Overall demand remains low

Oil is struggling to maintain session highs as overall oil demand remains low amid ongoing travel restrictions and as commercial activities grind to a halt.

Whilst there are signs that the number of deaths have peaked in Italy, numbers in the US, the world’s second largest consumer of oil are still a few weeks behind. The World Health Organisation has warned that the US, the world's largest economy, may become the global epicentre of the coronavirus outbreak. US PMI data is due this afternoon. If European data is anything to go by, then the hit on the service sector could be eye watering. And it could get a lot worse over the coming months as more and more US cities move into lock down mode.

Levels to watch

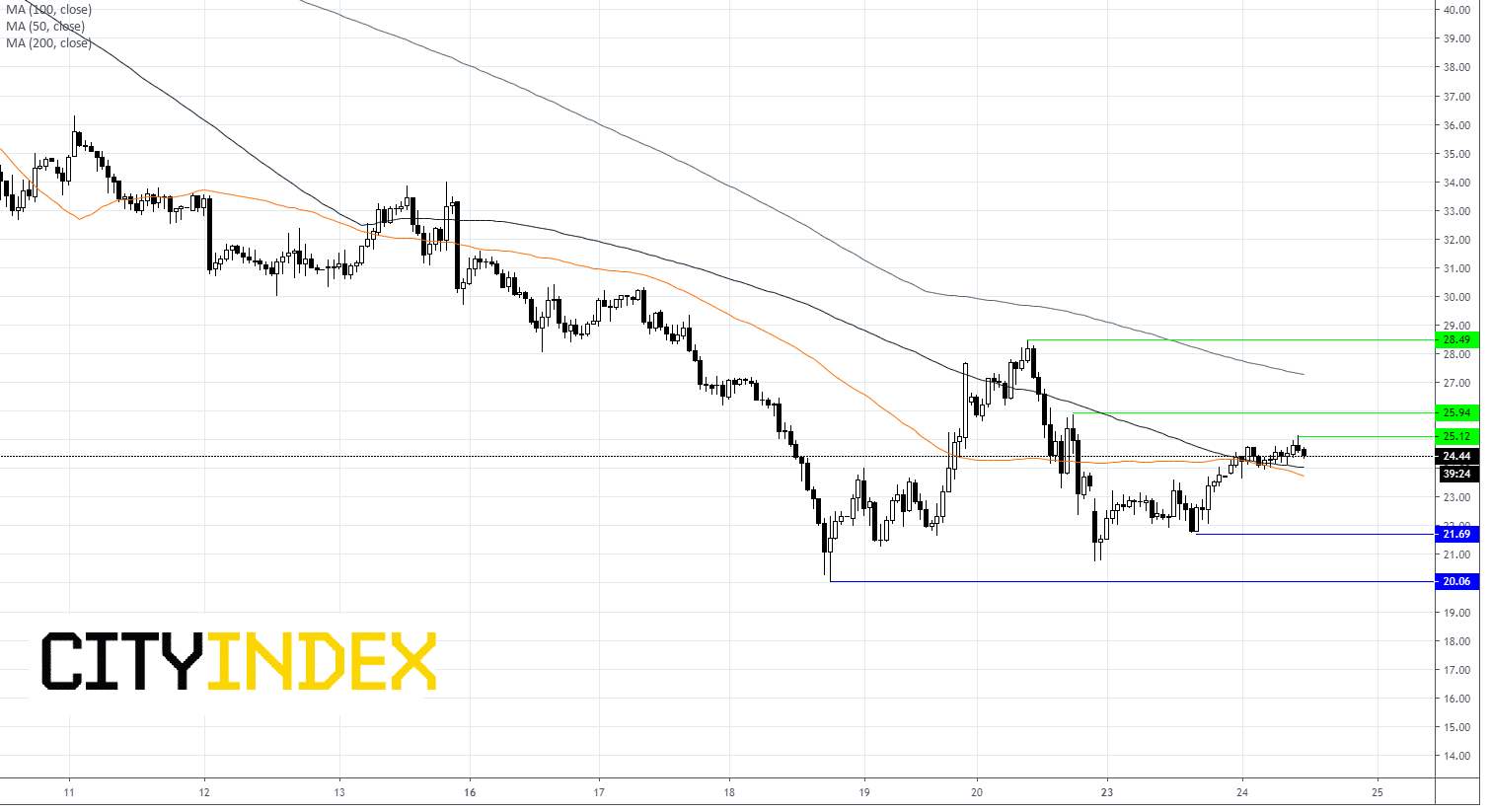

Oil has jumped 4.5% in early trade but is giving back those gains. WTI is currently up 2.5% at 24.00 testing support of 50 and 100 sma.

A break through $24.00 could open the door to $21.70 (yesterday’s low) prior to $20.06 (low 18th March).

Resistance can be seen at $25.12 (today’s high) prior to $26 (high 20th March) and $27.30 (200 sma).