Investors pay a huge premium on bets that the group will continue to outfox rivals and grow

There can be few surer signs that most investors are aboard Ocado’s “centre of gravity” shift than a 10% stock rise despite accelerating losses due to accounting changes and fire-disrupted revenues. With just 2 percentage points shaved off first half retail sales growth by the blaze at its Andover, UK, distribution centre, the £9bn group has maintained full year forecasts. It still sees sales rising 10%-15% even after a £99m exceptional charge mainly linked to fire damage. For the uninitiated, the 16-year old group remains a ‘growth stock’ and is judged more on sales growth than profits.

Key financial points illustrate this:

- Ocado made an £142.8m pre-tax loss over 26 weeks ending 2nd June

- It also made a loss of £13.6m in 2018’s first half

- Adjusting for the planned sale of the group’s Fabled by Marie Clare fashion business the H1 2019 loss was $43m

- Ocado cautioned that fire would reduce full-year Ebitda by £15m with a further £10m cost for management incentive plans

- Prior Ebitda consensus forecasts pointed to around £45m

By continuing to pick up the stock, investors are buying Ocado’s story that it is transitioning from a domestic pure-play online grocer to a technology-driven software and robotics platform, selling its proprietary end-to-end solutions to retail ‘partners’, including its latest major deal with Marks & Spencer. Although the M&S deal will soon bear its first fruit of £562.5m, underpinning investment plans, shares are up about 45% since news of that deal. That puts the group on a near-500% premium to a rating defined by its average two-year debt and equity divided by sales. It is the group’s hottest premium in years despite shaky share price progress so far in 2019. In short, Ocado remains priced for perfect market satisfaction. Historically, it has often delivered far less. The main question for investors is whether they believe it can continue to outfox chief rivals like Amazon. If it begins to struggle over the next two years, it will look even more unfeasibly expensive.

Chart thoughts

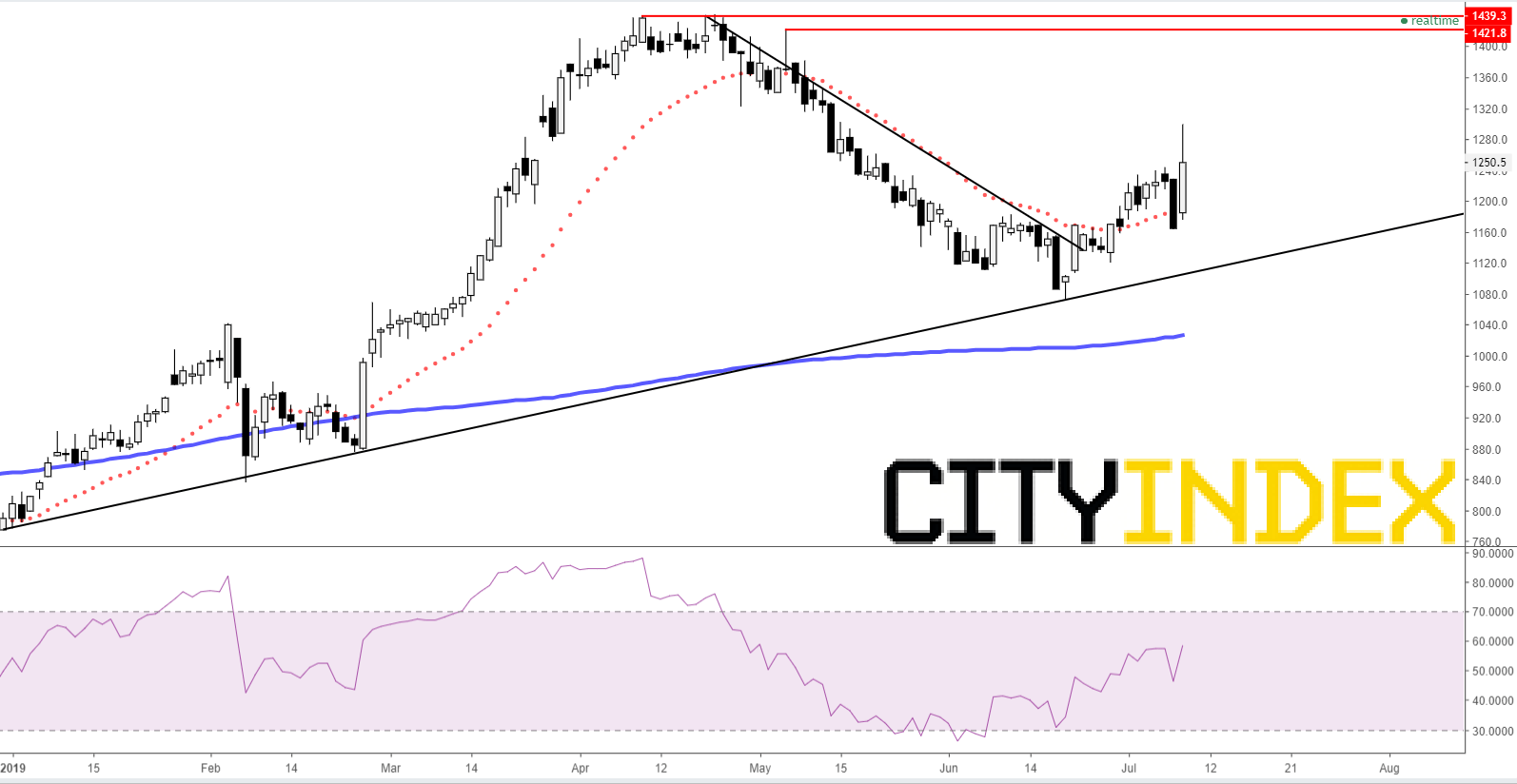

Breakout! And the stock looks set to enjoy further dividends after breaching its dominant recent pattern of a symmetrical triangle to the upside. The Relative Strength Index Momentum gauge is also rallying, underpinning the return of upward momentum. 200-day and 21-day exponential moving averages (blue, red-dotted respectively) are favourably placed. Both now offer support or implied support and are rising, though OCDO needs to close above the latter this week to confirm the medium-term bias. Absent an exogenous shock, the line of least resistance will be a melt-up back to all time high 1439p and lower high 1421p. It’s too early to confirm that the stock will make it sustainably higher than those prices which are now OCDO’s main challenges.

Ocado CFD – daily [09/07/2019 15:49:06]

Source: City Index