OIL MARKET WEEK AHEAD: Russia’s U-turn

OPEC vs Russia, Round 2

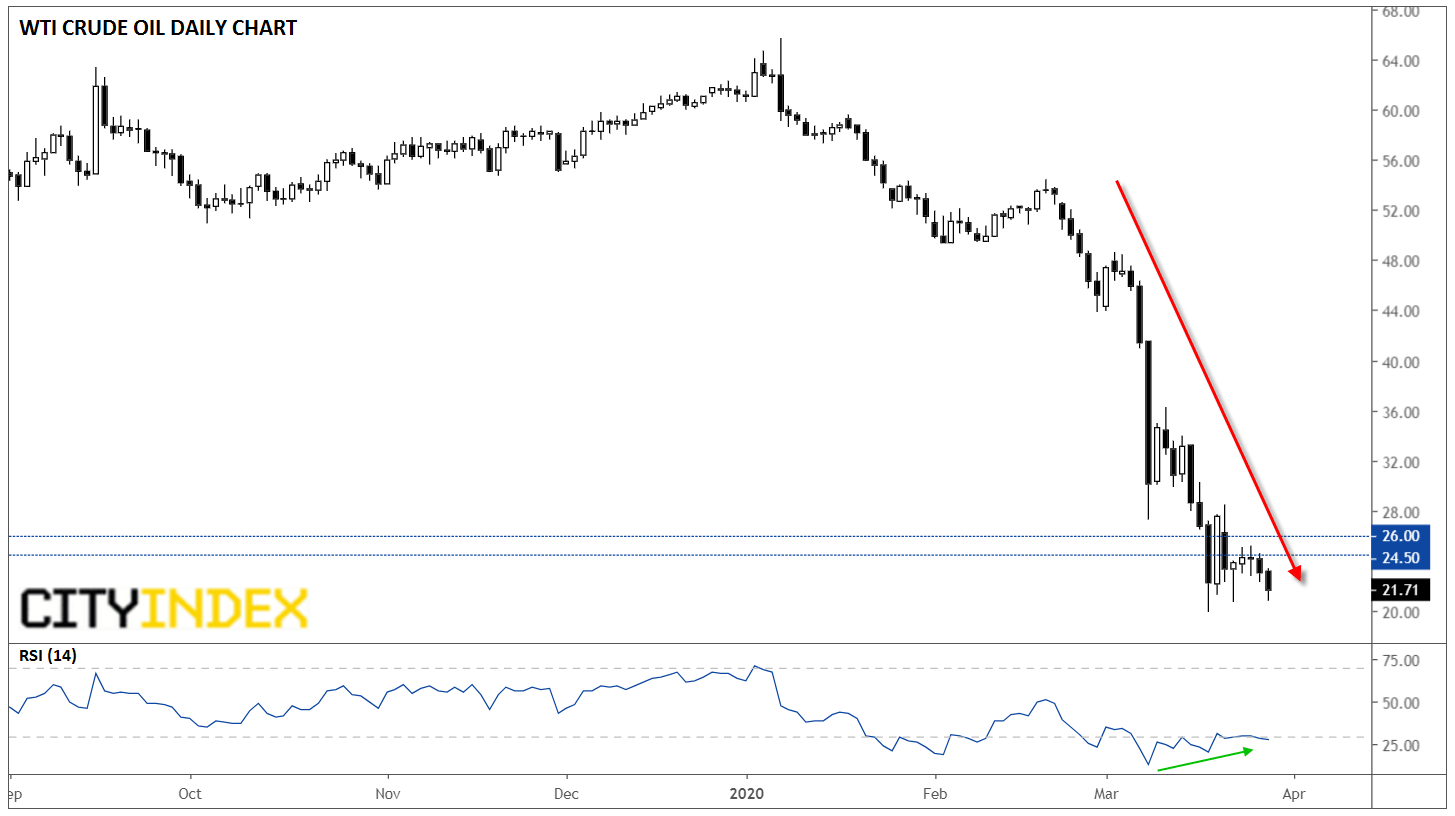

Now that oil prices have dropped to the lowest level since the Great Financial Crisis, all the oil producers are hurting, some more than others. This week, Russia for the first time hinted that it would be open to a deal with Saudi Arabia and OPEC to collectively curtail production in order to stem the decline in the oil price, which is nothing short of ironic given that Russia rejected this very proposal from OPEC almost two months ago.

