Crude oil extends losses

Crude oil remains under pressure, extending losses for a fourth straight day. Oil trades down around 10% so far this month after gaining around 40% in the first 6 months of the year.

Whilst optimism surrounding the demand outlook drove oil prices higher across the first half of the year concerns over rising delta cases and the slowing economic recovery in China, the world’s second largest consumer of oil. After a stellar first half, oil is looking vulnerable.

Chinese retail sales and industrial production were softer than expected on Monday, highlighting the impact that tougher covid restrictions are having on the Chinese economy. Adding pressure to oil prices, Chinese oil demand slumped 2.3% as daily crude processing in July fell to its lowest level since May 2020.

Covid cases are on the rise in China, where pandemic restrictions have been tightened. Japan is also set to extend its state of emergency widen restrictions to include more prefectures whilst cases were also substantially higher in Australia.

Offering some support to oil prices were comments from OPEC+ yesterday. In response to US President Biden’s call for further output, OPEC+ said that they do not consider that additional supply, above the already agreed increase of 400,000 bpd, was necessary in the second half of the year.

Where next for crude oil prices?

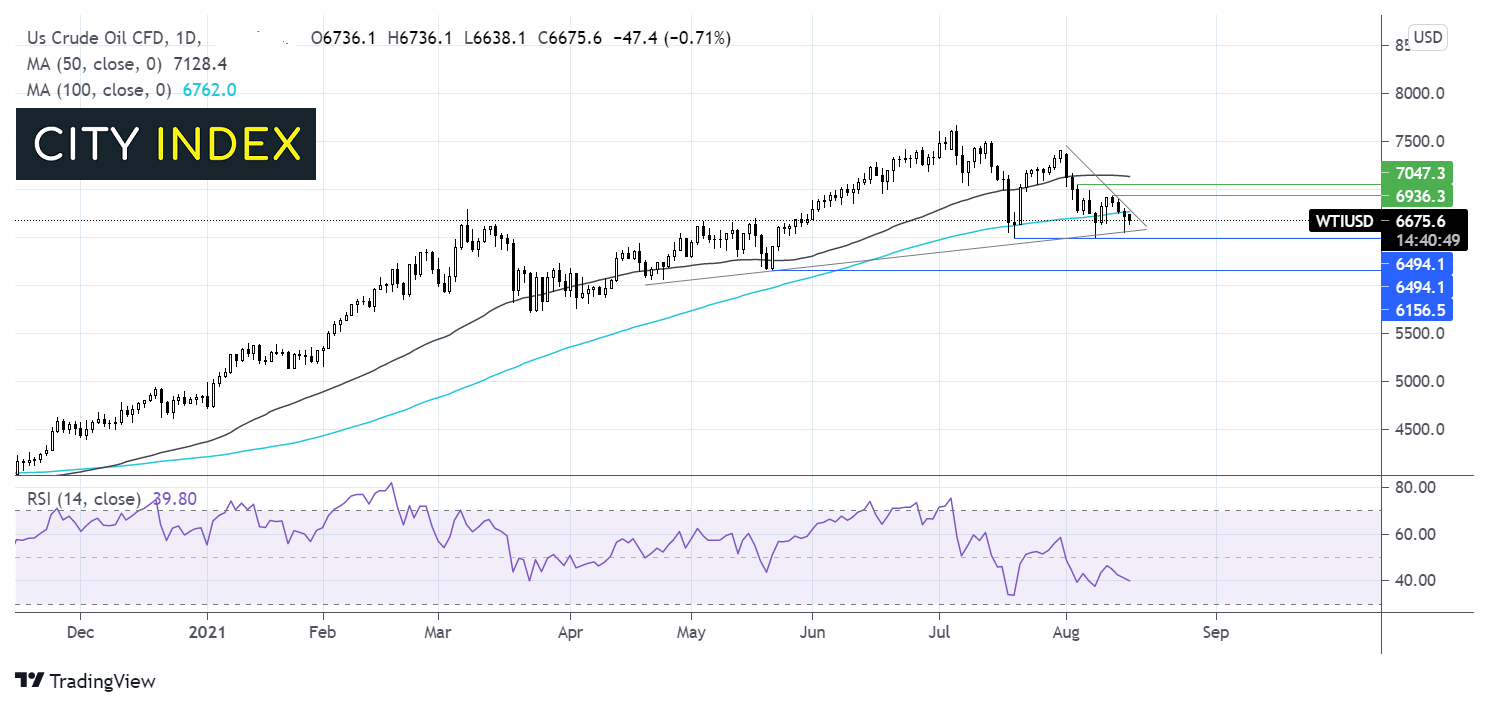

WTI crude oil trades lower for a 4th day. A close below the 100 dma combined with the RSI in negative territory and pointing lower suggests that there could be more downside to come.

Sellers will need to break below the rising trendline support at 65.70 in order to test support at 65.00 the July low. 61.50 the May could also offer support.

On the upside, buyers need to close above the 100 dma and descending trendline resistance which could prove to be a tough nut to crack. Beyond here, 69.30 last week’s high and 70.30 the August 4 high could offer some resistance.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.