A shaky start to the week after news that Saudi Arabia’s Abqaiq processing facility and the Khurais oil field have temporarily been shut down after two drone attacks by Yemen’s Houthi rebels over the weekend. The shutdown has disrupted approximately half (5 mb/d) of Saudi Arabia’s output and about 5% of global production.

The drone attack serves as a wakeup call to the crude oil market that has largely remained indifferent to rising tensions in the Gulf region including the attack on two tankers in the Gulf of Oman in June, instead preferring to focus on the implications of the U.S. - China trade war.

After closing at $54.85 on Friday, crude oil futures traded to as high as $63.33 shortly after the re-open this morning. After reassurances from the Saudis that lost production would soon be restored and a decision from President Trumps to authorises the release of oil from the strategic petroleum reserve, the price of crude oil is trading back below $60.00 at the time of writing.

Despite signs of normalisation in the crude price already beginning to appear, the threat of future drone attacks and the ability to send the price of crude oil up over 10% in an instance, is likely underpin the price of crude oil in coming months. As an aside, it brings the Gulf region one step closer to military conflict, an unwelcome development at any time. More so now, given the global economies already fragile state.

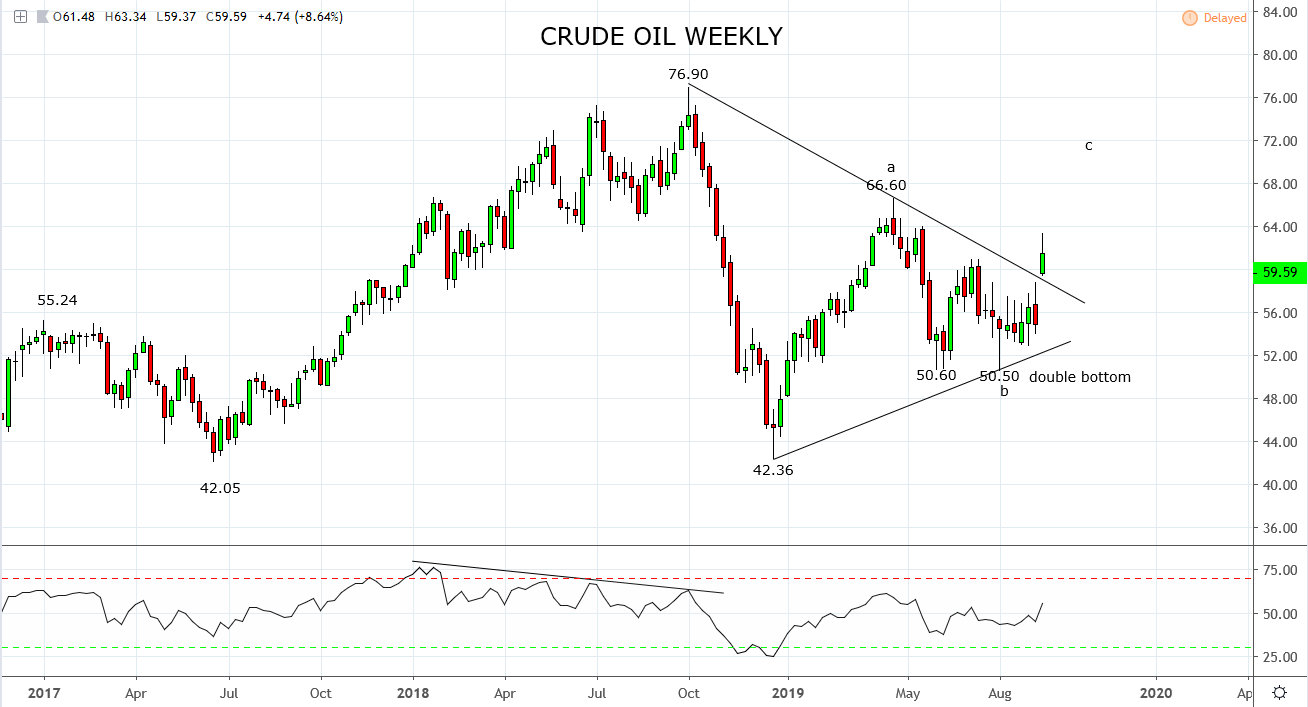

These threats are now reflected in the Weekly Chart below, which shows crude oil has broken above downtrend resistance near $59.00, confirming the formation of a medium-term low at the double bottom from the June and August lows $50.50 area.

As such, buyers are likely to emerge on dips into the $59.00/58.00 support zone with sell stops placed below $55.00. In terms of upside targets, interim resistance is viewed at $64.00, before the April 2019 $66.60 high.

Source Tradingview. The figures stated are as of the 16th of September 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.