The subsequent spat between Russia and Saudi Arabia hit the market just as global demand started to shrink because of travel restrictions and cancelled flights. Despite the bad feelings, hatchets may end up being buried, at least temporarily, as other OPEC producers plea for some form of agreement. This week Algeria, Iraq and Nigeria have asked for OPEC to hold emergency talks and to slow down the influx of crude into the global market; some form of reaction is likely from Saudi Arabia within days rather than weeks.

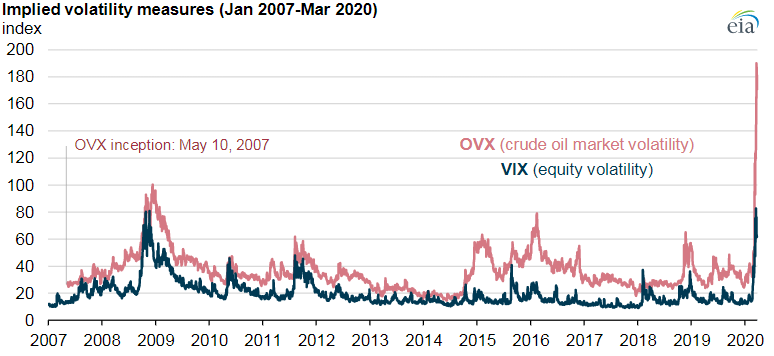

Source: EIA

Volatility is becoming one of the only certainties as the number of new corona cases in Europe and the US reach scary highs and even phenomenally high rescue packages seem to provide only brief respites in the market.

US jobless data: Canary in the coal mine

After the shocking increase in the US initial jobless claims this week, next week’s data will be crucial in trying to assess the full picture of the coronavirus on the US economy. Analysts estimate that the number of claims filed this week is not even the full extent of job losses that happened in the week ending March 20 because the offices registering the claims were overwhelmed with the sheer number.

If, as expected, unemployment continues to rise at a similar pace, it will undermine domestic US demand for crude not only in the next few weeks but potentially for months to come. The non-farm payroll report on Friday will likely dovetail on the information coming from the jobless claims to evidence the speed of job destruction across the country.

Source: GAIN Capital, TradingView

China’s March manufacturing data expected to show pickup

Next week will be a good week to look at some of the Chinese data which is now beginning to cover March, when some of the industries that shuttered operations in February restarted operations. February data was shockingly low with the PMI reading from China’s Federation of Logistics - which mainly looks at large enterprises - coming in at 35.7 and the Caixin index - which reflects the situation among medium sized and smaller businesses - reading at 40.3. The data due on Tuesday and Wednesday should show a significant pickup, although in the case of both large and small operations it is likely to have remained below the 50 mark, which is the line between contraction and expansion.

Though the virus is now in full swing across large parts of Europe and is building in the US, the Chinese data could also provide a glimmer of hope, an indicator of how long the coronavirus clampdown is likely to last in other countries.

|

When |

What |

Why is it important |

|

Mon 30 March 10.00 |

Europe March industrial confidence |

First glimpse into the damage wreaked by the pandemic in Europe |

|

Tue 31 March 02.00 |

China March official manufacturing PMI |

PMI covering large producers. February reading plunged to 35.7 |

|

Tue 31 March 21.30 |

API weekly crude oil stocks |

Expected to show an increase as demand dries up |

|

Wed 1 April 02.45 |

China March Caixin manufacturing PMI |

Expected to show a pickup in SMI production |

|

Wed 1 April 08.55 |

Germany March manufacturing PMI |

Likely to reflect a slowdown as the spread of the coronavirus intensified in the country |

|

Wed 1 April 14.55 |

US March manufacturing PMI |

The data will likely contain only little information about the changes caused by the pandemic. Last reading at 49.2 |

|

Wed 1 April 15.00 |

EIA crude oil stock change to March 27 |

Expect a significant drop as some states went into lockdown |

|

Thur 2 April 13.30 |

US initial jobless claims to March 27 |

The key indicator of the week as it will show the extent of damage in the job market |

|

Friday 3 April 13.30 |

US March non-farm payrolls |

The number of new jobs in businesses other than agriculture. It will dovetail on the initial jobless data |

|

Friday 3 April 18.00 |

Baker Hughes US oil rig count |

Could start showing early damage to the US oil industry |

|

Friday 3 April |

CFTC money managers oil positions |

Granular detail on changes to money managers’ positions following a week of volatility |