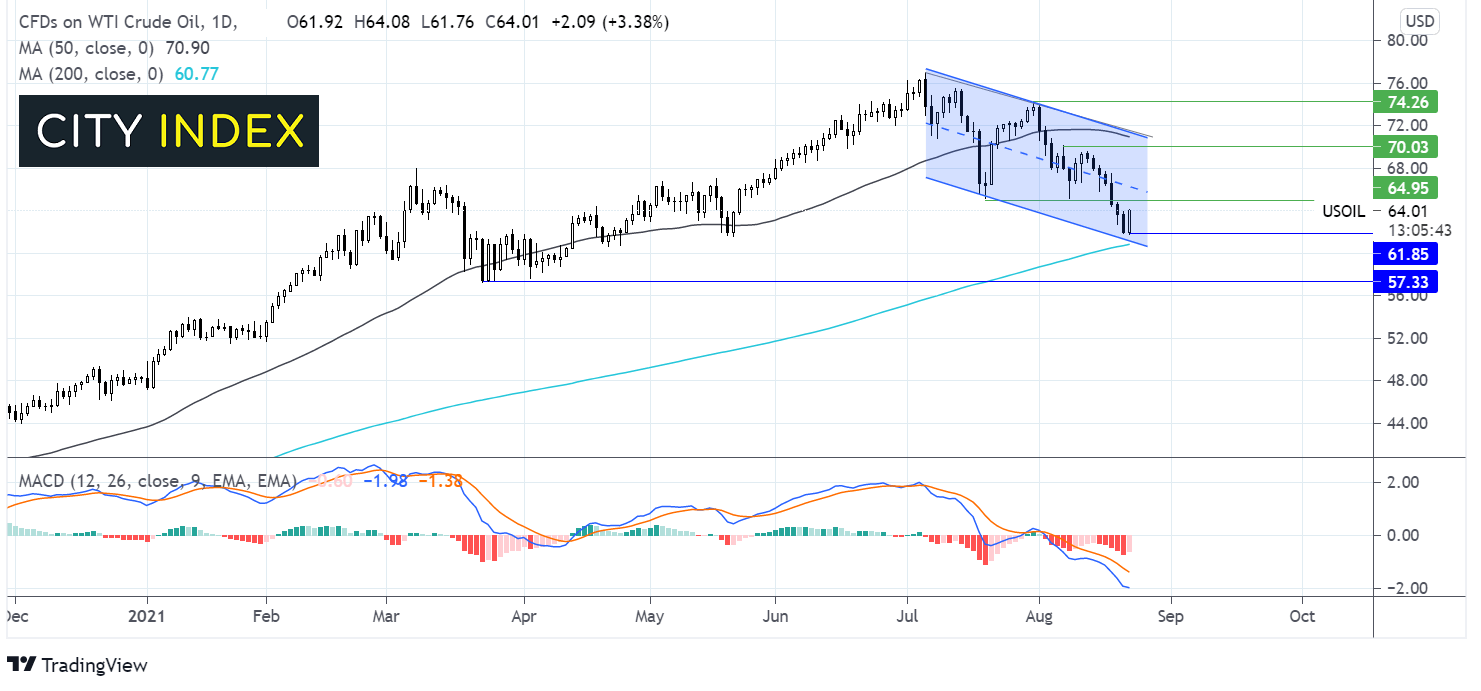

Despite the 3% rise in oil prices today WTI remains in a downward trending channel with the 200 dma offering support at 60.70.

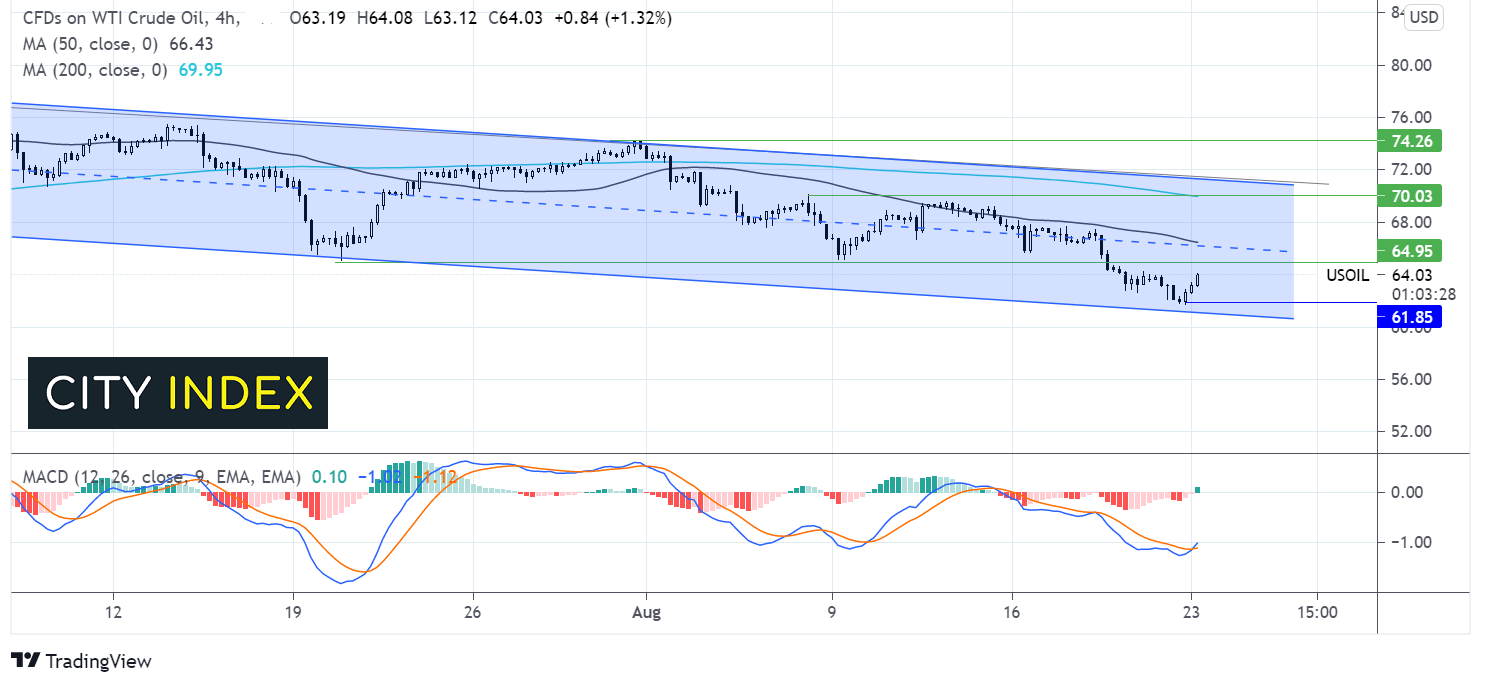

However, zooming in to the 4-hour chart, the bullish crossover on the MACD is keeping buyers optimistic. Any meaningful recovery would need to retake the 50 sma at 66.50, also the midline the descending channel. Beyond here 70.00 comes back into focus the mid-August high and the 200 sma on the 4 hour chart which could prove a tough nut to crack.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.