Oil Prices Lose Momentum And Start the Range Trade

WTI crude oil futures (October) slid 2.9% to $41.51 a barrel yesterday, while Brent oil futures dropped 2.8% to $44.43, pressured by the rebound in the U.S. dollar. In addition, investors expected the fall of crude oil demand as the refiners will soon halt operations to conduct maintenance.

Iraq may seek a two month extension to implement the extra production cuts for OPEC+ deal, suggesting that the country would not reduce its output quickly as it previously promised, reported Bloomberg.

Meanwhile, the U.S. Energy Information Administration (EIA) reported that crude oil inventories dropped 9.36M barrels in the week ending August 28 (-2.14 million barrels expected). Besides, the U.S. crude oil production dropped to 9.7 million barrels per day from 10.8 million barrels per day.

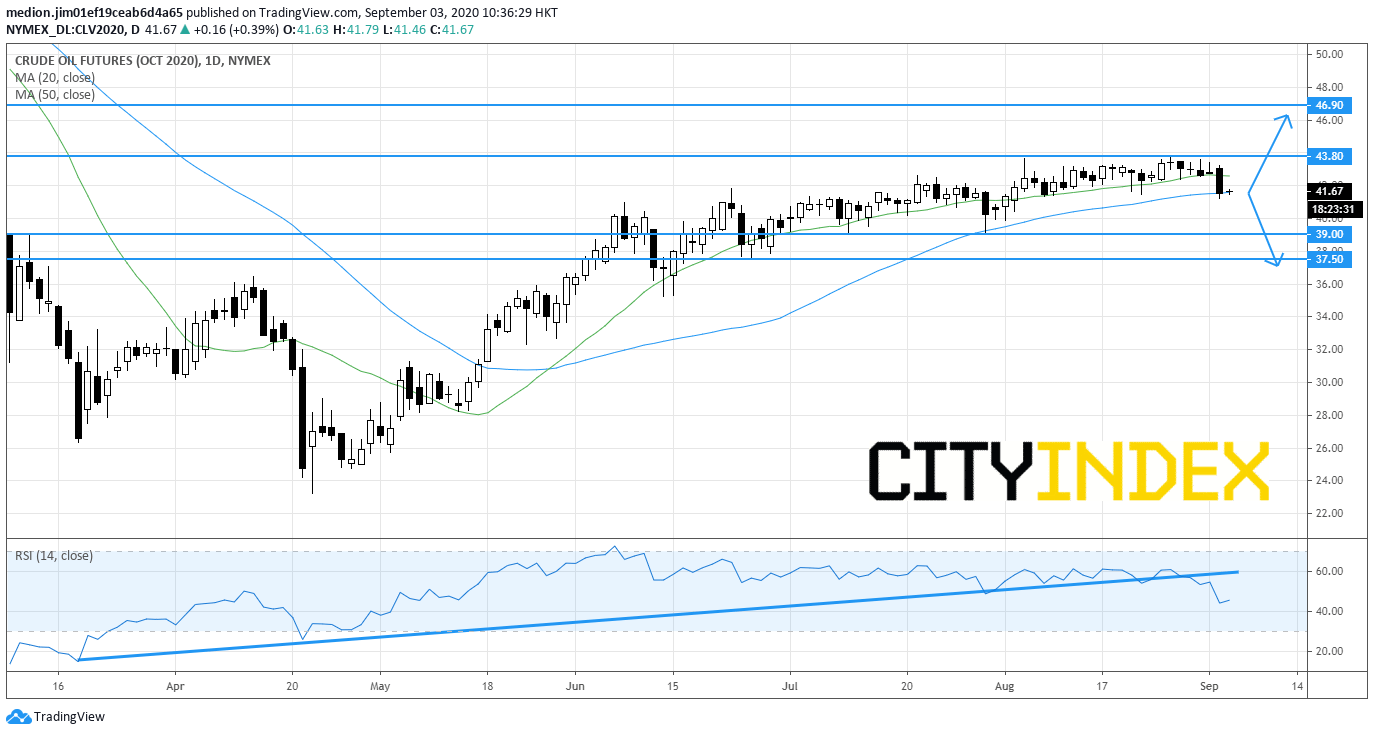

WTI Crude Oil futures (Short term): Enter the Consolidation phase

On a daily chart, WTI crude oil prices retreats from $43.8 and breaks below the 20-day moving average. In fact, the prices are testing the 50-day moving average. The relative strength index also broke below the rising trend line drawn from March.

However, as the previous low at $39.0 is still acts as the support level, the process of higher tops and higher bottoms has not violated. Therefore, readers should stay neutral for the range trading.

The support level would be $39.0 and $37.5, while resistance levels would be $43.8 and $46.90.

Source: Gain Capital, TradingView

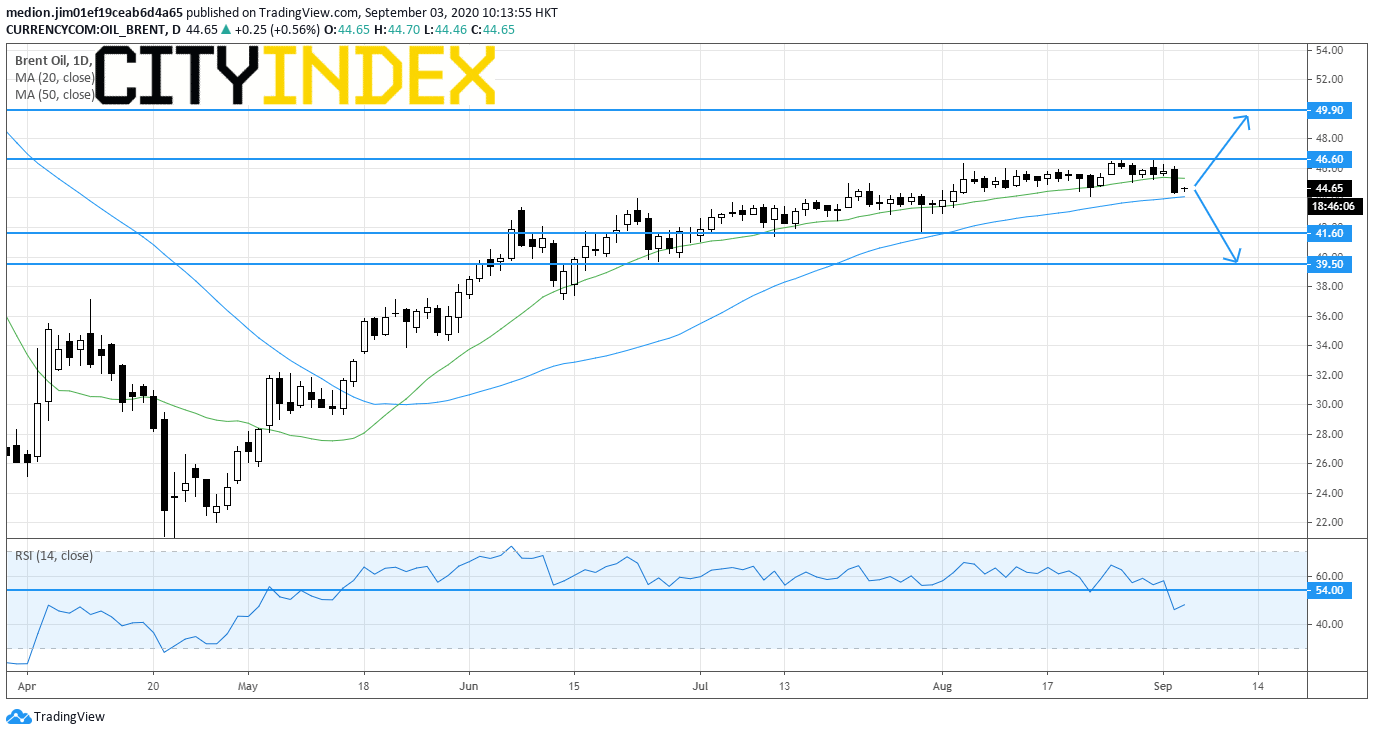

Brent Oil (Short term): Range between $41.6 and $46.6

On a daily chart, the Brent oil prices retreated after failing to penetrate the previous high at $46.60. Currently, the oil prices are testing the 50-day moving average. The relative strength index also breaks below the support level at 54.

However, the series of higher tops and higher bottoms since April's low remains intact. Therefore, readers should maintain neutral bias and expect the range trading.

The support levels would be located at $41.6 and $39.5, while resistance levels would be located at $46.6 and 49.9.

Source: Gain Capital, Tradingview

Iraq may seek a two month extension to implement the extra production cuts for OPEC+ deal, suggesting that the country would not reduce its output quickly as it previously promised, reported Bloomberg.

Meanwhile, the U.S. Energy Information Administration (EIA) reported that crude oil inventories dropped 9.36M barrels in the week ending August 28 (-2.14 million barrels expected). Besides, the U.S. crude oil production dropped to 9.7 million barrels per day from 10.8 million barrels per day.

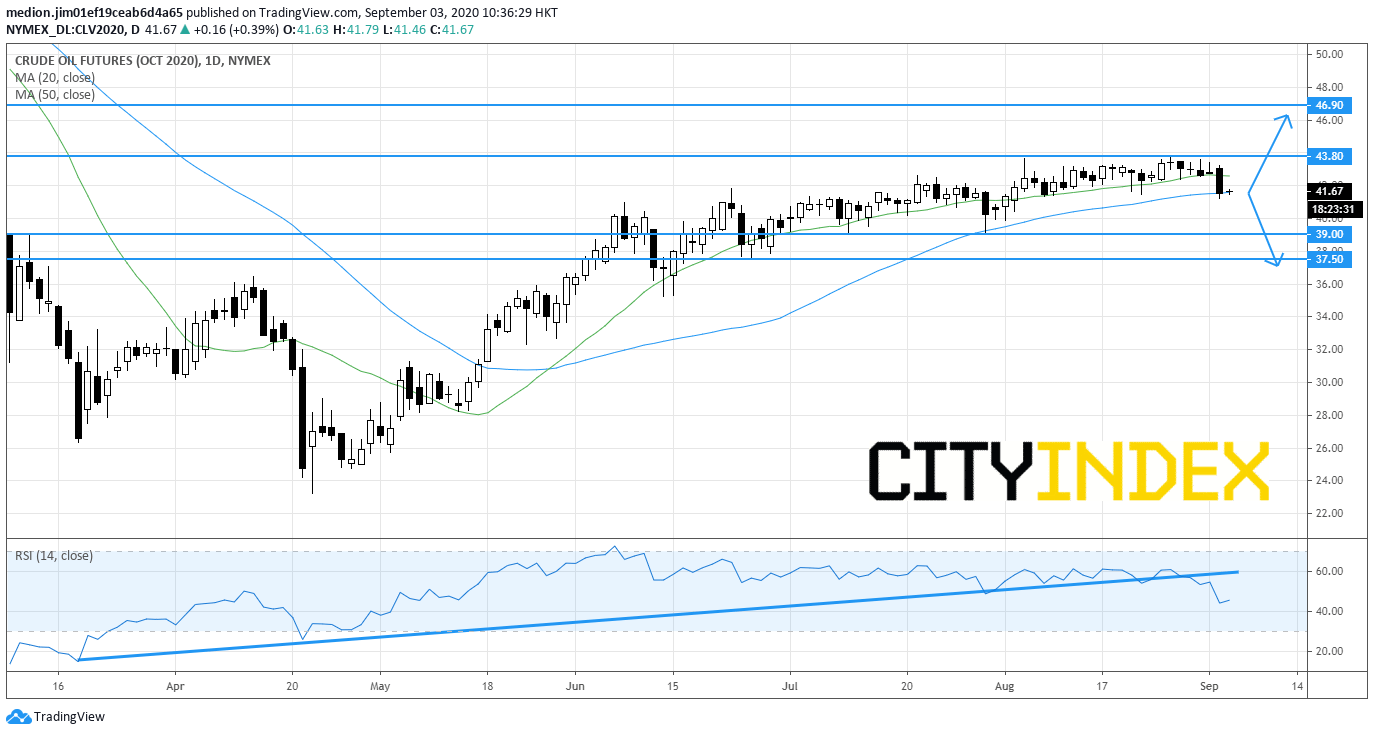

WTI Crude Oil futures (Short term): Enter the Consolidation phase

On a daily chart, WTI crude oil prices retreats from $43.8 and breaks below the 20-day moving average. In fact, the prices are testing the 50-day moving average. The relative strength index also broke below the rising trend line drawn from March.

However, as the previous low at $39.0 is still acts as the support level, the process of higher tops and higher bottoms has not violated. Therefore, readers should stay neutral for the range trading.

The support level would be $39.0 and $37.5, while resistance levels would be $43.8 and $46.90.

Source: Gain Capital, TradingView

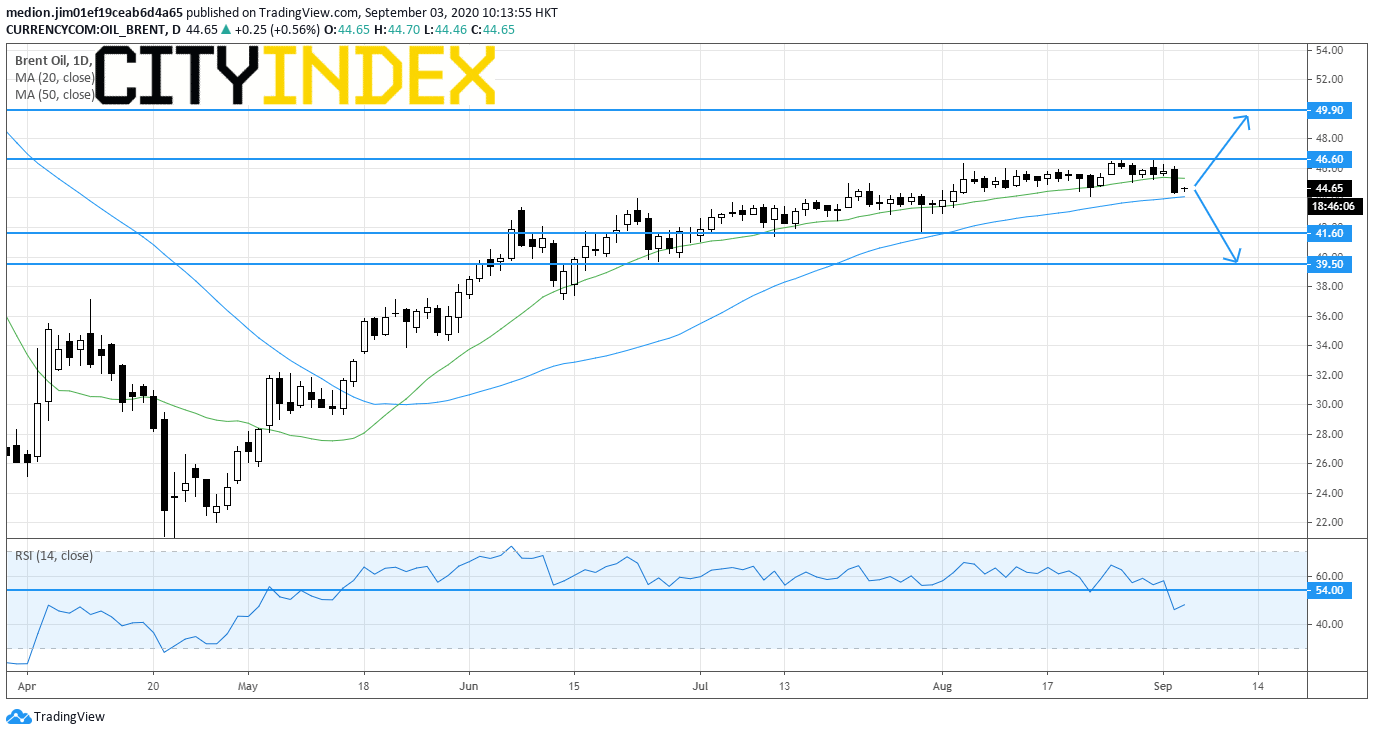

Brent Oil (Short term): Range between $41.6 and $46.6

On a daily chart, the Brent oil prices retreated after failing to penetrate the previous high at $46.60. Currently, the oil prices are testing the 50-day moving average. The relative strength index also breaks below the support level at 54.

However, the series of higher tops and higher bottoms since April's low remains intact. Therefore, readers should maintain neutral bias and expect the range trading.

The support levels would be located at $41.6 and $39.5, while resistance levels would be located at $46.6 and 49.9.

Source: Gain Capital, Tradingview

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM