Crude is rebounding on Wednesday, paring losses after two sessions of declines, however the losses at the start of the week were just a slight blip in an otherwise bullish charge. Crude oil as rallied 1.4% so far this week, extending gains on 3.4% in the previous week.

Oil is on the rise amid broad optimism that the hit from coronavirus will be short lived and amid supply concerns as the US moved to cut more Venezuelan crude from the market.

Coronavirus

Chinese manufacturers are starting to slowly ramp up again after strict lock downs and restrictions to prevent the spread of the deadly virus. However, as the number of new coronavirus cases in China declined for a second straight day on Wednesday investors are growing optimistic that the hit will be a short-term blow. Reports that the Chinese are close to developing a vaccine is also supporting the price of oil.

Chinese manufacturers are starting to slowly ramp up again after strict lock downs and restrictions to prevent the spread of the deadly virus. However, as the number of new coronavirus cases in China declined for a second straight day on Wednesday investors are growing optimistic that the hit will be a short-term blow. Reports that the Chinese are close to developing a vaccine is also supporting the price of oil.

Rosneft Sanctions

A US decision to blacklist and slap sanctions on a trading subsidiary of Russia’s Rosneft has also underpinned the price of oil. According to the White House, the Russian subsidiary provides a financial lifeline to the Venezuelan government, as Trump continues his campaign against Maduro. Importantly this is a direct challenge to Moscow, one of Maduro’s key supporter. Russia’s response has unsurprisingly been a mix of defiance and accusations.

Finally, oil is also being supported by the prospect by the prospect of deeper OPEC++ cuts. The group meets next month and are expected to discuss their response to the possible downturn in demand owing to coronavirus. Suggestions that the group could limit output further could boost oil further.

A US decision to blacklist and slap sanctions on a trading subsidiary of Russia’s Rosneft has also underpinned the price of oil. According to the White House, the Russian subsidiary provides a financial lifeline to the Venezuelan government, as Trump continues his campaign against Maduro. Importantly this is a direct challenge to Moscow, one of Maduro’s key supporter. Russia’s response has unsurprisingly been a mix of defiance and accusations.

Finally, oil is also being supported by the prospect by the prospect of deeper OPEC++ cuts. The group meets next month and are expected to discuss their response to the possible downturn in demand owing to coronavirus. Suggestions that the group could limit output further could boost oil further.

Levels to watch

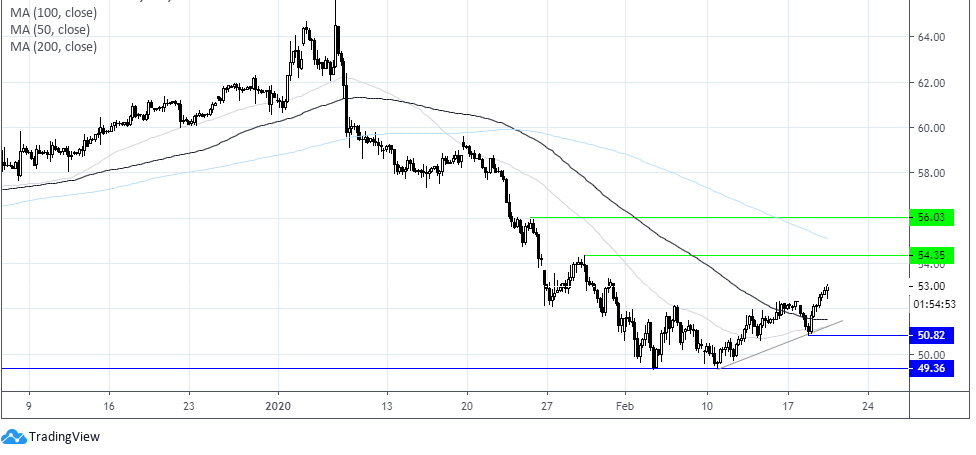

After dropping over 15% across January, WTI rebounded off $49.3 at the end of January and has been marching higher ever since.

WTI has pushed back above its 100 and 50 sma on the four hour chart, it remains below the 200 sma at $55.1.

WTI is trading at the high of the day at $53.08. Immediate resistance can be seen at $53.30 (high 31st Jan) prior to $54.30 (high 29 Jan), before looking to target 56.00.

Near term support is at $51.30 trend line suopprt, prior to $50.80 and $49.30.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM