After a three day Anzac day long weekend, many New Zealanders returned to work today after an easing of COVID-19 lockdown laws, following a successful five-week campaign to slow the spread of the coronavirus.

New Zealand previously had amongst the world’s toughest lockdown laws in place and the overnight downgrade from level 4 to level 3 restrictions, leaves New Zealand with a very similar level of restrictions to what we here in Australia are currently experiencing.

While it’s a positive step, the move has not gone far enough for some, prompting concerns the New Zealand economy will suffer longer lasting economic damage.

Westpac’s New Zealand economics team are now calling for a doubling in the size of the Reserve Bank of New Zealand (RBNZ) quantitative easing (QE) program to $60bn at the upcoming May interest rate meeting. A pace of buying that will leave the RBNZ owning almost 50% of all NZ government bonds on issue within 13 months.

The RBNZ has previously said it would be unwilling to own more than 50% of the bond market and for the RBNZ to deliver further monetary easing, it is then expected to lower the overnight cash rate (OCR) by 75bp to -.50% in November 2020.

After an undertaking in March to keep the OCR rate on hold for 12 months, Westpac expects the RBNZ to pre-signal to the market early in the second half of 2020 that they are prepared to take the OCR into negative territory if required.

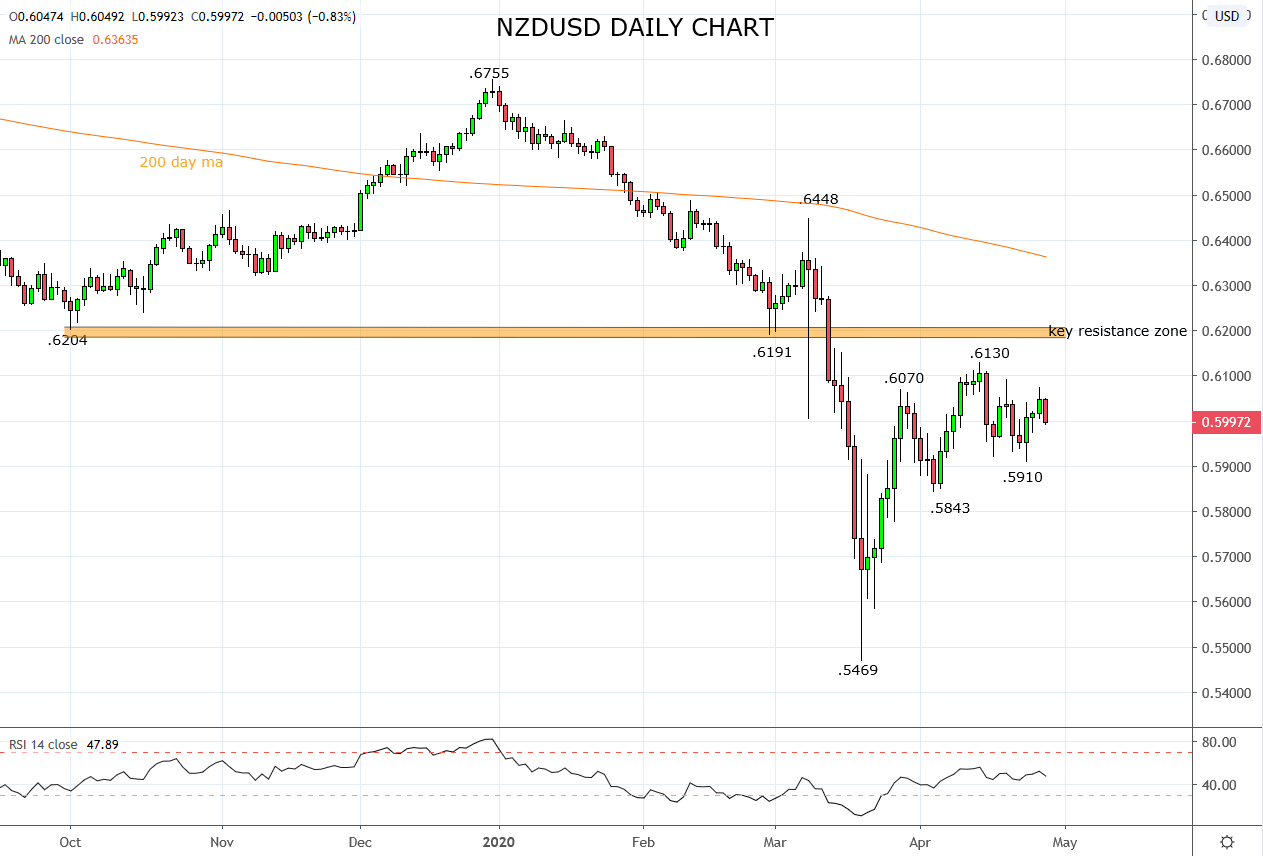

In response to this and the more adverse risk sentiment in Asia today, the NZDUSD has fallen back below .6000c at the time of writing. Technically, providing the NZDUSD remains below the key resistance zone at .6190/6200c, a mild bearish bias remains in place. The earliest confirmation that the downtrend has resumed would be a break/close below support .5910/00. This would suggest a move initially towards .5840 is underway, before .5600c.

Conversely, should the NZDUSD break and close above the key resistance zone .6190/.6200c, it would allow the NZDUSD to take another leg higher, towards a medium-term layer of resistance .6420/.6480c.

Source Tradingview. The figures stated areas of the 28th of April 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation