Oil set for weekly gains

Oil prices are holding ready see-sawing between small gains and small losses as attention moves towards next week’s OPEC meeting.

Oil prices are still set to gain over 2.5% across the week, the same week that the US and some other oil consuming countries such as India and Japan announced that they will release strategic oil reserves in a bit to cool oil prices and tame inflation. Traders will be watching carefully to see if China follow suit.

The move came after OPEC shrugged off repeated calls from oil importers to lower oil prices, instead sticking to their planned 400,000 barrels a day increase agreed in July.

OPEC have already warned of an oil glut next year and they have now said that they expect inventories to swell to a surplus 1.1 million barrels a day following the release of US reserves.

COVID cases are also on rise in Europe, with several countries locking down. Germany’s new government was formed today, and they have said that the first task is to get COVID under control, which could mean mobility restrictions.

Where next for oil prices?

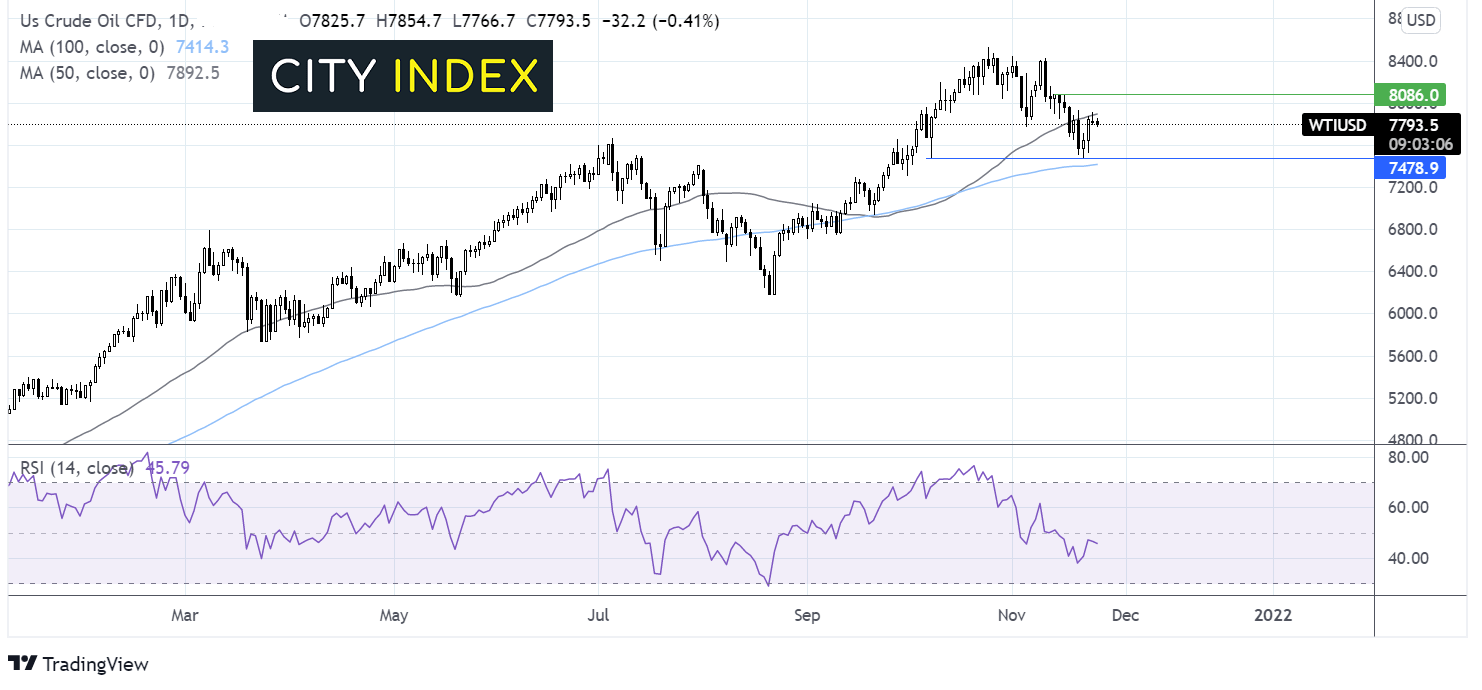

Whilst oil prices have rebounded from 72.70 almost the 100 sma, the rebound has stalled at the 50 sma at 78.83.

Buyers will need a close over the 50 sma in order to target $80.00 round number and $80.86 last week’s high. A move above here could see buyers gain traction.

Meanwhile failure to take the 50 sma could see the price rebound lower towards 74.70 and the 200 sma at 74.15.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.