The corporate and economic calendars are looking a little bit light for the week ahead now that the the big releases such as the US and Eurozone GDP reports and China’s manufacturing PMI are behind us. They brought little support for the oil market, showing a further slowdown in the developed economies and a blip higher in the Chinese manufacturing sector for smaller- and medium-sized companies.

In the week ahead, China’s export data for October will provide an insight into the toll taken by the unresolved trade conflict with the US. In September, exports stood at $14.4 billion. China’s Services PMI on Tuesday will also be of interest, not in terms of direct demand for crude oil, as the services sector is not a major user, but as an indicator of how well China’s white collar sector is doing and the implications of future consumer demand in China.

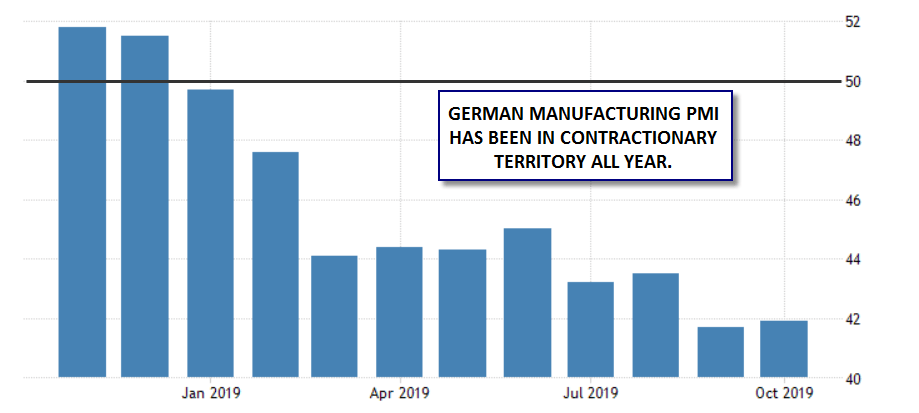

In contrast, Germany’s and the Eurozone’s Manufacturing PMI data on Tuesday are not expected to bring any good news for oil demand as both continue to struggle, weighed down by slowing local GDP growth and contracting exports.

Source: IHS Markit/BME German Manufacturing PMI

Similarly, on the corporate front most of the big news is now out of the way after BP, Shell and ConocoPhillips all reported lower earnings for the quarter, directly linked to weaker oil prices. In the week ahead there will be a sprinkling of results mainly from smaller US producers including Marathon Oil and Devon Energy.

Trade talks will need a new date

Now that violent anti-government protests have forced Chile to cancel the APEC summit, the US and China will have to look for a new date and place to continue their trade discussions. Before the cancellation, the US Administration had nearly finished putting together the paperwork for a partial trade agreement and President Donald Trump as good as committed to sign it at the summit. The Administration will now have to look for a different venue to continue the process. Look out for news of where and when, as well as for details on which part of the contentious trade talks have been agreed. In the current climate of slowing Chinese economic growth, progress - any progress - on the trade talks will be interpreted as a future boost to Chinese oil demand.

|

When? |

What? |

Why is it important? |

|

Monday 07.00 |

China Consumer Price Index |

Previously up 2.45% Y-o-Y |

|

Monday 09.00 |

Germany Markit Manufacturing PMI |

Indicator of the state of German manufacturing. Previously at 41.9 |

|

Monday |

China October Exports |

|

|

Monday 15.00 |

US September Factory Orders |

Indicator of the strength of industrial activity |

|

Tuesday |

US September Trade Balance |

Look out for China trade numbers |

|

Wednesday 6 Nov 16.30 |

EIA Crude Oil Inventories |

|

|

Thursday |

German September Trade Balance |

Look out for car exports decline |

|

Friday 8 Nov 20.30 |

CFTC Oil Net Positions |

COUNTRY UPDATE: NIGERIA

OPEC has been unwittingly keeping and exceeding its output cut targets over the last month because of disruptions in Saudi Arabia, but one of the countries that has been consistently lax with sticking to the targets has been Nigeria. OPEC has recently pulled the country back into the fold by raising its OPEC target, but the West African nation continued to pump above its target. However a recent change in legislation could unwittingly do more for the country’s compliance than any government commitment. Nigeria has just introduced a new bill increasing taxes on the oil industry which makes inward investment in deepwater production less cost effective and could lead to a 20% decline in deepwater output over the next five years.