Wishing all our readers a Happy New Year and best wishes for 2020. Our last update on Bitcoin was in late November 2019, shortly after a sharp drop that saw Bitcoin fall from above $10,000 to below $7,000.

In the article we spoke about our own observation that Bitcoin had made big turns in December the previous two years. Initially in the shape of a medium-term high at the $19666 high of December 2017 before making a medium-term low at the $3122 low in December 2018, prompting us to ask - Is Bitcoin setting up for another December turn? here.

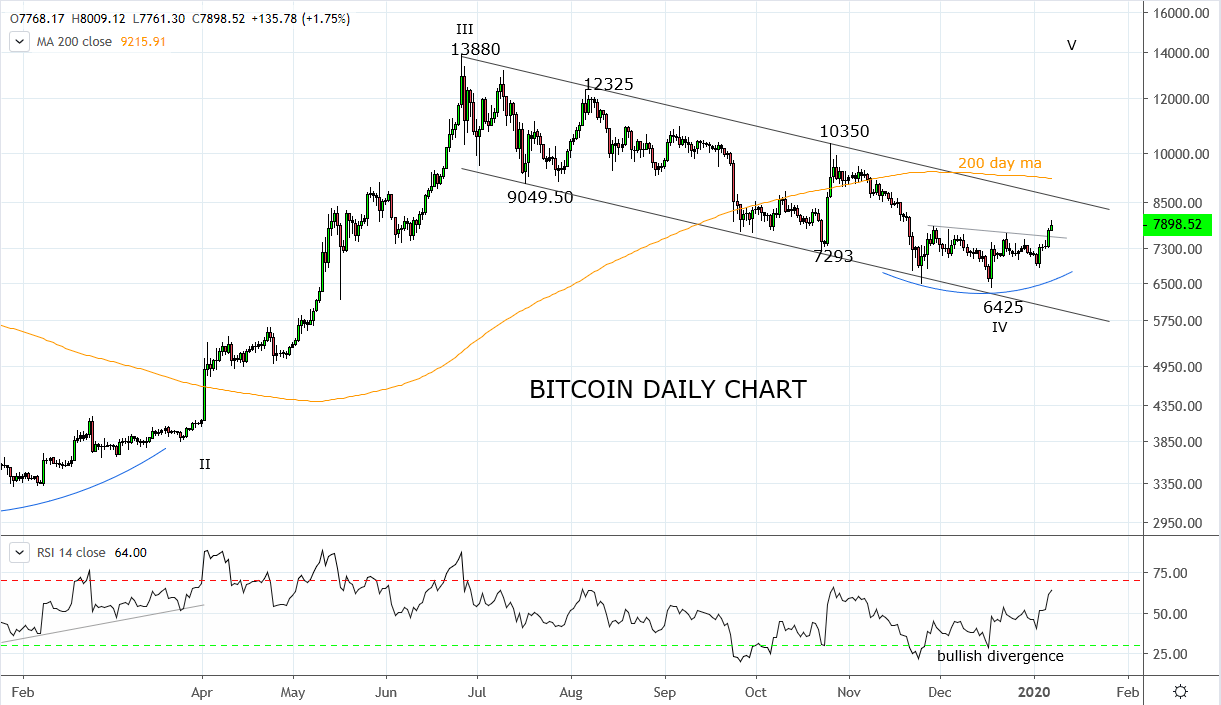

Since that point, the price action has been supportive of another December turning point, including the textbook, bullish engulfing candle that occurred at the $6425 low. This candle formed in conjunction with a display of bullish divergence on the RSI indicator as price made a new low and the RSI indicator stubbornly refused to confirm the price breakdown.

The U.S. assassination last week of Quds Force Iranian commander Qassem Soleimani has added an unpredictable element to the start of 2020. Traditional safe-haven assets like gold and silver traded to new highs overnight on selling, punctuated by a distinct loss of momentum/potential reversal type daily candle as longs moved swiftly to lock in profits.

A timely reminder to start the new year that chasing moves on a Monday morning in Asia, particularly involving a market with very heavy positioning can be a perilous pursuit.

Summary:

Our view remains that the sell-off from the June $13880 high displays corrective qualities. We note the bullish engulfing type candle that formed at the $6425 December low and post the overnight close above the inverted head and shoulders neckline, think the chances that Bitcoin has put in place another tradable December low has increased considerably.

As such, we like the idea of building a small long Bitcoin position with a stop loss below $6400. We would look to add to the position on a break and close above trend channel resistance $8700 and then again on a close above the 200-day moving average $9200 area. The target is a move towards the $14,000/16,000 region.

Source Tradingview. The figures stated areas of the 7th of January 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation